Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum Price Outlook: Almost 30% of ETH Disappeared from Circulation – Is $10,000 Around the Corner?

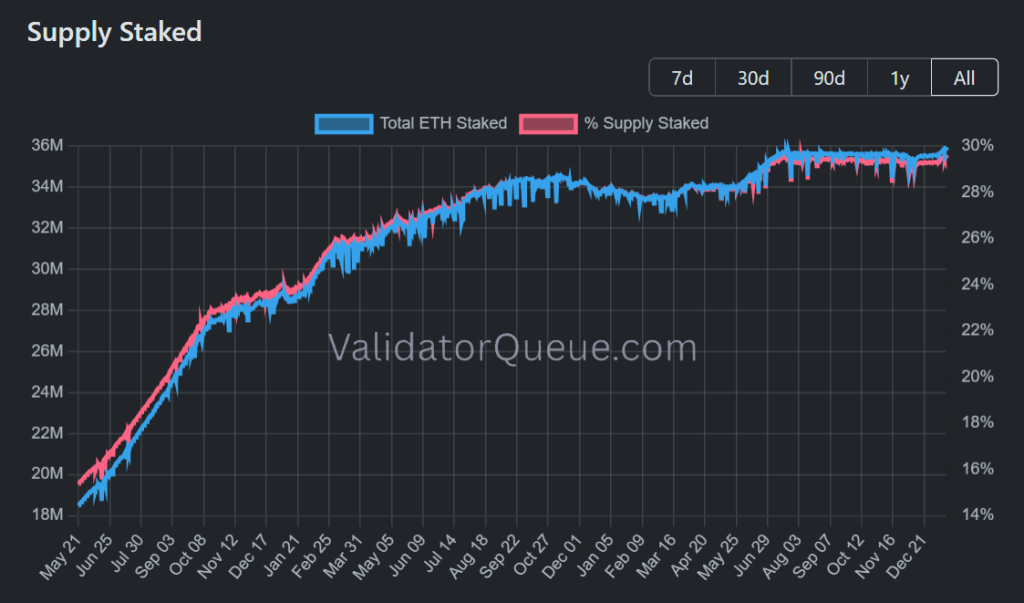

Approximately one-third of all ETH has been secured through staking, diminishing active supply and bolstering the optimistic Ethereum price prediction as market momentum intensifies.

More than 36 million ETH, valued at about $118 billion, is currently staked in Ethereum’s proof-of-stake framework, which accounts for 30% of the circulating supply.

With such a significant amount of ETH removed from circulation, supply-side pressure is rapidly decreasing, creating an ideal scenario for a possible surge toward $10,000.

Ethereum tokens staked (ETH) and percentage of circulating supply staked (%). Source: ValidatorQueue.

Ethereum tokens staked (ETH) and percentage of circulating supply staked (%). Source: ValidatorQueue.

This signifies a major transformation in investor behavior, prioritizing long-term strategies and yield generation via staking over short-term speculative trading.

Much of this shift appears recent, as the validator entry queue wait time has greatly increased due to a surge of new stakers this month.

Ethereum staking enter and exit queue wait time (days). Source: ValidatorQueue.

Ethereum staking enter and exit queue wait time (days). Source: ValidatorQueue.

Simultaneously, the validator exit queue wait time has reached record lows with minimal backlog. Staked ETH is not in a hurry to convert to liquid form.

This is largely attributed to increased institutional engagement, as traditional finance players seek regulated access to staking yields through ETFs and treasury vehicles like BitMine.

As a greater portion of supply becomes illiquid, staking may restrict sell-side availability during spikes in demand, further reinforcing bullish momentum.

This effect could be amplified with involvement from mainstream traditional asset managers such as Morgan Stanley, which is preparing to introduce its own spot Ethereum staking ETFs.

Ethereum Price Prediction: Is $10,000 Now on the Horizon?

Improved liquidity and sustained demand could finally provide the Ethereum price with the momentum necessary to achieve a two-and-a-half-year ascending channel.

Over the past year, it has developed a bullish head-and-shoulders pattern that positions it for a breakout, with a local bottom at $2,750 confirming its final ascent – the setup that stakers may be capitalizing on.

Momentum indicators lend credibility to the trend. The RSI is tightening against the 50 neutral line following several higher lows, indicating strength beneath the surface.

The MACD has also reversed towards the signal line in a potential golden cross setup, suggesting that buyers may soon dominate the prevailing trend.

A fully developed right shoulder targets the critical breakout level of the channel, surpassing previous all-time highs around $4,950. This could initiate a potential 440% breakout surge to $18,000.

However, similar to the pattern, its breakout will likely unfold over several years.

By 2026, a 195% increase to the $10,000 milestone could be attainable as clearer regulatory frameworks through legislation like the Clarity Act bolster mainstream adoption of Ethereum infrastructure and investment products, including staking ETFs.

Bitcoin Hyper: New Presale Introduces Solana Technology to Bitcoin’s Blockchain

While the broader market trend indicates a capital shift into altcoins, Bitcoin should not be overlooked just yet, as its ecosystem finally addresses its biggest limitation: scalability.

Bitcoin Hyper ($HYPER) is combining Bitcoin’s security with Solana technology, establishing a new Layer-2 network that facilitates scalable, efficient use cases that Bitcoin alone could not sustain.

Similar to how the Ondo Layer-2 benefited Ethereum, Bitcoin Hyper could integrate Bitcoin more deeply into mainstream discussions such as DeFi and RWAs.

The project has successfully raised over $30 million in presale, and post-launch, even a small fraction of Bitcoin’s substantial trading volume could significantly elevate its valuation.

Bitcoin Hyper is addressing the slow transaction speeds, high fees, and limited programmability that have historically restricted Bitcoin’s potential – just as the market begins to turn bullish.

Visit the Official Bitcoin Hyper Website Here

The post Ethereum Price Prediction: Nearly 30% of ETH Just Vanished From Circulation – $10,000 Just Weeks Away? appeared first on Cryptonews.