Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

If Conflict with Iran Is Likely, What Could Be the Impact on Bitcoin Prices?

The price of Bitcoin is once again at a critical juncture.

Price fluctuations are becoming extreme, hovering around $67,400 as it appears uncertain about its next move. Traders are feeling anxious. Very anxious.

On Polymarket, participants currently assign a 61% probability to a U.S. military action against Iran this month. The cryptocurrency market reacted swiftly. Liquidations occurred, and a risk-averse mentality took hold. Consequently, many are adopting a defensive stance.

Key Takeaways

The Signal: Polymarket participants estimate a 61% likelihood of imminent U.S. military engagement.

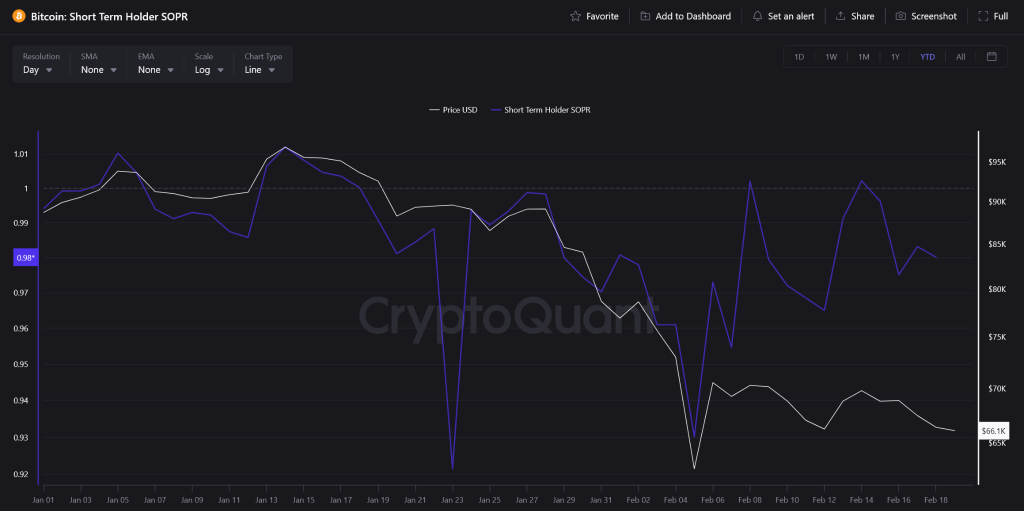

The Risk: The Short-Term Holder SOPR has fallen below 1.0, signaling panic selling at a loss.

The Impact: Bitcoin is at risk of breaching the crucial $65,000 support level if tensions escalate this weekend.

Why Is This Happening Now?

The strain between Washington and Tehran appears increasingly inevitable.

Reports indicate that the Pentagon has prepared strike options following the stagnation of nuclear negotiations. Such news drives investors towards gold and cash, leading to the initial sell-off of risk assets.

On-chain data corroborates this trend. The Short-Term Holder SOPR is below 1, indicating that recent purchasers are selling at a loss to exit their positions.

Source: CryptoQuant

Source: CryptoQuant

Adding to the uncertainty are potential adjustments in Federal Reserve policy, creating a complicated scenario. With the U.S.-Iran situation taking precedence, Bitcoin is behaving like a typical risk asset, characterized by significant intraday declines and fragile market sentiment.

What Does This Mean for Bitcoin Price?

Bitcoin is heavily reliant on the support range of $66,000 to $65,729. A daily close below this level could quickly bring $60,000 into view.

The short-term Sharpe ratio has turned negative, indicating poor risk-adjusted returns amid the turmoil. Nearly $80 million in long positions have already been eliminated since the decline from $70,000.

Source: BTCUSD / TradingView

Source: BTCUSD / TradingView

While retail investors are selling off, some political insiders are suggesting substantial long-term targets. This implies that larger investors may perceive this downturn as a buying opportunity. Arthur Hayes has also highlighted Treasury liquidity dynamics that could bolster crypto once the situation stabilizes.

Volatility heading into the weekend seems assured. However, discussions in Oman on Friday could alter the sentiment. If tensions ease, a significant relief rally could ensnare late short sellers.

Discover: Here are the cryptocurrencies likely to surge!

The post If War With Iran Is Almost Certain, How Might Bitcoin Price React? appeared first on Cryptonews.