Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Forget Trading Charts, the True Future of Cryptocurrency Lies in Routine Transactions

The majority of individuals are not preoccupied with price charts; they prioritize timely payments, low-cost money transfers, and straightforward transaction processes. This is why an increasing number of banks, processors, and payment networks are exploring blockchain-based payment systems.

These systems are already facilitating real financial transactions in practical applications, ranging from merchant settlements to international payouts, and the pace of adoption is quicker than many anticipated.

Card networks are experimenting with stablecoin settlements, regulators are developing guidelines, and merchants are seeking to minimize the steps between a sale and the receipt of funds.

For this technology to thrive beyond the crypto community, it must achieve what traditional finance has already established: money transfers should be reliable, cost-effective, and effortless.

Payments Succeed When Regulations Are Clear

Policymakers are gravitating towards areas where the utility is evident. They are differentiating between speculative activities and fiat-backed tokens aimed at streamlining checkout and international payments. In the European Union, for instance, the MiCA framework establishes a unified regulatory framework for e-money and asset-referenced tokens, complete with phased implementation timelines and new guidance from ESMA.

Similarly, Singapore has implemented a stablecoin framework that mandates high-quality reserves and 1:1 redemption. Additionally, Hong Kong has advanced with a licensing system for issuers of fiat-referenced stablecoins. The message is clear: if a use case addresses speed, fees, or accessibility, regulators will create a pathway for it.

Established Payment Companies Are Driving the Transformation

Regulators have opened that pathway, and major networks have already entered it. Payments now appear to be the most scalable option for widespread adoption. For example, PayPal’s Pay with Crypto offers up to 90% reductions in cross-border fees integrated directly into a familiar checkout process. No seed phrases, no tutorials—just pay and receive payments.

Another major player, Visa, reports settling over $225 million in stablecoin transactions and continues to broaden its support for various tokens, blockchains, and even a euro-denominated option. Meanwhile, Mastercard has partnered with Paxos’ Global Dollar Network to incorporate regulated stablecoins into existing money transfer products.

Furthermore, PayPal’s PYUSD stablecoin is being launched on the Stellar network to enhance everyday payment and remittance options.

Imagine sending low-cost payments internationally that settle instantly.

With @PayPal’s PYUSD on Stellar, that experience is just around the corner for shoppers and merchants. pic.twitter.com/GrMq7dYA6u— Stellar (@StellarOrg) June 27, 2025

Trading-Centric Platforms Are Hindering Genuine Adoption

The challenge is that numerous crypto platforms still resemble trading applications, dominated by charts, order types, and tickers.

This approach may have been effective during speculative phases, but it does not assist a contractor wishing to invoice in dollars, a marketplace requiring same-day settlements, or a local shop that simply wants funds to arrive in a bank account without complications.

Surface-level complexity deters mainstream users. In simple terms, if a payout necessitates selecting a blockchain and estimating a network fee, most will choose to opt out.

Utility thrives when outcomes are clear: tap to send, and funds arrive. Customer support can address edge cases, and compliance can be integrated into the process without intimidating users. A trading-centric mindset complicates this and limits the audience the industry can reach.

The Fundamental Principles of Financial Utility

Revising this approach involves treating the product as a utility that provides predictable outcomes. Funds should settle as expected. Fees must remain transparent. Disputes should have a clear resolution process. Uptime should be a guarantee, not a hope. If designed in this manner, the experience would resemble money movement rather than mere speculation.

Localization is as crucial as the blockchain itself, as Europe relies on SEPA and euro settlements while the United States depends on ACH, instant card payouts, and straightforward business reporting. This is why cross-border payments require fiat-backed tokens that seamlessly connect to local accounts.

Moreover, compliance is an integral aspect of the product. It begins with simple KYC and KYB checks that are easy to complete. Clear disclosures regarding stablecoin reserves and redemption, along with merchant reports that align with real-world accounting, transform these networks into tools that consumers and businesses can rely on.

Does This Approach Truly Work?

