Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Europe Becomes the Second-Largest Cryptocurrency Market with Almost $1 Trillion in On-Chain Value – Chainalysis

Central, Northern, and Western Europe (CNWE) is establishing itself as a significant force in the cryptocurrency sector, currently holding the second position after North America.

A recent report from Chainalysis highlights a dynamic crypto economy in the region, with $987.25 billion in on-chain value transacted between July 2023 and June 2024, accounting for 21.7% of the global transaction volume.

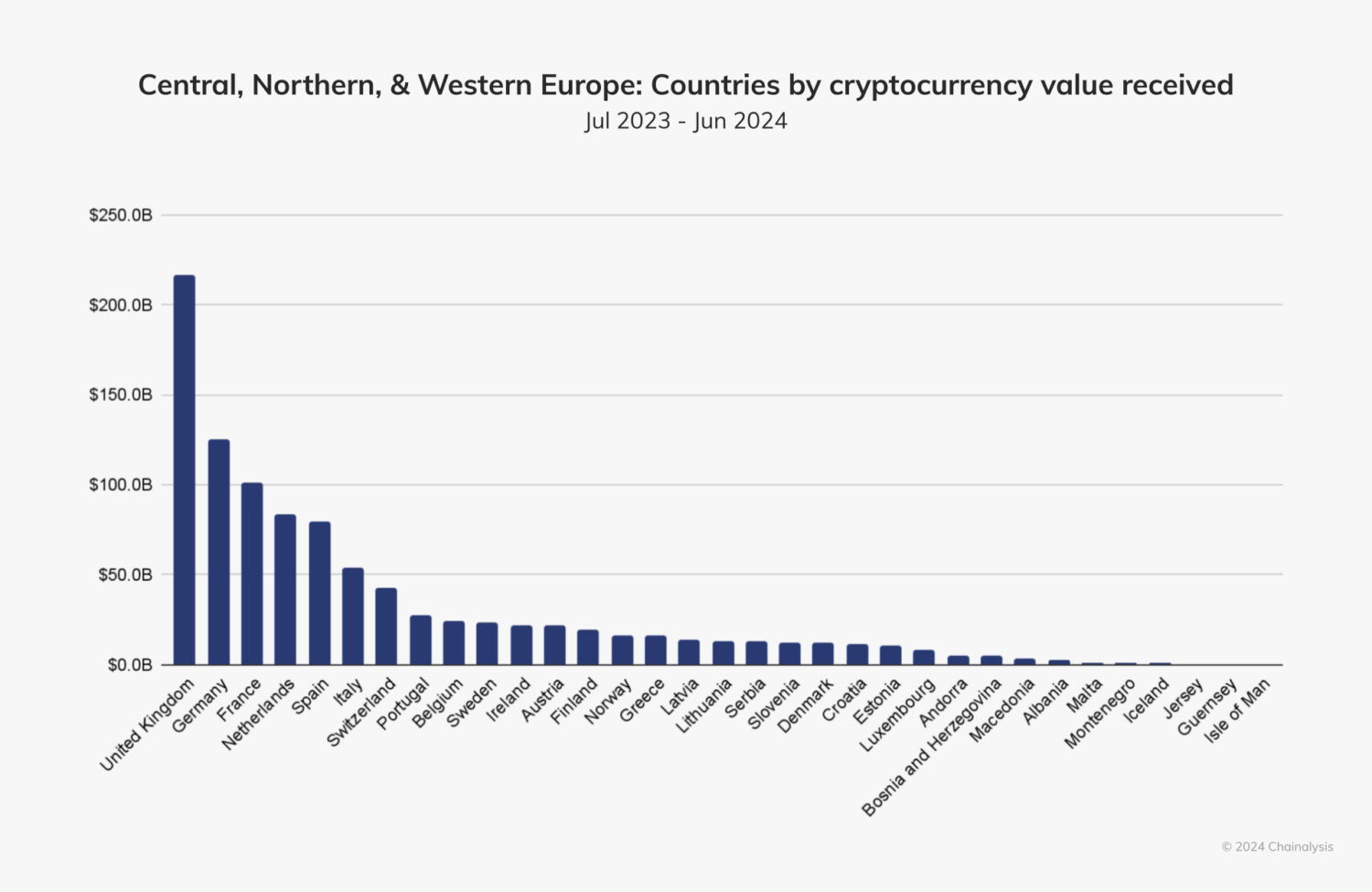

The United Kingdom (UK) emerges as the clear frontrunner in CNWE’s cryptocurrency landscape, drawing in an impressive $217 billion in crypto value during this timeframe. The UK also plays a crucial role in fostering innovation, especially in areas such as merchant services and stablecoins.

The crypto economy in CNWE, spearheaded by the UK, experienced an influx of nearly $1 trillion from July 2023 to June 2024. Source: Chainalysis

The crypto economy in CNWE, spearheaded by the UK, experienced an influx of nearly $1 trillion from July 2023 to June 2024. Source: Chainalysis

Stablecoins Outperform Bitcoin and Propel CNWE Crypto Expansion

Stablecoins, which are cryptocurrencies linked to traditional assets such as the euro or US dollar, have emerged as the dominant force in CNWE, growing 2.5 times faster than North America for transactions under $1 million. They represent nearly half of all crypto inflows, valued at $422.3 billion, indicating a notable increase in both retail and institutional usage.

