Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Japan’s Remixpoint Finalizes $3.2 Million Acquisition of Bitcoin

Japanese companies are continuing to advance their Bitcoin (BTC) acquisition strategies, with former crypto exchange operator Remixpoint completing a purchase valued at $3.2 million.

According to the Japanese media outlet Coinpost, Remixpoint announced late last week that it had acquired “additional” Bitcoin “worth 500 million yen.”

Remixpoint Bitcoin Acquisitions to Persist

The company revealed it had increased its BTC holdings by 33.34. Remixpoint now possesses BTC 333.189.

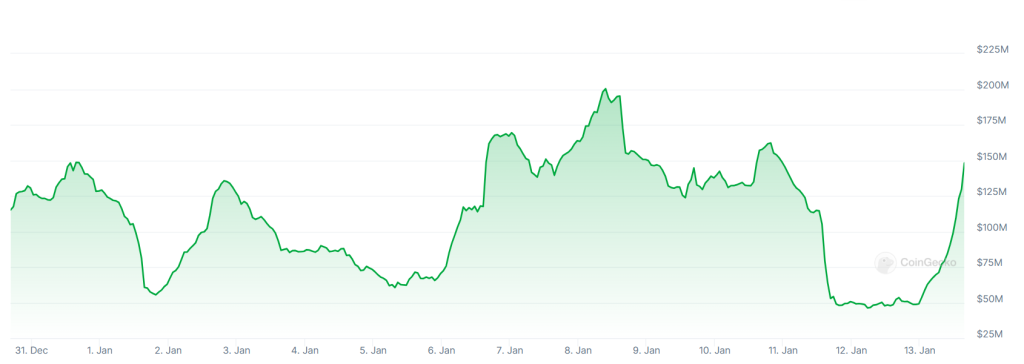

Trading volumes on the Japanese crypto exchange bitFlyer over the last 14 days. (Source: CoinGecko)

Trading volumes on the Japanese crypto exchange bitFlyer over the last 14 days. (Source: CoinGecko)

However, it appears that the firm is not finished investing in Bitcoin. On January 9, the company announced intentions to allocate an additional $16 million towards BTC.

Nonetheless, the firm has yet to establish a timeline for the remainder of its purchases. Instead, it states that it will gradually invest the $16 million in Bitcoin as it “evaluates market trends.”

Remixpoint has also previously invested in Ethereum (ETH) and various altcoins. However, it has not disclosed any new altcoin investment plans following earlier statements indicating it had set aside funds for broader crypto acquisitions.

Japan Prime Minister Shigeru Ishiba requested US President Joe Biden to address concerns within the Japanese and US business sectors regarding Nippon Steel’s proposed acquisition of U.S. Steel https://t.co/dFNfveFlWa

— Reuters (@Reuters) January 13, 2025

Company Also Holding Ether and Altcoins

According to official Remixpoint documentation, the company continues to hold Ethereum, along with Solana (SOL), XRP, Avalanche (AVAX), and Dogecoin (DOGE).

The firm made its altcoin acquisitions in September of last year, during which it also invested approximately $4.22 million in Bitcoin.

The company is listed on the Tokyo Stock Exchange and previously operated the BITPoint crypto exchange, which it launched in 2016.

In 2023, the firm completed a transaction to sell BITPoint to the securities, crypto mining, and banking company SBI.

Remixpoint is involved in the software, automotive, and electricity trading industries. It was established in 2004 and went public two years later.

Japanese Companies Opting for BTC

Remixpoint is not the only significant Japanese firm investing heavily in Bitcoin this year. Earlier this month, the investment company Metaplanet announced plans to increase the size of its own Bitcoin holdings.

Happy New Year to Our Valued Shareholders! As we enter 2025, I couldn’t be more excited about what lies ahead for Metaplanet. Last year was transformational, as we broke records, expanded our Bitcoin treasury, and strengthened our position as Asia’s leading Bitcoin Treasury… pic.twitter.com/K2HsOS8TaZ

— Simon Gerovich (@gerovich) January 5, 2025

The firm expressed its desire to solidify its status as “Asia’s leading Bitcoin treasury company.” It also mentioned its “goal” to “increase” its Bitcoin holdings to BTC 10,000 by the end of 2025.

The post Japan’s Remixpoint Completes $3.2 Million Bitcoin Purchase appeared first on Cryptonews.