Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

FCA Enforcement Falls Short of Eliminating Half of Illegal Crypto Ads in UK: Study

The UK Financial Conduct Authority (FCA) is under increasing scrutiny following revelations that nearly 50% of flagged illegal cryptocurrency advertisements remain online despite the agency’s enforcement actions.

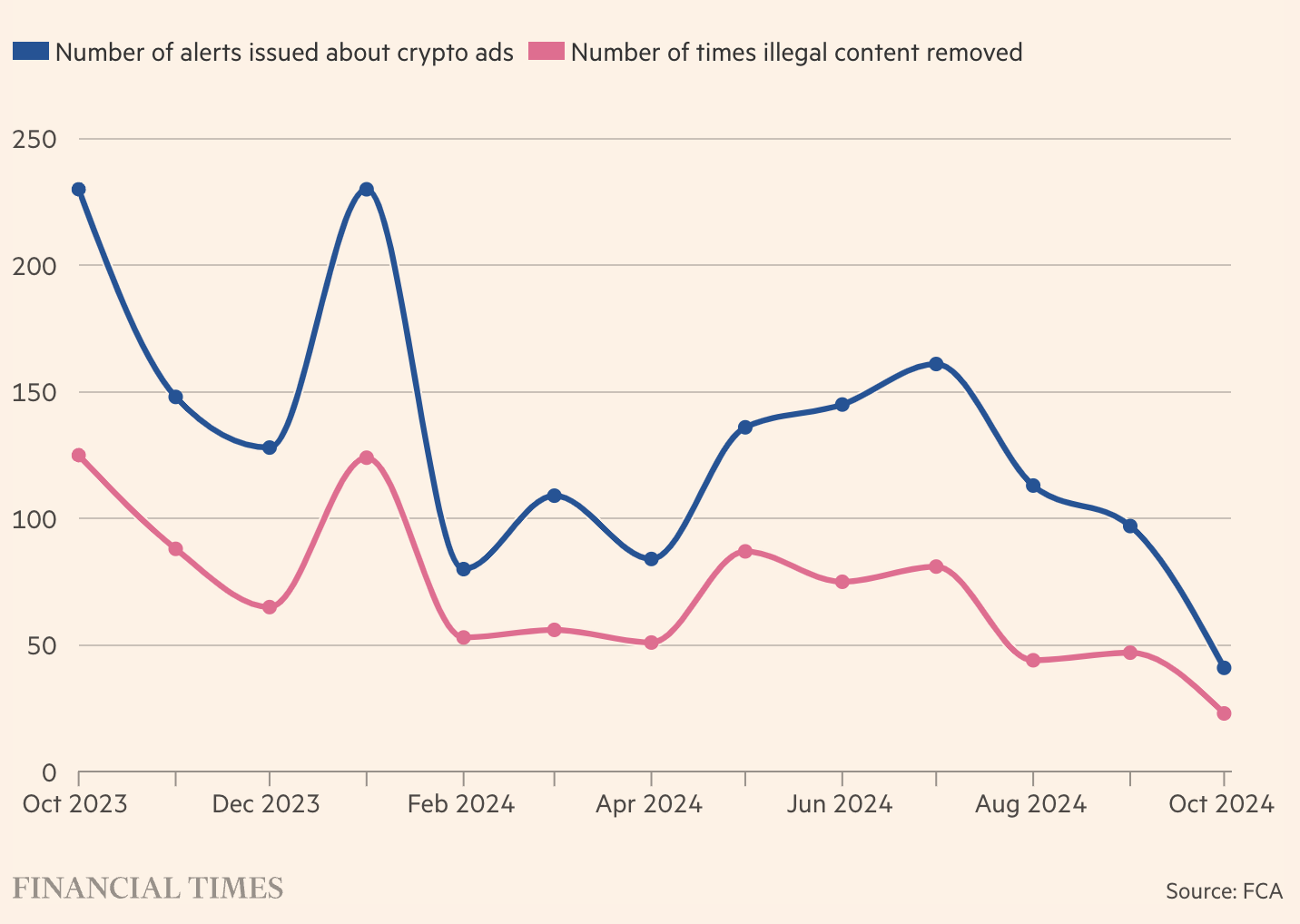

According to a report by the Financial Times, from October 2023 to October 2024, the FCA issued 1,702 notifications regarding non-compliant crypto advertisements, applications, and websites.

However, only 54% of these advertisements were successfully taken down.

Source: ft.com

Source: ft.com

The FCA, which possesses the legal power to impose sanctions and initiate criminal proceedings against offenders, has yet to penalize any organization for non-compliance with its takedown orders.

Instead, the agency has focused its efforts on social media influencers, commonly referred to as “finfluencers,” who promote unauthorized financial products online.

While the FCA has made strides in securing voluntary agreements from tech giants such as Google and Meta to prohibit non-compliant paid advertisements, critics contend that the absence of concrete penalties diminishes the effectiveness of this initiative.

FCA’s Assault On Crypto Advertisements: How Far Can The Agency Go?

In a recent high-profile case, the FCA brought criminal charges against nine social media influencers for endorsing unauthorized financial products, including high-risk crypto derivatives.

Some defendants, who gained fame through reality television shows like Love Island and The Only Way Is Essex, are facing prosecution for their roles in illegal promotions on platforms such as Instagram.

Additionally, the FCA has issued warnings to 20 more influencers as investigations are ongoing.

Despite these actions, insiders point out that the lengthy process required to build cases and impose fines is due to the regulator’s thorough investigative and legal procedures.

Although the FCA implemented new regulations for social media promotions in March, enforcement has not kept pace.

Former FCA chair Charles Randell highlighted the necessity for stricter enforcement, stating,

“Ultimately, unless a very real and present threat of legal action is evident to both the [tech] platforms and to authorized crypto asset exchanges that issue non-compliant advertisements, we are unlikely to see any change.”

Randell also criticized the lack of accountability for tech platforms that continue to host illegal advertisements and emphasized the need for greater collaboration between regulators and social media companies.

Structural Challenges and the Path to Stronger Regulation

One significant challenge the FCA encounters is its limited authority to compel social media platforms to promptly remove non-compliant content.

The agency currently relies on voluntary cooperation and good-faith negotiations, resulting in uneven enforcement.

While agreements with platforms like Bing and Meta have seen some success,

the FCA intends to finalize comprehensive crypto regulations by 2026 to address these challenges.

The proposed framework aims to tackle market abuse, enhance oversight of trading platforms, and establish clear guidelines for stablecoins and crypto lending.

A recent report indicates that key measures include banning public crypto offerings by unregulated entities and requiring authorized firms to share information to detect market abuse.

The FCA is soliciting public and industry feedback on these proposals, with consultations open until March 2025 as part of a broader strategy to finalize a comprehensive regulatory framework by 2026.

This initiative builds upon the FCA’s previous actions, including bans on advertising by unregistered crypto firms implemented in 2023.

Matthew Long, FCA’s director of payments and digital assets, stressed:

“We must create a system that protects investors while encouraging growth in the crypto sector,”

Notably, a recent report indicates that cryptocurrency ownership in the UK has risen to 12% of the adult population, with over seven million individuals now holding digital assets.

Consequently, public awareness of cryptocurrencies has significantly increased, reaching 93%. Bitcoin, Ethereum, and Dogecoin are among the most recognized cryptocurrencies.

The post FCA Crackdown Fails to Remove Half of Illegal Crypto Ads in UK: Report appeared first on Cryptonews.