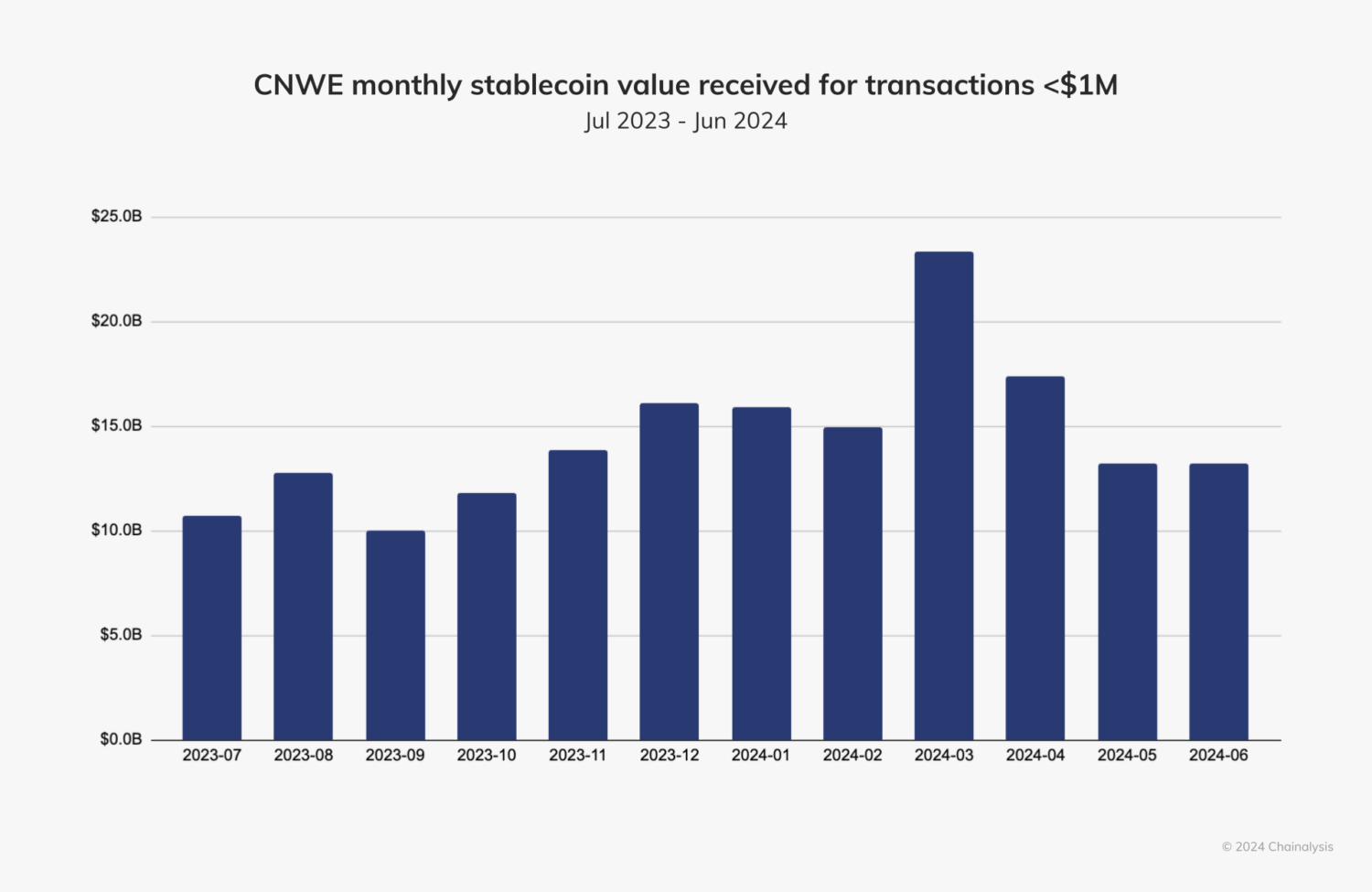

Over the past year, the average monthly stablecoin transfers below $1 million in CNWE fluctuated between $10 billion and $15 billion.

CNWE recorded an average of $10 billion to $15 billion in monthly stablecoin transfers below $1 million last year. Source: Chainalysis

CNWE recorded an average of $10 billion to $15 billion in monthly stablecoin transfers below $1 million last year. Source: Chainalysis

Notably, stablecoins have significantly outpaced Bitcoin (BTC) in fiat currency transactions, with the euro making up an impressive 24% of global stablecoin acquisitions.

The European Union is actively influencing the future of cryptocurrency in CNWE through the introduction of its Markets in Crypto-Assets Regulation (MiCA), according to the report. While the effects on stablecoins are already being felt, the complete impact on crypto-asset service providers (CASPs) remains to be seen, with regulations for this sector set to take effect in December 2024.

Beyond Stablecoins: The Expanding Crypto Landscape in CNWE

Despite the prevalence of stablecoins, CNWE’s cryptocurrency landscape encompasses more. For transactions under $1 million, Bitcoin experienced a notable 75% increase, the highest growth rate among all asset types in the region. Overall, Bitcoin constituted approximately one-fifth of CNWE’s total crypto value received.

Although still in its early stages, the tokenization of real-world assets (RWA) is beginning to gain traction in CNWE. Experts view this as a potential transformative factor in the traditional securities market. “Across Europe, we see tokenization projects for RWAs gaining traction, particularly in sectors such as real estate, intellectual property, and collectibles like art, cars, or wine,” stated Philipp Bohrn, VP of Public and Regulatory Affairs at Bitpanda, a cryptocurrency exchange based in Austria.

