Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Is Clawdbot Achieving a ‘99% Success Rate’ on Polymarket?

Key Takeaways:

- Prediction markets, exemplified by Polymarket, are emerging as a significant crypto narrative in 2026, fueled by impressive win rates and noticeable profits.

- Accounts demonstrating near-perfect performance are frequently driven by automation rather than market forecasting.

- Bots capitalize on short-term pricing imbalances, especially in times of high volatility, instead of merely guessing outcomes.

- Instruments like Clawdbot reduce the barriers to automation while introducing new risks, such as technical issues and potential loss of fund control.

- While automation can provide an advantage, it does not substitute for market comprehension, risk management, or long-term viability.

Prediction markets, spearheaded by Polymarket, are emerging as a prominent crypto narrative in 2026. Observers are noting other users posting remarkable win rates and earning substantial profits daily. Naturally, they desire similar outcomes. But is it truly that straightforward?

At its essence, prediction markets are quite simple. You place a wager on a specific outcome and await the results. Some markets concentrate on significant macroeconomic questions, such as whether interest rates will be raised or lowered. Others are much more focused. For instance, during the Monad (MON) token launch, there was a market where participants could wager on the amount of money the ICO would garner.

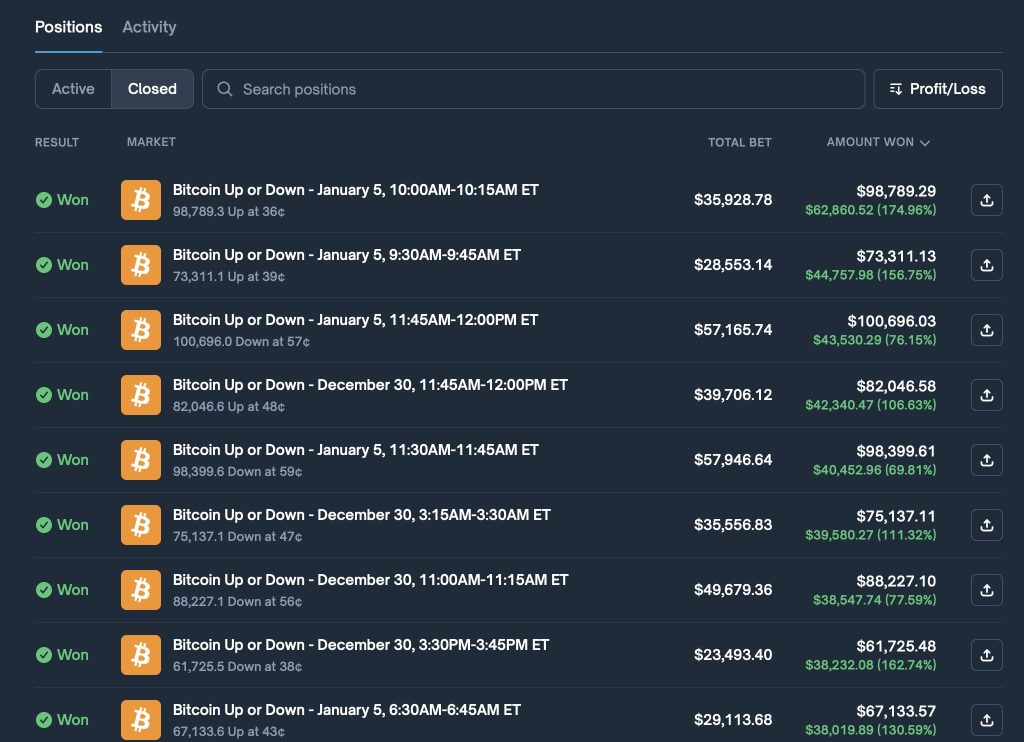

One user on Polymarket, identified as Account88888, adopted a distinctly different strategy. Rather than engaging in long-term narratives, they concentrated on 15-minute Bitcoin price markets, betting solely on whether BTC would rise or fall. In one instance, the user staked $35,928.78 and ended up with $62,860.52, achieving a return of 174.96%.

Source: Polymarket

Source: Polymarket

Account88888 boasts a win rate approaching 100%. This immediately sparked curiosity among seasoned Polymarket users. Is this genuinely a human trader? Or is there something else at play? The most plausible explanation is automation.

On X, bots advertising “hands-free” trading are ubiquitous.

‘Instead I learned they do not think at all. They calculate’

A Polymarket trader known as Marlow has been observing similar accounts, including Account88888, for some time. Initially, the strategy appeared unusual. On the surface, it seemed like a method that should incur losses rather than yield consistent profits.

“Account88888. 99% win-rate. Over 11,000 trades. The script surfaced in minutes,” Marlow noted.

The crucial takeaway is that the bot is not attempting to predict the market. It is mechanically capitalizing on arbitrage opportunities arising from pricing inefficiencies on Polymarket.

