Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

How Stage 3 AI Brokers Could Transform DeFi—And What’s Preventing Progress

In the past year, AI brokers have gained significant momentum in the cryptocurrency industry, fueled by their ability to execute autonomous trading, anticipate market trends, and enhance financial operations.

These digital systems perform trades, predict market changes, and undertake various complex financial tasks with minimal human involvement.

The market valuation of AI brokers has skyrocketed, with CoinMarketCap reporting a total worth surpassing $13.5 billion.

Source: Grand View Analysis

Source: Grand View Analysis

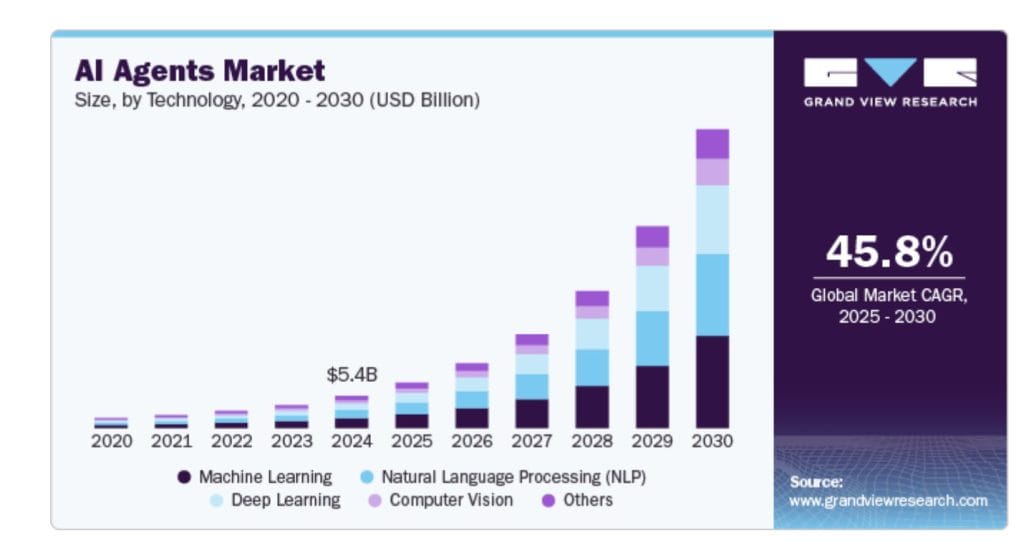

The global market for AI brokers was valued at $5.40 billion last year, with forecasts indicating a compound annual growth rate of 45.8% from 2025 to 2030.

What Are Stage 3 AI Brokers?

As AI brokers progress, Stage 3 brokers have emerged, showcasing greater autonomy and advanced learning abilities.

Unlike basic AI brokers that adhere to predefined workflows, Stage 3 AI Brokers demonstrate independent learning, long-term memory, and decision-making skills that mirror human cognitive processes.

James Ross, founder of Ethereum layer-2 network Mode, explained to Cryptonews that while most current artificial intelligence relies on human guidance and set workflows, Stage 3 brokers operate with minimal intervention.

“Stage 3 brokers can make independent choices based on a richer context and real-time data,” Ross stated. “They have long-term memory, enabling them to retain and utilize past experiences, user preferences, and environmental factors for future decisions.”

Ross noted that these brokers continually enhance their behavior through experience, autonomously recognizing patterns and adapting without explicit retraining.

They are also capable of processing multiple types of data simultaneously, including text, images, audio, video, and real-time environmental inputs, resulting in more sophisticated decision-making.

“These brokers anticipate user needs, provide recommendations, and take actions based on behavioral patterns rather than merely responding to commands,” Ross stated.

Stage 3 AI Brokers for the Crypto Industry

With their advanced capabilities, Stage 3 AI Brokers could significantly influence the cryptocurrency market.

Jessica Salomon, advisor to Chirper.Fun Stage 3 Agent Launchpad, informed Cryptonews that Stage 3 brokers will enhance user interaction within the crypto space.

“The key transformation will be the shift from transactional to relationship-driven interactions, where AI brokers act as true users rather than just tools,” Salomon stated.

Ross pointed out that earlier AI brokers were limited to tasks such as trading, market observation, and executing smart contract functions.

These brokers operated on static models, restricting their effectiveness in rapidly changing crypto environments.

Stage 3 AI Brokers overcome these limitations by refining their models in real time, adapting to new market trends, and identifying anomalies.

“They’ll analyze complex patterns, predict market movements, and proactively adjust their strategies instead of merely reacting to changes,” Ross stated.

