Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum Price Forecast: Will ETH Decline as Significant October Options Positions Reach Expiration Today?

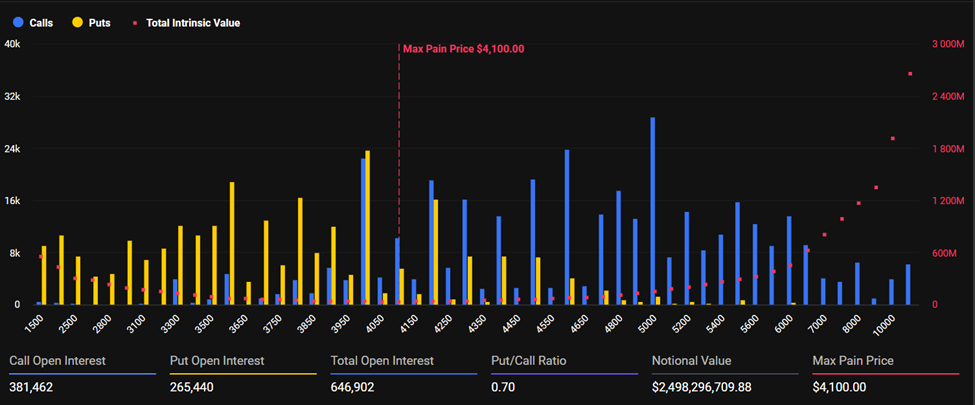

Today’s forecast for Ethereum indicates that the ETH price may experience a further decline as more than 646,902 contracts, amounting to $2.49 billion in Ethereum October options, are scheduled to expire.

Expirations of this magnitude frequently result in short-term price fluctuations as traders close or modify their positions in anticipation of settlement.

Data from derivatives analytics platforms reveals that Ethereum’s current put-to-call ratio is at 1.25, indicating a higher volume of bearish positions (puts) compared to bullish positions (calls).

$2.49 Billion in ETH Options Expire Today As Bearish Bets Outnumber Bulls 1.25 to 1

The open interest for calls is at 381,462 contracts, exceeding the put open interest of 265,440.

October Expiry Alert.

Over $16B in BTC + ETH options expire tomorrow at 08:00 UTC on Deribit.$BTC: Put/Call: 0.73 (calls dominant) | Max Pain: $114K

Positioning reads cautiously bullish. With US-China trade tensions visibly easing, upside risk is stronger, and traders are… pic.twitter.com/bTJGHtjKiJ— Deribit (@DeribitOfficial) October 30, 2025

This significant call side indicates that a substantial portion of traders are either preparing for downward movement or hedging against possible price drops in the near future.

As per Deribit, Ethereum’s max pain is estimated to be around the $4,100 level, despite the improved macro sentiment following recent developments.

Source: Deribit

Source: Deribit

“ETH positioning appears cautious, with puts surpassing calls. The scale of this expiry heightens the potential for price movements, but macro and policy risks continue to limit conviction,” they noted.

The max pain level, which is the price point where the highest number of option holders would face losses, typically sees prices gravitate toward it as expiry approaches, as it minimizes losses for market makers and option sellers.

With ETH attempting to stabilize around $3,800 at the time of writing after a rapid drop to the $3,670 area, a short squeeze or post-expiry rally seems to be in progress, which could mitigate the impact of the expiring October options.

Ethereum price prediction: Descending Channel Breakout Target $4,160

From a technical perspective, the Ethereum (ETH/USD) 1-hour chart indicates a clear rebound from a robust support level near $3,780 following a prolonged downtrend characterized by a descending channel.

The chart illustrates an attempt to break above the upper trendline resistance, suggesting a possible shift in momentum from bearish to bullish.

Source: TradingView

Source: TradingView

If Ethereum manages to maintain its position above the $3,880–$3,900 range, it could confirm a reversal pattern with targets set at $3,971.7, $4,065.7, and ultimately $4,160.4, as depicted on the chart.

This stepwise projection suggests a potential rally driven by short-term accumulation near the support level.

Conversely, if the price fails to hold above the breakout zone, ETH may retest the lower support around $3,500 before gaining sufficient momentum for an upward continuation.

Smart Money Rotates Into Ethereum Presale As Pepenode Raises $2M in Weeks

An Ethereum rally implies that ERC-20 tokens will gain from liquidity rotation, and astute investors are already positioning themselves for this scenario by acquiring tokens from Ethereum-based projects currently in their presale phase.

One of the leading presale options at the moment is Pepenode (PEPENODE), a new mine-to-earn initiative that has secured over $2 million as investor interest continues to grow.

Pepenode’s mine-to-earn model requires no hardware, no electricity expenses, and no technical setup.

Participants purchase virtual mining nodes as part of a browser-based game, upgrade them according to their strategy, and earn rewards instantly.

Unlike most presale projects, there is no need to wait for an exchange listing. Instead, participants can buy and stake immediately for an APY of 642%.

To secure your presale allocation, visit the Pepenode website and acquire PEPENODE for $0.0011272 each, using ETH, BNB, USDT (ERC-20 or BEP-20), or even credit or debit cards.

The post Ethereum Price Prediction: Is ETH About to Dump as Millions in October Options Positions Expire Today? appeared first on Cryptonews.