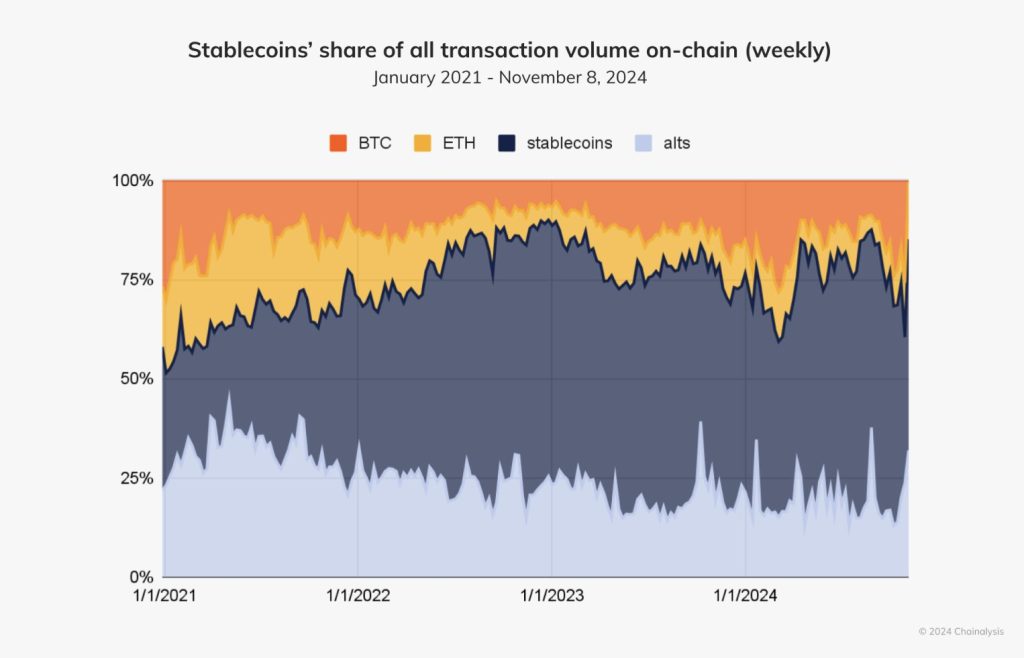

Observe where the traffic flows—away from price charts and towards payment channels. Banks and processors are integrating tokenized payments into real workflows—merchant settlements, B2B payouts, remittances—because transactions clear more swiftly with fewer intermediaries. This is not merely speculation: McKinsey outlines the transition, and on-chain data supports it, as Chainalysis indicates that stablecoins now account for the majority of value transferred across networks.

Source: Chainalysis

Source: Chainalysis

The significant factor lies in the costs. Typical card acceptance fees range from 1.5% to 3.5% per transaction, while the World Bank continues to report over 6% for sending $200 internationally. Nevertheless, demand continues to grow, and eMarketer forecasts that U.S. crypto payers will increase by approximately 82 percent from 2024 to 2026, albeit from a small base.

Now consider remittances, where every minute and cent counts. Remittance flows to low and middle-income nations reached approximately $656–669 billion in 2023 and are projected to approach $685 billion in 2024, with the global total nearing $900 billion.

When a typical cross-border transfer still incurs over six cents on the dollar, reducing time and fees is not merely a feature request—it is an essential task.

The Path Ahead

Ultimately, platforms face a distinct choice—either continue optimizing for trading and cater to a limited audience, or evolve into utilities that provide certainty to households and businesses.

The latter path necessitates essential but less glamorous work: establishing redundancies, managing reconciliations and chargebacks, drafting clear disclosures, and overseeing local payouts. While less visible, this approach fosters sustainable revenue and authentic customer loyalty.

Payments may not be the sole application for these networks, but it is the one that regulators currently endorse and enterprises can implement today. This is why card networks, banks, and on-ramp providers are now converging around the concept of quicker, safer settlements built on tokenized money. Follow the existing momentum, then build trust by simplifying the experience and, frankly, making it a bit mundane.

Disclaimer: The views expressed in this article are those of the author and do not necessarily reflect the opinions of Cryptonews.com. This article aims to provide a broad perspective on its subject and should not be interpreted as professional advice.

The post Forget Trading Charts, Crypto’s Real Future is Boring Payments appeared first on Cryptonews.