Stage 3 AI Brokers for DeFi

Ross highlighted that decentralized finance (DeFi) is an excellent application for Stage 3 AI brokers.

This is because these brokers can autonomously manage portfolios, lending strategies, and liquidity pools by adjusting to market conditions.

“For instance, an AI agent might identify an impending market downturn and proactively reallocate assets, interact with DeFi protocols, or trigger hedging strategies – all without human involvement,” Ross stated. “This level of real-time, adaptive decision-making exceeds the capabilities of today’s brokers, which are typically restricted to predefined rules.”

Ross added that the AI brokers used by Mode – which enables DeFi brokers to actively transfer assets on-chain – are outperforming human traders.

Significant breakthrough on Synth data + BTC options pricing agent via @modenetwork AI Terminal

Incredibly powerful for professional options traders + retail

Needs a bit more refinement and then I’ll post videos this week

Next level DeFAI incoming pic.twitter.com/hLYjMULabb— James Ross

(@JRossTreacher) February 17, 2025

DeFi asset management protocol Velvet Capital is also utilizing advanced AI brokers to assist investors in trading digital assets and launching portfolios.

The company recently unveiled its “AI Agent Portfolio Launchpad,” a tool for AI-driven portfolio creation that enables automated strategies to manage investments.

What’s Next For Stage 3 AI Brokers?

Stage 3 brokers may also find applications within decentralized autonomous organizations (DAOs).

Ilan Rakhmanov, founder of ChainGPT, told Cryptonews that DAOs still heavily rely on human decision-making, which can slow processes and create inefficiencies.

Rakhmanov believes that an AI agent could eventually step in to analyze market conditions in real time or manage treasury funds based on both on-chain and off-chain data.

“These brokers might also negotiate with smart contracts, and even propose governance improvements,” Rakhmanov stated. “That’s the future we’re heading towards.”

While the application of advanced AI brokers is relatively new, it is noteworthy that NEAR Protocol recently began utilizing “Shade Brokers.”

Kendall Cole, co-founder of Proximity Lab, informed Cryptonews that Shade Brokers operate by extending much of the trust minimization of smart contracts to off-chain AI brokers.

He explained that these AI-driven brokers expand the design landscape for DeFi applications by completely eliminating human involvement.

“For example, there are teams creating index token brokers that trade major Layer-1 tokens cross-chain based on popularity trends,” Cole stated. “There are also prediction market brokers that create and settle markets, or x.com game brokers that execute transactions on behalf of users based on tweets.”

Cole noted that Shade Brokers will enable entirely new products, both in crypto and beyond.

Challenges Hindering Adoption

Despite the potential of Stage 3 AI Brokers, several challenges persist.

Salomon pointed to ethical considerations, including privacy risks associated with long-term memory storage and the possibility of AI-driven emotional manipulation.

“Maintaining consistent behavior while allowing for natural evolution and learning presents a significant challenge, as does creating genuine real-time responses that reflect true emotional intelligence rather than scripted patterns,” she stated.

Building trust remains a crucial hurdle for AI brokers. Ido Ben Natan, CEO of security platform Blockaid, told Cryptonews that without trust, users will hesitate to deposit funds into systems for meaningful financial activities.

Ben Natan noted that Blockaid is currently working on frameworks to enhance AI decision-making security.

“As part of our platform, we provide companies with solutions for securing all of their brokers’ on-chain interactions,” he stated. “This allows developers to create secure guardrails around their brokers and prevent them from unintentionally interacting with malicious assets or entities.”

Salomon added that the overall success of advanced AI brokers will depend on maintaining clear AI-human boundaries, strong privacy protections, and transparent development processes.

“The immediate focus will be on building trust and demonstrating value in specific use cases before expanding to broader applications,” she noted. “This will allow time to address both technical and ethical challenges while fostering user confidence.”

Investing in the Era of Smart Automation

Intelligent systems are beginning to assume roles once reserved for human expertise, redefining how digital assets are managed.

Stage 3 AI brokers showcase a combination of learning, memory, and proactive adjustments that challenge traditional market practices.

This evolution prompts a closer examination of the interaction between technology and investor decision-making.

It may be the right time for market participants to explore a more dynamic engagement with their portfolios.

In light of these changes, investors might consider adopting strategies that blend both technological insight and personal judgment.

The post How Stage 3 AI Brokers Might Transform DeFi—And What’s Holding Them Back appeared first on Cryptonews.

(@JRossTreacher) February 17, 2025

(@JRossTreacher) February 17, 2025