Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Goldman Sachs Projects Federal Reserve to Reduce Rates to 3.25%–3.5% by June Amid Diminishing Recession Concerns

Goldman Sachs anticipates a sequence of consecutive 25 basis point reductions in Fed rates as concerns regarding a U.S. recession diminish.

As reported by The Economic Times, Goldman Sachs indicated on Wednesday that it foresees the U.S. Federal Reserve implementing successive 25-basis-point (bps) interest rate reductions from November 2024 through June 2025.

In the previous month, the U.S. central bank lowered the overnight rate by half a percentage point, citing increased confidence that inflation will continue to decline towards its 2% annual goal.

This follows last month’s unexpectedly positive U.S. jobs data, which reinforces Goldman Sachs’ belief that the upcoming FOMC meetings will yield smaller 25-basis-point cuts.

Goldman Sachs predicts the Fed will lower rates to a terminal funds rate of 3.25%–3.5% by June 2025, a scenario that enhances confidence in the long-term prospects for cryptocurrencies.

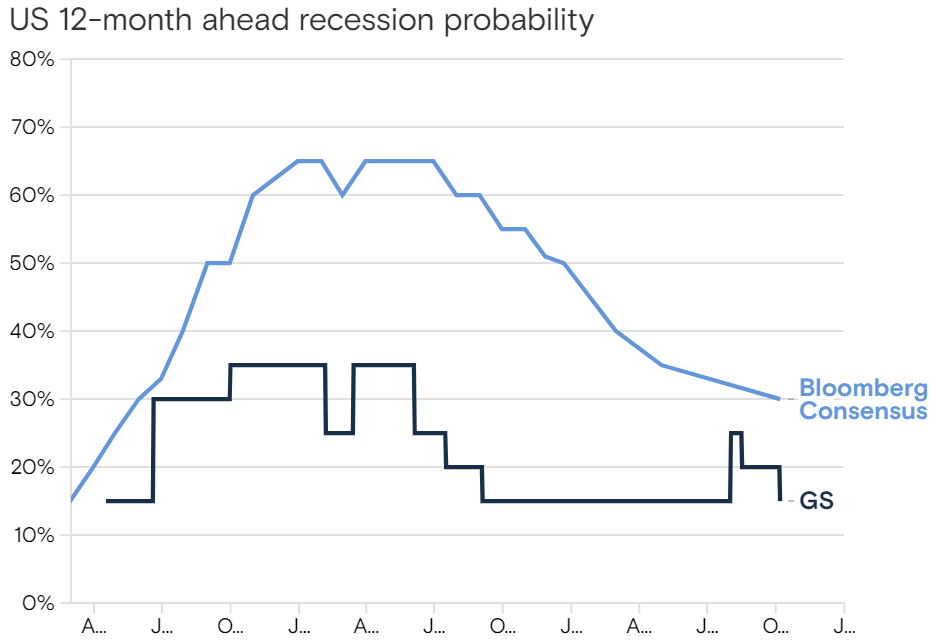

U.S. Recession Odds Decline to 15%

Concerns that last month’s dovish rate cut would be insufficient to address a potential U.S. recession are fading as stronger-than-anticipated U.S. jobs data promotes optimism.

This follows a Goldman Sachs report earlier this month, which reduced their forecast for a U.S. recession over the next 12 months to 15%, down from the previous 20%, driven by indications of a still-robust job market.

U.S. recession probability over the next 12 months: Goldman Sachs

U.S. recession probability over the next 12 months: Goldman Sachs

The U.S. economy added 254,000 jobs in September, significantly exceeding Wall Street’s prediction of 147,000. The unemployment rate also fell to 4.1%, while the annual wage growth rate increased to 4.0% from 3.8% in August.

Additionally, the unemployment rate has returned below the level that triggers the “Sahm rule” after a scare in August when the indicator suggested a possible recession.

This stronger-than-expected jobs report led macro traders to largely remove bets on another 50bps rate cut from the Federal Reserve in November.

According to the CME Fed Watch Tool, money markets are currently pricing in a 90.9% likelihood of a 25bps rate cut next month.

This supports the narrative that a soft landing for the U.S. economy remains attainable — indicating that the Fed may be able to manage inflation without instigating a recession.

Moreover, the report dismissed the possibility that rising geopolitical tensions could hinder inflation progress, asserting, “Conflict in the Middle East hasn’t altered Goldman Sachs Research’s belief that inflation will continue to decrease.”

What Do More Fed Rate Cuts Mean For Crypto?

This development could prevent recession fears from “overshadowing the optimistic narrative of rate cuts from the Fed,” as noted in a recent 10x research report.

By alleviating fear, uncertainty, and doubt (FUD), the market is set for what is expected to be a bullish conclusion to the year.

Interest rate reductions generally steer investors towards risk-on assets like cryptocurrencies as traditional investments become less attractive. Last month’s 0.5% cut in September set the stage for this month’s rally, illustrating this trend.

Lower interest rates can weaken the U.S. dollar, making cryptocurrencies more appealing as alternative stores of value.

This shift in monetary policy follows the European Central Bank’s (ECB) decision to lower interest rates by 0.25% during its monetary policy meeting today.

BREAKING:

ECB cuts interest rates again by 0.25 percentage points.

We know what happens nextpic.twitter.com/B7jBiddGCt

— Bitcoin Magazine (@BitcoinMagazine) October 17, 2024

Goldman Sachs has forecasted that the ECB will continue to lower rates until the policy rate reaches 2% by June 2025.

With both the Fed and ECB leaning towards rate cuts, the environment appears conducive for a potential rally in risk assets, including cryptocurrencies.

As central banks relax monetary policies, the reduced returns on traditional investments could lead more investors towards crypto, paving the way for substantial market gains.

The post Fed to Cut Rates to 3.25%–3.5% by June as Recession Fears Ease: Goldman Sachs appeared first on Cryptonews.

ECB cuts interest rates again by 0.25 percentage points.

ECB cuts interest rates again by 0.25 percentage points.