Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Increase in Bitcoin Whale Addresses After Spot ETF Authorization: CryptoQuant

Bitcoin (BTC) has experienced significant price growth this year, driven by institutional investments following the approval of spot ETFs by the United States Securities and Exchange Commission (SEC).

Recent data from on-chain analytics company CryptoQuant indicates a positive sentiment towards the leading cryptocurrency in recent weeks, resulting in a price increase.

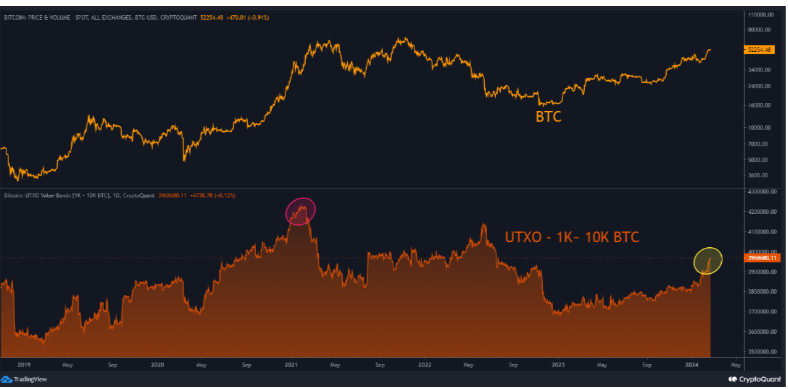

The data reveals a growing quantity of Bitcoin Unspent Transaction Output (UXTO) in the market, ranging from 1000 to 10,000 BTC.

These numbers have consistently risen since Q4 2023, coinciding with institutional investments in Bitcoin as the market anticipated the SEC’s approval.

The influx of funds contributed to a price surge that erased losses from 2022 and introduced a renewed bullish perspective on the market. In December 2023, the asset’s price reached $42,000, with several analysts suggesting a potential price of $50,000 following the approval.

On the institutional side, inflows amounting to millions were noted across various products, increasing Bitcoin’s Assets Under Management (AUM) to over $36 billion.

Bitcoin Whales Become Active

While the approval of spot Bitcoin ETFs impacts both institutional and retail investors, whale activity has surged in the past 30 days.

“These amounts are more likely to be associated with whales or institutional investors rather than individuals, particularly since the recent approval of Bitcoin spot ETFs, which has seen a sharp increase.”

CryptoQuant analysts observed that while these inflows are not as substantial as the peaks of 2021, they indicate significant institutional engagement.

“Typically, in bull markets, following a notable influx of institutional investors, new individual investors enter the market, signaling the conclusion of the bull run,” they noted.

Shortly after the approval, miners transferred $1 billion worth of BTC reserves to exchanges, with analysts suggesting this was in anticipation of the upcoming halving and the need to hedge towards larger facilities.

Additionally, data from CryptoQuant indicates nearly $1 billion moving out of Coinbase to other custodians, described as a holding strategy. This is due to outflows from centralized exchanges reflecting a bullish sentiment.

Bitcoin Sees a New Era Post ETF Approval

The SEC granted approval for the long-anticipated spot Bitcoin ETF on January 10, creating a new investment opportunity for transitional investors.

This has triggered a new wave in the market, elevating asset prices and attracting new investors. To date, Bitcoin ETFs have garnered $5.2 billion in net inflows, with over $1 billion recorded in the past week.

Bitcoin’s AUM has also reached $48 billion, driven by an increase in asset price and new market inflows. At the time of writing, Bitcoin is trading at $51,086, marking a 26% increase over the last 30 days as the overall market capitalization reaches $1.94 trillion.

The success of spot Bitcoin ETFs has prompted institutional players to consider Ethereum (ETH) ETFs in the United States. Some analysts anticipate new inflows to ETH in light of ETF expectations.

The post Bitcoin Whale Addresses Surge Following Spot ETF Approval: CryptoQuant appeared first on Cryptonews.