Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Groupe BPCE of France to Provide Bitcoin and Cryptocurrency Investment Options to 35 Million Users

The Autorité des Marchés Financiers (AMF), France’s financial markets regulator, has granted approval for BPCE, one of the largest banking groups in the nation, to engage in the cryptocurrency sector.

This will be facilitated through its subsidiary, Hexarq, following the receipt of regulatory endorsement from the AMF. The launch of services is anticipated in 2025.

Source: amf-france.org

Source: amf-france.org

France’s Groupe BPCE Prepares Crypto Integration Across Its Products by 2025

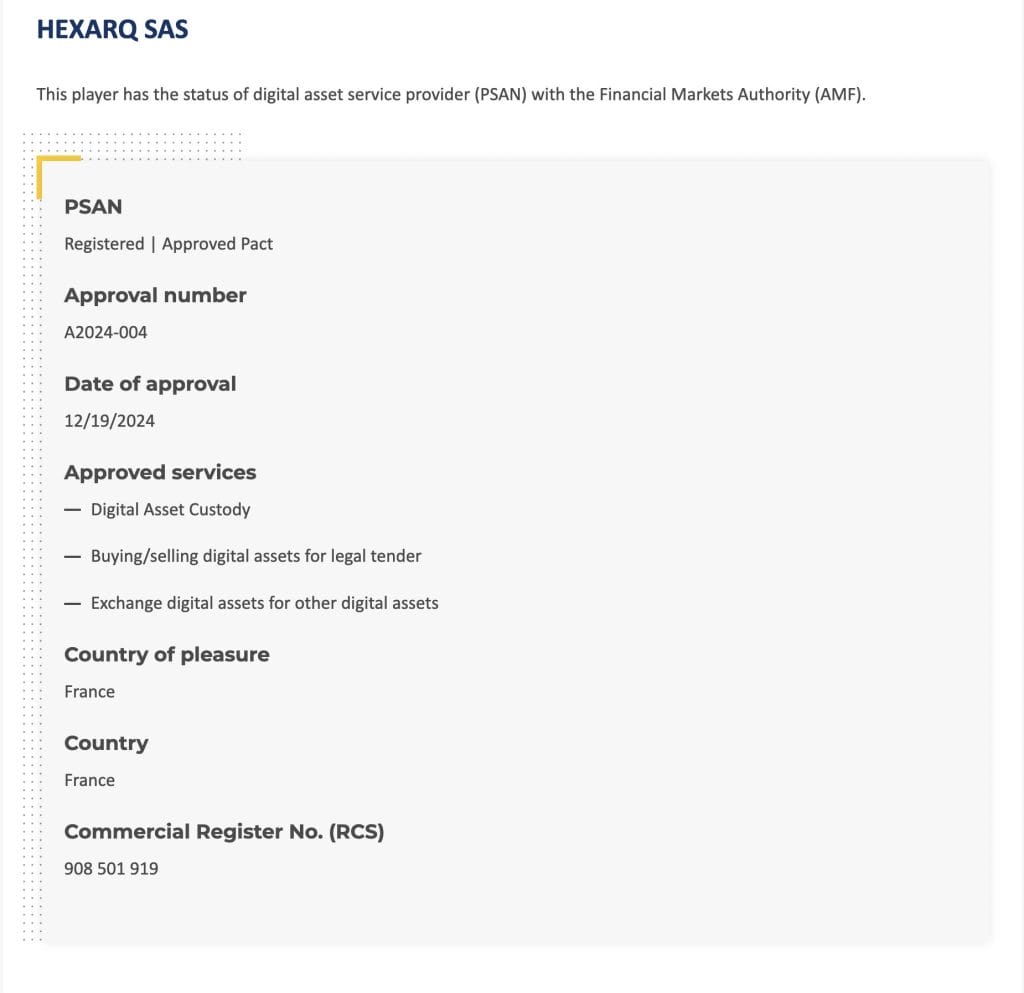

Hexarq has obtained PSAN (Prestataire de Services sur Actifs Numériques) authorization from the AMF.

This authorization enables Hexarq to provide services such as cryptocurrency custody and the legal buying, selling, and trading of cryptocurrencies against the euro in France. The PSAN framework regulates digital asset service providers within the country.

With this authorization, BPCE’s subsidiary becomes the fourth crypto entity to receive AMF’s CASP authorization. Société Générale’s crypto subsidiary, Forge, was the first to gain approval in 2023, followed by Deblock SAS and GOin SAS in 2023 and 2022, respectively.

As one of the top ten largest banks in Europe, BPCE is preparing to deliver cryptocurrency services to its extensive customer base.

Hexarq intends to incorporate its crypto services into BPCE’s two main banking networks, Banque Populaire and Caisse d’Épargne, by 2025.

Established in January 2021, Hexarq specializes in digital asset services, which include cryptocurrencies and tokenized real-world assets (RWAs).

Following the AMF’s endorsement, the crypto platform will broaden its offerings and leverage BPCE’s extensive banking infrastructure.

BPCE’s entry into the cryptocurrency market is noteworthy, as the group oversees assets valued at approximately €1.3 trillion (around $1.3 trillion), serving a customer base of over 35 million.

Hexarq will launch these services through a dedicated application, which will be integrated into BPCE’s Banque Populaire and Caisse d’Épargne networks.

France Leads EU Crypto Regulation Ahead of MiCA’s Full Rollout

If everything proceeds as planned, BPCE’s cryptocurrency services will be incorporated into its existing networks, providing millions of bank clients with seamless access to digital assets.

Despite this significant advancement, BPCE has chosen not to disclose further details regarding the precise timeline or the specific services set to launch in 2025.

France has assumed a leading position in Europe’s crypto regulation, becoming the first major EU economy to initiate crypto asset service provider license applications under the MiCA regulation.

The AMF has been actively engaged in regulating the crypto sector in France, having begun accepting CASP applications in August 2024.

This initiative is undertaken prior to the full implementation of the European Union’s MiCA regulations, which will come into effect on December 30.

Meanwhile, the French crypto market continues to witness ongoing regulatory changes. Some exchanges, such as Bybit, are preparing to cease operations in France by January 2025.

Additionally, a prominent crypto exchange, Gemini, recently announced its expansion into France last month after obtaining a VASP (Virtual Asset Service Provider) registration, further reinforcing France’s emerging significance as a center for crypto activities within Europe.

The post France’s Groupe BPCE to Offer Bitcoin and Crypto Investments to 35M Users appeared first on Cryptonews.