Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

HTX Exchange Exceeds Coinbase in Spot Trading Volumes

HTX (previously known as Huobi) marked a significant achievement on May 27 by momentarily exceeding US-based Coinbase in daily spot trading volumes for the first time.

Justin Sun, a prominent figure in the TRON blockchain and one of HTX’s investors, announced this achievement on X. He noted that HTX executed transactions worth $1.81 billion in cryptocurrencies over a 24-hour period, surpassing Coinbase’s $1.58 billion.

HTX Exchange Achieved $1.81B Spot Trading Volume

For the first time, @HTX_Global has recorded higher spot trading volume than @coinbase. This is merely the beginning, and we are just starting out.

pic.twitter.com/VeYHFCviHy

— H.E. Justin Sun 孙宇晨 (@justinsuntron) May 27, 2024

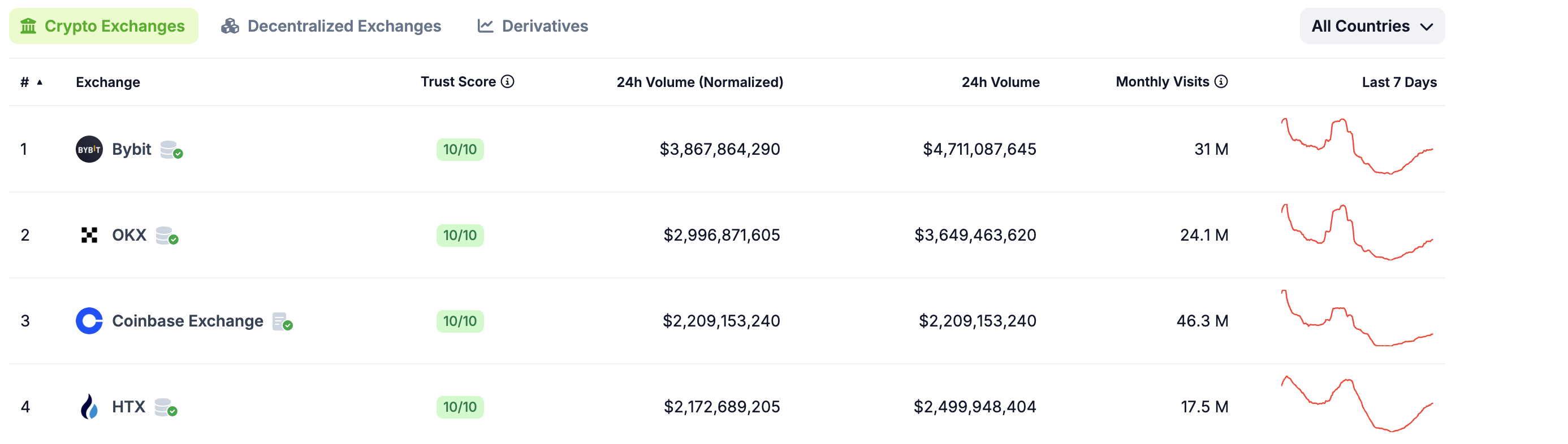

Recent data from CoinGecko indicates that Coinbase has regained the leading position. In the last 24 hours, Coinbase handled a trading volume of $2.2 billion, making it the third-largest cryptocurrency exchange worldwide, trailing only Bybit and OKX. HTX recorded approximately $2.1 billion, placing it behind Coinbase.

Coinbase spot trading volume now exceeds HTX

Coinbase spot trading volume now exceeds HTX

It’s worth noting that the HTX exchange, among the largest and oldest cryptocurrency exchanges globally, celebrated its 10-year anniversary in September 2023. To commemorate this milestone, the exchange transitioned from Huobi to HTX.

The rebranding stirred controversy, with numerous individuals in the crypto community drawing comparisons between HTX and the defunct exchange FTX. This relates to the new name, where “H” represents Huobi; “T” stands for Sun’s blockchain initiative Tron; and “X” signifies the exchange.

HTX Exchange Recent Milestone Associated with Coinbase Legal Issues

The temporary drop in Coinbase’s spot trading volume coincided with the exchange’s legal challenges in the United States.

The United States Securities and Exchange Commission (SEC) initiated a lawsuit against Coinbase, alleging that the exchange was offering unregistered securities. The SEC’s claims assert that Coinbase did not register as a broker, national securities exchange, or clearing agency, thus bypassing regulatory disclosure requirements established to safeguard securities markets.

Today we charged Coinbase, Inc. with operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency and for failing to register the offer and sale of its crypto asset staking-as-a-service program. https://t.co/XPG2gDkxtV pic.twitter.com/hCdVMw8B2v

— U.S. Securities and Exchange Commission (@SECGov) June 6, 2023

Since then, Coinbase has been defending its business practices in court. However, the legal situation reached a pivotal point in March 2024 when a U.S. court rejected Coinbase’s motion to dismiss the SEC’s case. The ruling allowed the SEC to proceed with its allegations that Coinbase operates an unregistered exchange, broker, and clearing agency.

Coinbase took a strategic legal action by submitting a memorandum in support of its interlocutory appeal in May 2024. This appeal aims to overturn the earlier court decision and possibly alleviate some of the company’s legal burdens.

Earlier in the month, the exchange’s legal troubles intensified as Coinbase customers filed a lawsuit against two of the company’s subsidiaries for allegedly violating securities law repeatedly since Coinbase’s inception.

The post HTX Exchange Surpasses Coinbase In Spot Trading Volumes appeared first on Cryptonews.