Each Polymarket market operates similarly. There are solely two possible outcomes. When the market concludes, the winning side pays $1, while the losing side pays nothing. Prices prior to settlement merely reflect the perceived likelihood of each outcome at that instant. They do not alter the final payout.

This creates opportunities during periods of heightened volatility. If both competing outcomes are temporarily undervalued and their total cost falls below $1, an arbitrage opportunity emerges. Essentially, you are purchasing a guaranteed $1 payout for less than its nominal worth.

In tumultuous times, traders rush to hedge against various scenarios simultaneously. Demand becomes skewed. Prices on both sides are driven down. In some situations, the “UP” and “DOWN” contracts within the same market might trade at, for example, $0.30 and $0.35 combined, still under $1, despite the fact that one of them must yield $1 upon settlement.

The bot simply acquires both sides, bides its time for the market to resolve, and collects the difference. This process repeats thousands of times. It profits from the mathematical certainty born from temporary imbalances in supply and demand.

Marlow expresses it clearly:

The bot buys both. Waits fifteen minutes. Collects $1. Keeps six cents. Repeats. It is indifferent to direction. It does not analyze charts. It does not respond to news. It harvests the spread between panic pricing and mathematical certainty. My scanner keeps identifying more of these. Various strategies, but the same signature. Execution patterns too clean and rapid for human intervention. I developed this tool intending to learn how the best traders think. Instead, I realized they do not think at all. They calculate.

‘Automation Is a Heavy Advantage in 2026′: Clawdbot (Now Moltbot) Enters Polymarket

As narratives like this circulate, advertisements began surfacing on X promoting bots that claim to trade on Polymarket or other prediction markets on your behalf. Concurrently, interest in AI agents has continued to expand, even though the market is already saturated.

Created by Peter Steinberger, Clawdbot, now rebranded as Moltbot, aims to make working with AI agents significantly more integrated.

In simple terms, Clawdbot operates as a locally running AI agent that links a large language model with real actions on a user’s computer. It can execute terminal commands, read and write files, install software, browse the internet, and send messages via various messengers.

Users interact with Clawdbot through popular chat applications like Telegram, WhatsApp, or iMessage. Behind the scenes, the agent determines which tools to employ and which actions to undertake based on context, instructions, memory, and available capabilities. Essentially, it functions as a continuously operating personal service that receives text commands and executes them directly on the system where it is installed.

Clawdbot has now made its entrance into Polymarket as well.

A trader known as Xmaeth on X, boasting around 33,000 followers, shared how they configured Clawdbot to trade on Polymarket. This post has already garnered 1.6 million views. The trader allocated $100 and provided API access to the Polymarket account, directing it to trade 15-minute BTC markets with cautious risk management. According to Xmaeth, the account balance surged to $347 overnight.

Xmaeth’s conclusion was straightforward:

Automation is a substantial advantage in 2026. Save it for later reference.

Source: X

Source: X

Automation Isn’t Magic on Polymarket

The emergence of Clawdbot and similar tools does not imply that prediction markets have transformed into a one-click money-making machine. These agents necessitate technical configuration, trust in the underlying code, and comprehensive access to funds. Outcomes are frequently demonstrated over brief periods, with little proof of sustained long-term stability.

The risks are significant, particularly when larger sums of capital are at stake. A single erroneous trade or a software bug can lead to rapid losses.

Moreover, automation heightens competition. As more bots penetrate the market, visible inefficiencies are exploited more quickly, resulting in reduced profit margins for latecomers.

Polymarket’s instance illustrates that profitability in crypto can arise from various avenues. Algorithmic arbitrage is one. Manual strategies and market structure analysis are other possibilities. Yet, as always, it is not the bot itself that provides an edge. It is the comprehension of how the market operates. Without that knowledge, neither automation nor AI presents a sustainable benefit.

Another unresolved question is how Polymarket, and prediction markets in general, will react. On one hand, bots draw attention, and users pursue “easy money.” On the other hand, regulators are unlikely to view fully automated extraction strategies positively, especially given Polymarket’s ongoing regulatory hurdles.

Whether these bots can maintain their effectiveness over time remains uncertain. What is evident is that as their numbers increase, so too will incidents of misuse, scams, and negative outcomes.

This leads to the most profound question of all. If this truly works on a large scale, do Polymarket, Clawdbot, and similar tools reshape our perceptions of work, income, and markets? Are we moving towards a reality where money can be generated automatically, on a large scale? Or does that vision crumble under regulation, competition, and reality?

For the moment, questions are accumulating faster than answers.

Disclaimer: Crypto is a high-risk asset class. This article is intended for informational purposes and does not constitute investment advice.

The post Is Clawdbot Creating a ‘99% Win-Rate’ on Polymarket? appeared first on Cryptonews.