Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Gold Breaks $5,100 Record Amid Trump Tariff Concerns; ETH Drops Below $2,900

Gold reached a new all-time high, surpassing $5,100 per ounce on Monday, continuing its record-setting streak as investors seek refuge amid escalating geopolitical tensions and global financial uncertainties.

Spot gold prices increased by 2.4%, trading at $5,102 an ounce, before retracting to $5,086.

This rise follows President Donald Trump’s warning to Canada that the U.S. would impose a 100% tariff on goods sold in the U.S. if the country finalizes a trade agreement with China. “If Canada makes a deal with China, it will immediately be hit with a 100% Tariff against all Canadian goods and products coming into the U.S.A.,” Trump stated in a post on Truth Social.

In contrast, Ethereum is trending downward, trading at $2,877.15 with a 24-hour trading volume of $24.69 billion. The token is currently 36% lower than its peak of $4,953.73.

The Race to $5K Concludes

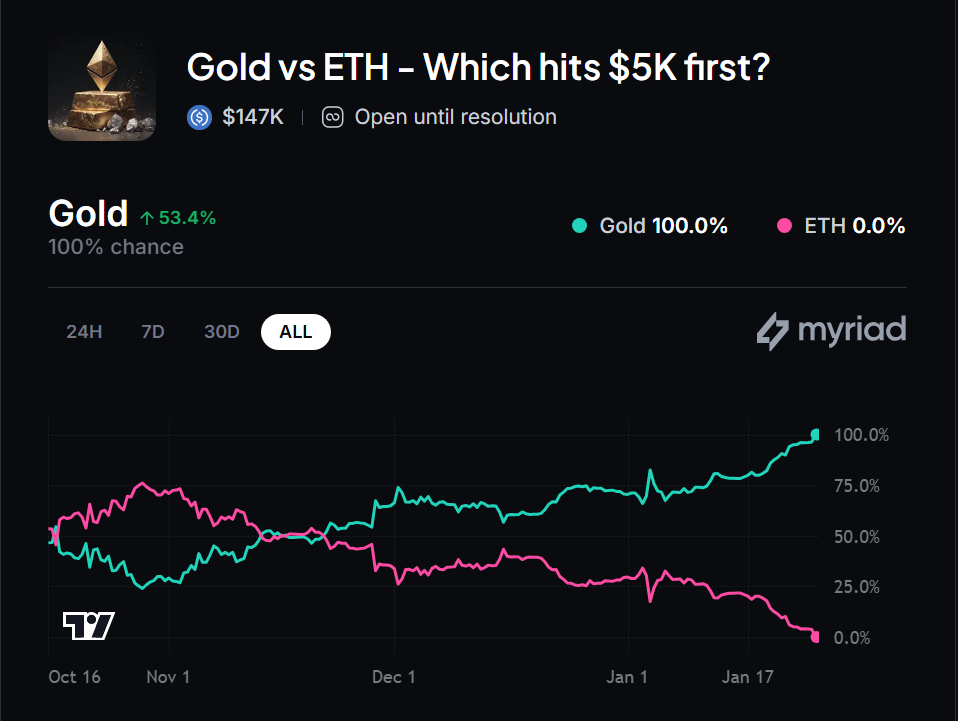

The “Gold versus ETH: Which hits $5K first?” market on Myriad has reached a conclusion, with gold reaching the $5k milestone first. The precious metal surged 7.28% over the week and was recently valued at $4,938 before Monday’s breakout.

Source: Myriad

Source: Myriad

While gold is often compared to Bitcoin, bettors on Myriad have favored ETH for months, wagering on its volatile upward potential, but their confidence has waned as cryptocurrency markets decline. The prediction market commenced in October 2025.

Institutional Flows Narrate the Trend

Western ETF holdings have increased by approximately 500 tonnes since the beginning of 2025. Goldman Sachs raised its December 2026 gold price forecast to $5,400 an ounce, up from $4,900, asserting that hedges against global macro and policy risks have become “sticky.”

Central bank acquisitions remain strong, with Goldman estimating that central bank purchases are averaging about 60 tonnes per month, significantly above the pre-2022 average of 17 tonnes.

“Although this gold rally has not, and will not, be linear, we believe the factors driving this upward adjustment in gold prices are not exhausted,” stated Natasha Kaneva, head of Global Commodities Strategy at J.P. Morgan. “The long-term trend of official reserves and investor diversification into gold still has further to go.”

Ethereum experienced $630 million in outflows last week, reflecting a bearish outlook as investors withdraw their capital. A whale that had remained inactive for nine years transferred 50,000 ETH, valued at $145 million, to a Gemini wallet, a move typically associated with liquidation intentions.

According to @EmberCN monitoring, a dormant 9-year ETH whale address was activated in the last 12 hours, transferring 50,000 ETH (worth $145 million) to the Gemini exchange. The address withdrew 135,000 ETH ($12.17 million) from Bitfinex 9 years ago when ETH was priced at approximately $90, representing… pic.twitter.com/akGYWcKoVC

— Wu Blockchain (@WuBlockchain) January 26, 2026

Geopolitical Triggers

The rise of the precious metal occurs amidst flashpoints from Greenland and Venezuela to the Middle East, indicating heightened geopolitical risk. Trump’s tariff threat follows rising tensions after Canadian Prime Minister Mark Carney’s speech at the World Economic Forum in Davos, which was perceived as a criticism of the Trump administration’s policies.

Earlier this month, Carney revealed that Canada and China had reached a preliminary agreement to eliminate trade barriers. Under this tentative arrangement, Beijing reduced tariffs on specific Canadian agricultural products, while Ottawa raised quotas for imports of Chinese electric vehicles.

Canadian Prime Minister Mark Carney stated on Sunday that Ottawa has no intentions of pursuing a free trade deal with China, emphasizing that the recent agreement only lowers tariffs on selected sectors. Carney’s comments came a day after President Trump threatened a 100% tariff on Canadian goods.

What Market Participants Are Monitoring

The divergence between gold and cryptocurrency suggests a broader risk reassessment. Following a record-breaking 2025, gold entered 2026 with its momentum intact as geopolitical tensions, declining real interest rates, and efforts by investors and central banks to diversify away from the dollar reinforce its status as a safe haven.

ETH struggled to reclaim its “digital gold” narrative during periods of peak macro stress. Analysts note that if ETH maintains support around the $2,500 level, it could potentially achieve an all-time high of $6,000 by 2026, but this scenario depends on a return of risk appetite. In August 2025, Trump raised the tariff on Canadian goods to 35%. A 100% tariff threat represents a significant escalation.

Markets are anticipating two interest rate cuts by the Federal Reserve later this year. Traders are looking forward to this week’s FOMC meeting, where the central bank is widely expected to keep rates unchanged.

The post Gold Smashes $5,100 Record as Trump Tariff Threat Looms; ETH Slides Under $2,900 appeared first on Cryptonews.