Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum Stablecoin Adoption Surges 400% in One Month as Large Investors Capitalize on Price Drop — Is $5K ETH on the Horizon?

The utilization of stablecoins on Ethereum has increased by 400% over the past month, reaching a record high of $580.9 billion, with more than 12.5 million transfers, as reported by Token Terminal.

The market capitalization of stablecoins on Ethereum now surpasses $163 billion.

On-chain analytics from Arkham Intelligence indicate that the majority of stablecoin transfer activity is driven by whales purchasing the current dip in ETH, following a 4.61% decline in the leading altcoin over the last week, testing the $3,738 support level.

Notably, a newly established wallet 0x86Ed has spent $32.47 million to acquire 8,491 ETH within the last three hours.

In a similar vein, the recently liquidated whale Machi Big Brother has deposited 284K USDC into Hyperliquid to maintain a long position in ETH.

After liquidation, Machi(@machibigbrother) deposited another 284K $USDC into #Hyperliquid to continue longing $ETH!

Current position: 2,300 $ETH($8.8M)

Liquidation price: $3,680.92

He has transitioned from $44.84M in profits to over $13.7M in losses! https://t.co/fk2wRZjZpx pic.twitter.com/Y533mmMI8V— Lookonchain (@lookonchain) October 23, 2025

Why Institutions Are All-In on ETH o $5k

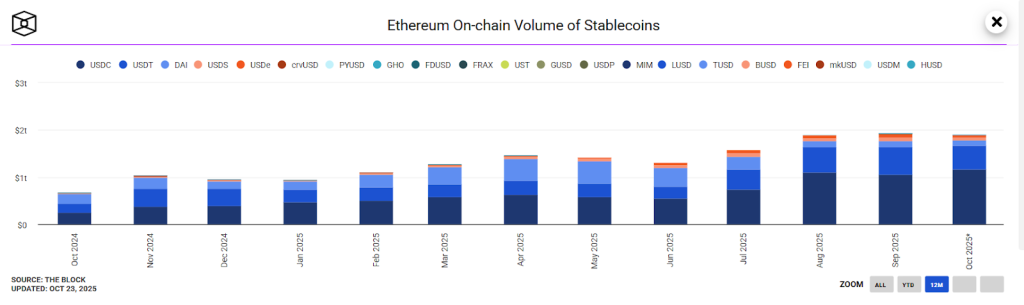

As of October, on-chain data from TheBlock reveals that the total transaction volume of stablecoins on Ethereum has exceeded $1.91 trillion for the second time in history.

Source: TheBlock

Source: TheBlock

This rising stablecoin activity and accumulation by whales have led analysts to speculate that ETH may finally be on track to reach the sought-after $5,000 threshold, a level it attempted to breach in August, where it faced resistance around $4,953.

Matt Sheffield, CIO at Ethereum treasury strategy firm Sharplink Gaming, stated that following the significant leverage liquidations observed two weeks ago, it is anticipated that the price will diverge significantly from adoption trends.

After major washouts like we saw two weeks ago across crypto markets, price can deviate materially from adoption. Trading increases liquidity, but introduces shorter-term volatility along the longer-term investment arc.

The reality is Ethereum adoption is happening at breakneck… https://t.co/Bvahqdzwky— Matt Sheffield (@sheffieldreport) October 22, 2025

However, the fact remains that Ethereum adoption continues to progress at “breakneck speed”, despite the overall market turmoil.

According to him, “if you zoom out, it’s clear how much room there is to go. SWIFT processes ~$150T in payments per year. That is 20x current USDT volumes on Ethereum, where the largest institutional transactions occur most frequently.”

CME Futures Explode As Institutions Position for Major ETH Breakout

Data from CryptoQuant corroborates this, indicating that institutional interest in Ethereum is rapidly increasing, as evidenced by the rise in CME futures open interest, suggesting that smart money is preparing for a significant ETH movement ahead.

Source: CryptoQuant

Source: CryptoQuant

This aligns with recent comments from Fundstrat Capital CIO Tom Lee, who noted that Ethereum could surge toward $5,000 if the ETH/BTC pair surpasses the 0.087 resistance level.

Lee indicated that a clear breakout above 0.087 would signify a structural shift for Ethereum, akin to the macroeconomic changes that transformed Wall Street in the 20th century.

Crypto analysts have highlighted that ETH has just confirmed a triple bottom at the $3,600 level, which serves as a bullish indicator for a potential rise toward $5,000.

Chart analyst Ash Crypto also noted that Ethereum is forming a Wyckoff re-accumulation pattern, suggesting a price range of $8,000-$10,000 ETH before the conclusion of the current bull run.

$ETH Wyckoff re-accumulation is happening right now.

$8,000-$10,000 ETH is still possible this cycle. pic.twitter.com/M9GV34lxri— Ash Crypto (@Ashcryptoreal) October 23, 2025

Technical analysis: Elliott Wave, Fibonacci Charts Reveal ETH to $5,000 Path

From a technical perspective, the Ethereum (ETH/USD) chart displays an Elliott Wave structure that indicates the completion of wave (4) and a potential initiation of wave (5) toward higher price levels.

The current price, approximately $3,887, is positioned just above the 0.618 Fibonacci retracement at $3,781, a crucial support zone where bullish reversals typically occur.

The 50-day moving average (red line) is serving as dynamic resistance, while the 200-day moving average (blue line) remains significantly lower, affirming a broader uptrend structure.

Should ETH maintain its position above the 0.786 retracement level ($3,640) and avoid invalidation at $3,443, the chart suggests a rally targeting $5,125 at the 1.618 Fibonacci extension, with the potential to reach as high as $6,021 if wave (5) fully develops.

Momentum will remain positive as long as ETH stays above the invalidation zone, and reclaiming the descending trendline could confirm the commencement of the next impulsive upward movement.

The post Ethereum Stablecoin Usage Jumps 400% in 30 Days as Whales Buy the Dip — $5K ETH Next? appeared first on Cryptonews.