Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Harvard Economist Who Forecasted Bitcoin Drop to $100 Acknowledges Error

Harvard economist Kenneth Rogoff has publicly acknowledged that his prediction from a decade ago, which stated that Bitcoin would plummet to $100, was fundamentally incorrect, recognizing three significant errors in his evaluation.

The former chief economist of the International Monetary Fund shared on X that he underestimated Bitcoin’s significance in the $20 trillion global underground economy, did not foresee favorable pro-crypto regulatory changes in the U.S., and was surprised by government officials amassing substantial crypto assets while formulating policy.

Rogoff’s 2018 forecast on CNBC, where he claimed Bitcoin was “more likely to be worth $100 than $100,000 ten years from now,” has been proven dramatically inaccurate, as Bitcoin is currently valued above $115,000.

His initial argument was based on the assumption that government regulation would eradicate Bitcoin’s main applications related to money laundering and tax evasion, leading to a price collapse.

Almost a decade ago I was the Harvard economist that said that bitcoin was more likely to be worth $100 than 100k. What did I miss? I was far too optimistic about the US coming to its senses about sensible cryptocurrency regulation; why would policymakers want to facilitate tax…

— Kenneth S Rogoff (@krogoff) August 19, 2025

Three Errors That Led to the $100 Prediction

In his new book “Our Dollar, Your Problem,” Rogoff pinpointed his first major mistake as being “far too optimistic about the U.S. coming to its senses about sensible cryptocurrency regulation.”

Contrary to the anticipated crackdown, the Trump administration implemented significant pro-crypto legislation, including the GENIUS Act, CLARITY Act, and CBDC Anti-Surveillance State Act.

The GENIUS Act created the first federal regulatory framework for stablecoins, requiring full backing with U.S. dollars and establishing formal consumer protections.

US Treasury seeks public input on AI tools to detect crypto money laundering as criminals stole $3B in 2025 with 4-second attack speeds.#Crypto #Securityhttps://t.co/wHuMM4vb5k

— Cryptonews.com (@cryptonews) August 19, 2025

Meanwhile, the CLARITY Act shifted the jurisdiction of digital assets from the SEC to the Commodity Futures Trading Commission, clarifying oversight responsibilities for crypto exchanges and dealers.

Rogoff’s second miscalculation pertained to Bitcoin’s unforeseen prominence in the global underground economy.

He admitted to not recognizing “how Bitcoin would compete with fiat currencies to serve as the preferred medium of exchange in the twenty-trillion dollar global underground economy.”

This demand establishes a price floor for Bitcoin as it captures market share from traditional cash-based illicit transactions.

