Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum Price Forecast: This Key Onchain Threshold May Facilitate a Move Towards $5,000

Ethereum is currently priced at approximately $4,471 following a slight decline of 1.14% in the last 24 hours, resulting in a market capitalization of $539.7 billion. Despite fluctuations in the short term, onchain indicators, ETF inflows, and corporate treasury activities imply that ETH might be gearing up for a breakout that could propel prices towards the $5,000 mark.

Network Signals and Onchain Strength

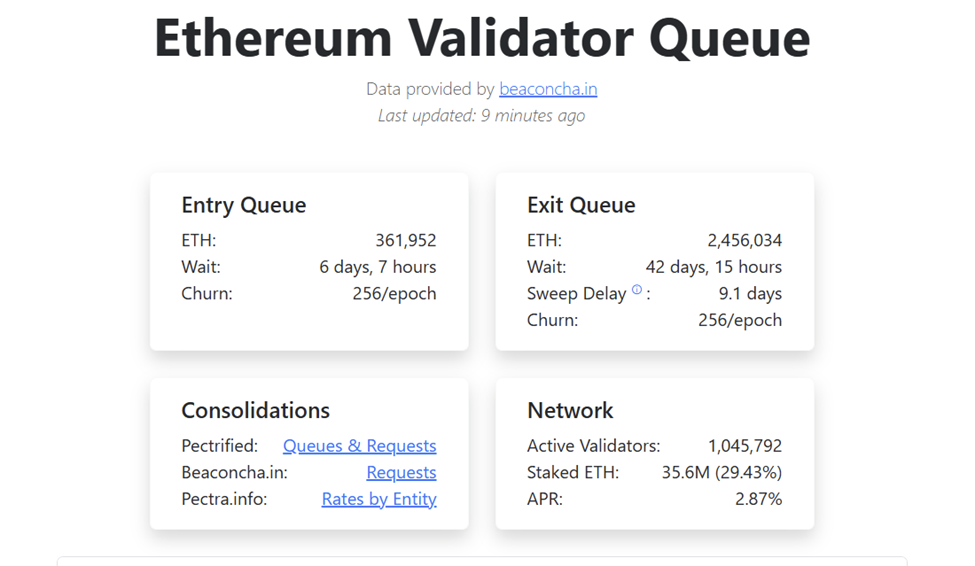

The recent price movements of Ethereum have shown a mixed pattern. On one hand, there has been a notable increase in validator exits, with over 2.45 million ETH—valued at $11 billion—awaiting unstaking. This has lengthened the withdrawal queue to an estimated 42 days, raising concerns about potential supply pressure in the near term.

However, unstaking does not necessarily lead to immediate selling. For many institutions, it forms part of a rebalancing strategy.

Concurrently, the fundamentals of the network are showing improvement. Transaction fees have risen by 35% compared to last week, and the number of active addresses has increased by 10%, indicating a growing utilization of Ethereum’s ecosystem.

Increased network activity enhances validator yields and fortifies security, while fee burns contribute to a reduction in overall supply. Corporate treasuries are also increasing their exposure.

In just the past month, companies have added 877,800 ETH, approximately $4 billion at current valuations, to their reserves. This consistent inflow has been observed from firms such as Bitming Immersion Tech, SharpLink Gaming, and The Ether Machine, highlighting ETH’s growing status as a reserve asset.

ETFs and Treasury Support Fuel $5K Ethereum Outlook

Ethereum has outperformed the wider crypto market by 21% over the last two months, maintaining its lead in decentralized applications. As per DeFiLlama, Ethereum, along with its layer-2 networks, commands 64.5% of the total value locked, significantly ahead of Solana’s 9%.

Spot Ether ETFs are also providing significant institutional support. The assets under management in these funds currently total $24.7 billion, with $213 million in net inflows recorded last Thursday alone. These products offer a regulated avenue for institutions to gain exposure to ETH, further solidifying Ethereum’s position in traditional finance.

Exchange balances continue to decline, with 2.69 million ETH withdrawn over the past two months—bringing the available supply to a five-year low. This decrease in liquid ETH not only alleviates selling pressure but also indicates ongoing accumulation.

Collectively, the diminishing supply, institutional inflows, and corporate reserves are establishing a foundation for Ethereum’s next upward movement.

Ethereum (ETH/USD) Technical Roadmap Toward $5,000

From a technical standpoint, the outlook for Ethereum is neutral as ETH is consolidating within a symmetrical triangle, facing resistance around $4,566 and support at $4,440.

Momentum indicators present a mixed picture: the RSI is near 41, suggesting oversold conditions, while candlestick patterns indicate bearish pressure.

A bullish engulfing candle above $4,566 could quickly shift sentiment, paving the way toward $4,670, $4,775, and ultimately $5,000.

The critical range for traders is between $4,440 and $4,566. A sustained defense of this area favors a continuation to the upside, with projections indicating a breakout path toward $5,000–$5,200 in the upcoming weeks. Conversely, a drop below $4,350 could pull ETH back toward $4,238 or even $4,108 before new demand emerges.

Ethereum consolidates near $4,470 inside a symmetrical triangle.

– Support holds at $4,440, resistance at $4,566.

– Breakout above $4,670 eyes $5K, while a drop below $4,350 risks $4,238. #Ethereum #ETH pic.twitter.com/k2P0iHTHkD— Arslan Ali (@forex_arslan) September 20, 2025

Despite short-term caution, the broader perspective remains positive. Ethereum’s combination of increasing institutional flows, decreasing supply, and robust network activity indicates that once current pressures subside, the path to $5,000 appears increasingly feasible.

Presale Bitcoin Hyper ($HYPER) Combines BTC Security With Solana Speed

Bitcoin Hyper ($HYPER) aims to be the first Bitcoin-native Layer 2 utilizing the Solana Virtual Machine (SVM). Its objective is to enhance the BTC ecosystem by facilitating rapid, low-cost smart contracts, decentralized applications, and even meme coin creation.

By merging BTC’s unparalleled security with Solana’s high-performance infrastructure, the project paves the way for entirely new applications, including seamless BTC bridging and scalable dApp development.

The team has placed a strong emphasis on trust and scalability, with the project undergoing audits by Consult to instill confidence in its foundations among investors.

Momentum is rapidly building. The presale has already surpassed $17.2 million, with only a limited allocation remaining. At the current stage, HYPER tokens are priced at just $0.012945—but this price will rise as the presale advances.

HYPER tokens can be purchased on the official Bitcoin Hyper website using either cryptocurrency or a bank card.

Click Here to Participate in the Presale

The post Ethereum Price Prediction: This Critical Onchain Level Could Unlock a Push to $5,000 appeared first on Cryptonews.