Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Experts Predict Stagflation as Key Challenge for 2025 Amid Bitcoin’s Critical Phase

Preliminary jobless claims are scheduled for release on January 2nd, but concerns regarding stagflation are the primary issue affecting Bitcoin price forecasts extending into 2025.

According to a Kobeissi Letter shared in an X thread on December 29th, “Investors are worried that we may witness a recurrence of the 1970s inflation scenario. The Fed is lowering rates due to a weakening labor market while inflation rises again.”

As the Federal Reserve approaches its next interest rate meeting in one month, markets continue to diminish the likelihood of further rate cuts in the coming year.

The onset of stagflation is upon us, and the Fed has yet to recognize it. We could see inflation exceeding 4% next year.

What Does ‘Stagflation’ Imply for Bitcoin?

This potential stagflation scenario, characterized by high inflation and stagnant economic growth, could significantly affect Bitcoin’s performance.

Historically, Bitcoin has been regarded as a safeguard against inflation; however, its correlation with traditional markets and responsiveness to macroeconomic conditions may introduce volatility.

While the discussion surrounding a possible U.S. recession was the macroeconomic focus influencing price movements in 2024, Kobeissi indicated that stagflation is expected to become “the theme of 2025.”

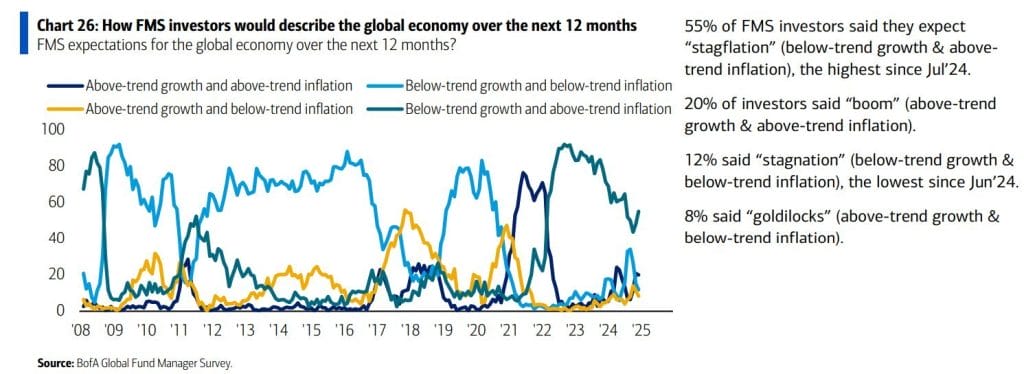

“In fact, 55% of high-net-worth investors anticipate stagflation in 2025,” it concluded, citing data from a Bank of America (BoA) survey.