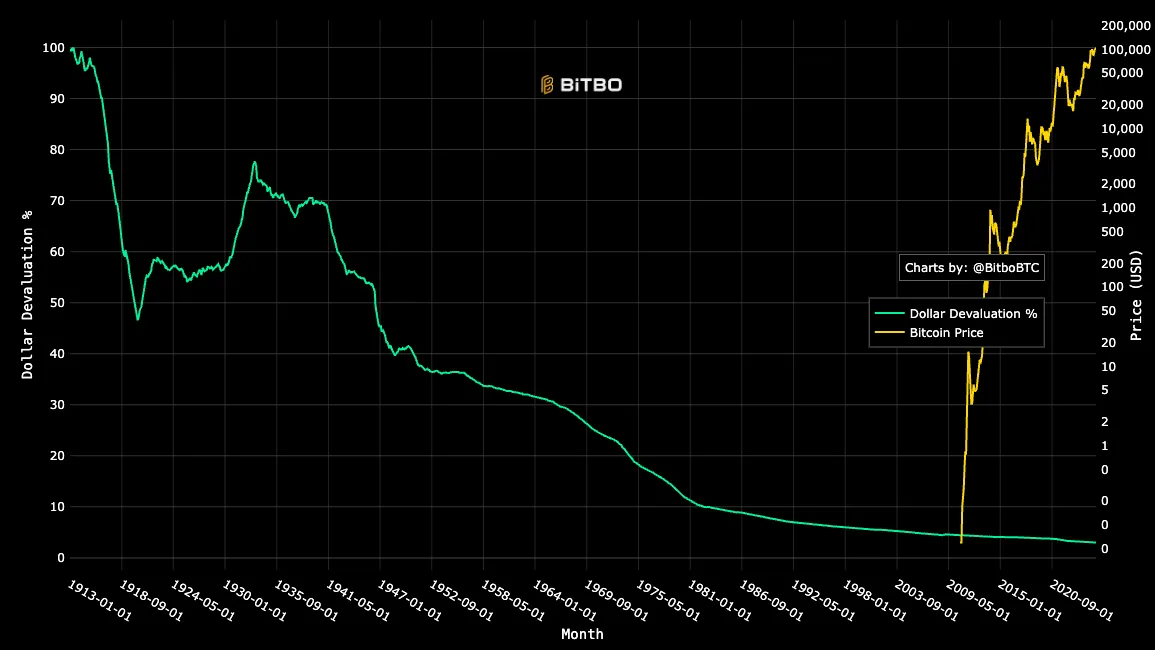

Source: Bitbo

Source: Bitbo

The underground economy has traditionally depended on U.S. dollar cash, but Bitcoin is increasingly utilized in these unregulated markets despite ongoing regulatory scrutiny.

This transactional functionality provides tangible value beyond speculation, challenging Rogoff’s initial belief that eliminating illegal use cases would severely impact Bitcoin prices.

His third mistake involved underestimating the political conflicts of interest.

Rogoff expressed astonishment at “a situation where regulators, and particularly the regulator in chief, would be able to openly hold hundreds of millions (if not billions) of dollars in cryptocurrencies seemingly without consequence given the obvious conflict of interest.”

Trump’s Crypto Holdings Confirm Economist’s Conflict Concerns

President Trump’s substantial crypto assets have confirmed Rogoff’s worries regarding regulatory conflicts of interest.

Trump possesses $1.2 billion in crypto wealth across various ventures, including $430 million in different wallets, $390 million from World Liberty Financial, and $315 million from his $TRUMP meme coin.

Source: Cryptonews

Source: Cryptonews

Trump Media & Technology Group holds around 18,430 Bitcoin valued at $2.1 billion, accounting for 40% of the company’s market capitalization and making it the sixth-largest corporate Bitcoin holder worldwide.

The timing of Trump’s crypto accumulation coincides with his administration’s regulatory changes, which included appointing pro-crypto SEC officials and establishing strategic Bitcoin reserve plans.

Approximately 20% of current Trump advisors actively hold cryptocurrencies, including Vice President JD Vance and seven Cabinet members with combined holdings exceeding $2 million.

Democrats on the House Financial Services Committee have criticized Trump for rewriting “the rules, then cashed in on the chaos he helped create.”

The crypto sector contributed over $26 million to Trump’s political action committee, with major contributors including Blockchain.com ($5 million), Marc Andreessen and Ben Horowitz ($3 million each), and Gemini Trust ($3 million).

These financial connections raise concerns about policy independence, particularly as the government evaluates Bitcoin reserve initiatives.

Rogoff, who has revised his viewpoint, stands in contrast to other notable Bitcoin skeptics who have retained their positions despite the cryptocurrency’s expansion.

At that time, Warren Buffett continued to label Bitcoin as “rat poison squared,” while Jamie Dimon upheld his “fraud” characterization, although he has recently softened his stance on blockchain technology.

Similarly, Paul Krugman and Charlie Munger have remained consistent critics, dismissing Bitcoin as lacking intrinsic value.

However, regarding government involvement, industry critics like ZachXBT have recently argued that government dependence contradicts cryptocurrency’s foundational principles of independence.

The blockchain investigator criticized how the industry has “normalized thefts” while relying on often ineffective law enforcement to recover stolen assets.

He emphasized the persistent structural issues that government involvement cannot resolve, or may even exacerbate.

The post Harvard Economist Who Predicted Bitcoin Crashing to $100 Admits He Was Wrong appeared first on Cryptonews.