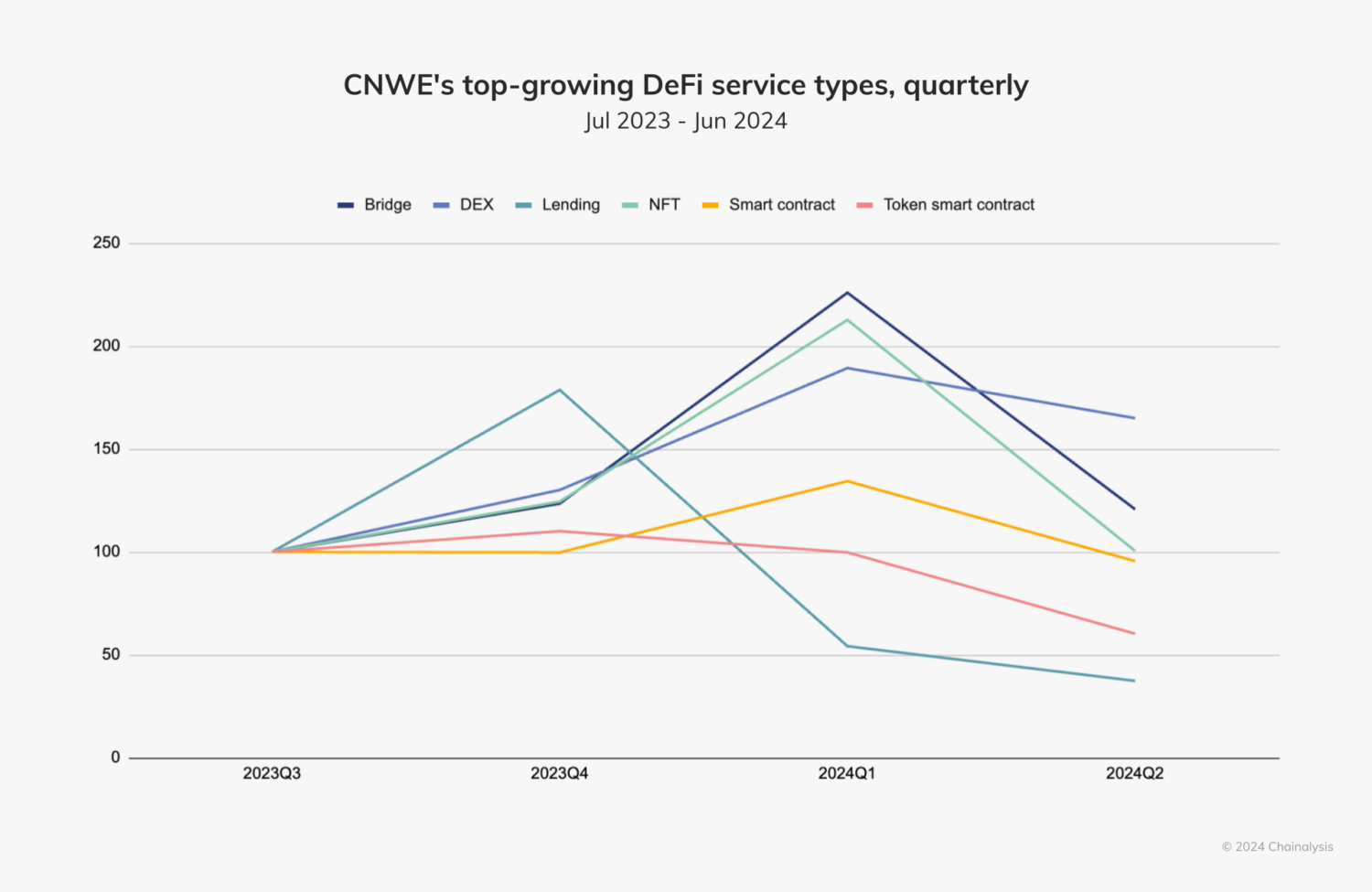

CNWE’s decentralized finance (DeFi) activities have expanded at a rate surpassing the global average, ranking fourth worldwide. The region has outperformed North America, Eastern Asia, and MENA in year-over-year growth, accounting for $270.5 billion of all crypto received in the area.

Decentralized exchanges (DEXs) served as the primary driver for DeFi growth in CNWE, surpassing other DeFi services.

DEXs propelled DeFi growth in CNWE, while other services such as NFTs, bridges, and lending saw variable inflows. Source: Chainalysis

DEXs propelled DeFi growth in CNWE, while other services such as NFTs, bridges, and lending saw variable inflows. Source: Chainalysis

The post Europe Emerges as Second-Largest Crypto Economy With Nearly $1 Trillion On-Chain Value – Chainalysis appeared first on Cryptonews.