Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

FTX incurs $53,000 in hourly expenses related to bankruptcy fees, recent documents reveal.

In the three months concluding on Oct. 31, the now-defunct crypto exchange FTX has been expending around $53,000 each hour on legal and advisory services related to its bankruptcy, as indicated by the latest compensation filings.

Documents submitted to the court from Dec. 5 to Dec. 16 reveal that bankruptcy attorneys have billed at least $118.1 million from Aug. 1 to Oct. 31. This totals approximately $1.3 million daily or $53,300 hourly over the span of 92 days.

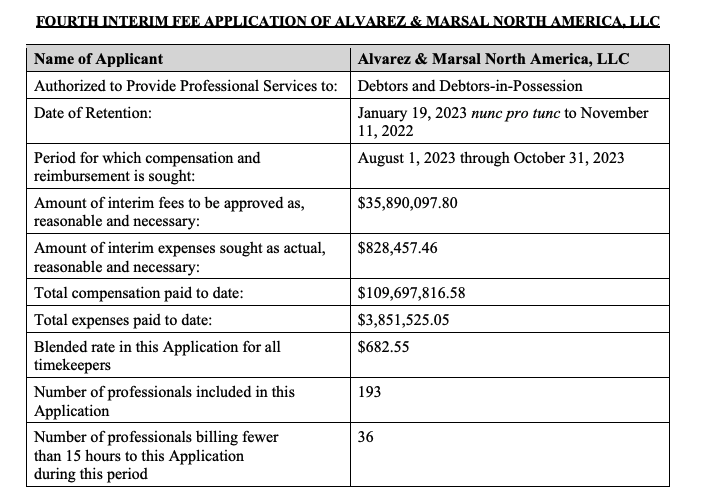

The highest invoice was from the management consulting firm Alvarez and Marshall, which billed $35.8 million for its services during the three-month period.

Alvarez and Marshall invoiced a total of $35.8 million to the FTX estate. Source: CourtListener

Alvarez and Marshall invoiced a total of $35.8 million to the FTX estate. Source: CourtListener

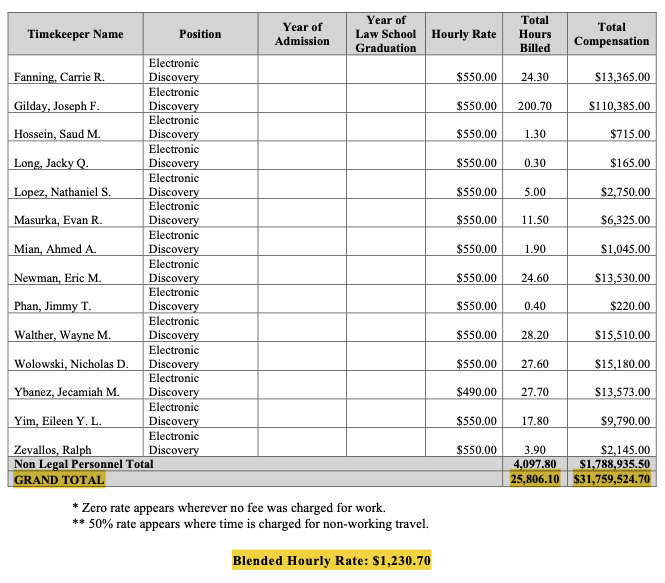

Following closely was the global law firm Sullivan & Cromwell, which charged $31.8 million for its services. The average hourly rate for Sullivan & Cromwell’s services was $1,230.

Sullivan and Cromwell’s services incurred a cost of $1,230 per hour for FTX creditors. Source: CourtListener

Sullivan and Cromwell’s services incurred a cost of $1,230 per hour for FTX creditors. Source: CourtListener

The global consulting firm AlixPartners billed $13.3 million during this timeframe for professional services related to forensic investigations. Quinn Emanuel Urquhart & Sullivan charged $10.4 million in the same period, while various other charges from smaller advisory firms totaled over $26.8 million.

Information shared by a pseudonymous FTX creditor in a Dec. 17 post on X (formerly Twitter) indicates that the total legal fees fully paid since the initiation of the FTX bankruptcy case is around $350 million.

Related: FTX debtors evaluate the value of crypto claims based on market prices at the time of petition

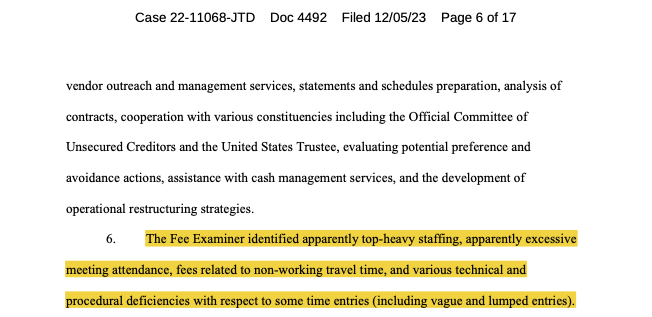

Additionally, an earlier report submitted on Dec. 5 by the court-appointed fee examiner, Katherine Stadler, highlighted “significant areas of concern” regarding the billings presented by larger advisory firms, including Sullivan & Cromwell, Alvarez & Marshall, and others between May 1 and June 31.

“The Fee Examiner noted seemingly top-heavy staffing, apparently excessive attendance at meetings, fees associated with non-working travel time, and various technical and procedural issues concerning some time entries (including vague and aggregated entries),” the report states regarding the billings from Alvarez & Marshall.

Advisory firms faced criticism for over-billing from the case’s Fee Examiner. Source: CourtListener

Advisory firms faced criticism for over-billing from the case’s Fee Examiner. Source: CourtListener

Magazine: Terrorism and the Israel-Gaza war have been weaponized to undermine crypto