BoA economic outlook survey. Source: The Kobeissi Letter/X

BoA economic outlook survey. Source: The Kobeissi Letter/X

Bitcoin Faces Crucial Bull Market Phase

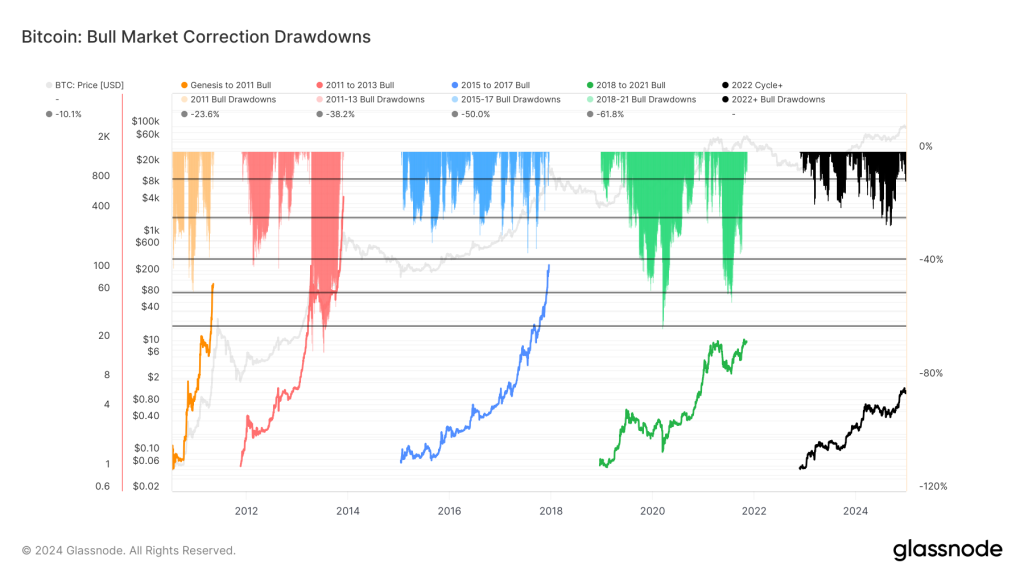

This situation is poised to define a critical phase in Bitcoin’s bull market, with the recent 15% correction over the past week still searching for a definitive support level.

This decline is notably on the lower end of historical behavior when comparing bull market corrections to previous cycles, according to Glassnode data.

Bitcoin bull market correction drawdowns. Source: Glassnode

Bitcoin bull market correction drawdowns. Source: Glassnode

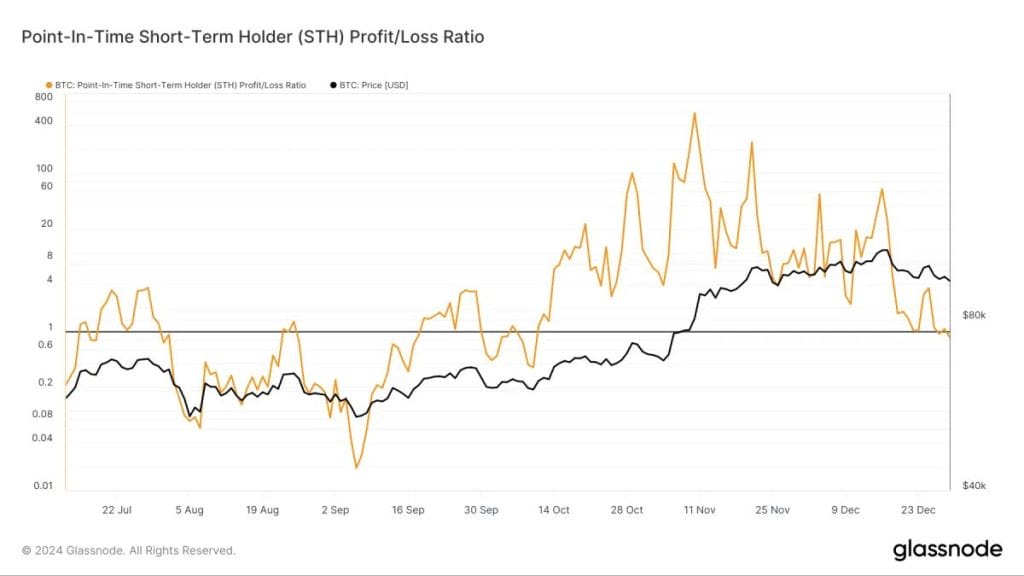

While this may suggest a deeper bottom, Glassnode highlighted short-term holders (STHs) as a means to determine when the market might recover.

Bitcoin’s Market Value to Realized Value (MVRV) metric, which compares STH supply in profit to that in loss, indicates potential seller fatigue as it approaches a break-even point.

Point-In-Time Short-Term Holder (STH) Profit/Loss Ratio. Source: Glassnode

Point-In-Time Short-Term Holder (STH) Profit/Loss Ratio. Source: Glassnode

Glassnode considers MVRV a reliable indicator of “local bottoms in bull markets and local tops in bear markets.” The last time the Point-In-Time Short-Term Holder (STH) Profit/Loss Ratio fell below 1 was in early October when BTC/USD was priced at $60,000.

This optimistic sentiment is supported by a recent Maxiport report, which states that Bitcoin has “matured” this cycle, with adoption positioning it to be better equipped against volatility.

Market dynamics are evolving. Unlike previous cycles marked by sharp 80% declines, Bitcoin’s growing base of dip buyers and institutional support diminishes the likelihood of severe corrections.

Considering these indicators, Bitcoin’s resilience amid current macroeconomic uncertainties underscores its capacity to navigate through this pivotal phase.

The post Analysts Identify Stagflation ‘The Theme of 2025′ as Bitcoin Faces Critical Zone appeared first on Cryptonews.