Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum Price Forecast: Major Funds Departing from Bitcoin – Are Institutions Subtly Turning Optimistic on ETH?

As digital assets become more prevalent in traditional finance (TradFi) markets, institutional interest has shifted towards ETH, reflecting optimistic Ethereum price forecasts.

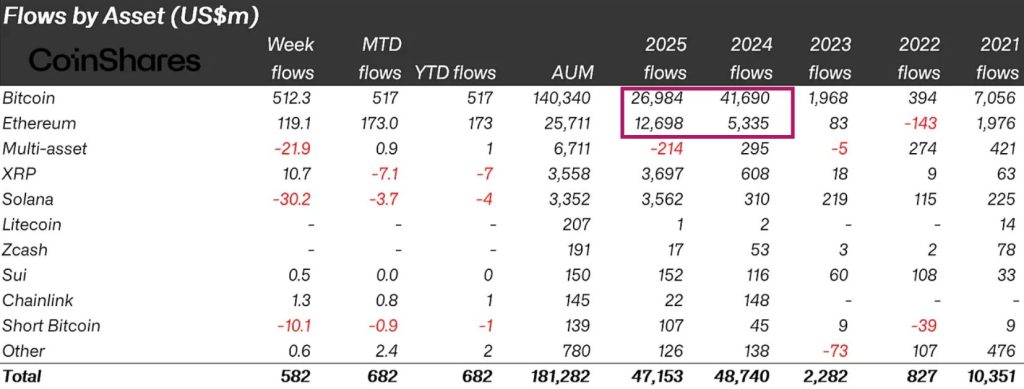

Capital movements indicate a notable transition away from Bitcoin’s supremacy. In 2025, Bitcoin inflows fell by 35% compared to the previous year, totaling $26.98 billion, while significant altcoins garnered substantially larger investments.

Ethereum has spearheaded this trend, achieving a remarkable 137% growth with $12.69 billion.

Netflows by asset year-over-year (US$m). Source: Coinshares.

Netflows by asset year-over-year (US$m). Source: Coinshares.

Decentralized finance typically serves as the primary factor distinguishing Bitcoin from prominent smart-contract platforms; however, DeFi activity itself saw a slowdown for a significant portion of 2025.

The total value locked in DeFi protocols soared by 121% in 2024, increasing from $52 billion to $115 billion, but experienced only a modest growth of 1.73% in the following year, reaching approximately $117 billion.

Total Value Locked (TVL) in DeFi Applications ($). Source: DefiLlama.

What distinguishes this cycle is the origin of demand. Instead of a natural increase in DeFi utilization, institutional engagement has taken precedence.

The ETF narrative has expanded regulated digital asset exposure in U.S. TradFi markets, generating institutional-grade demand that clearly favors ETH.

Ethereum Price Prediction: Why Are Institutions Optimistic About ETH?

This shift in capital may have been intentional, as Ethereum appears to be at the bottom of a potential 20-month bullish head-and-shoulders breakout throughout 2025.

The Ethereum price has confirmed a local bottom at $2,750, establishing higher lows in a new uptrend that reinforces the right shoulder.

Momentum indicators lend credibility to this trend. The RSI is nearing the 50 neutral line after multiple higher lows, indicating underlying strength.

The MACD has also turned towards the signal line in a prospective golden cross setup, signaling that buyers may soon dominate the prevailing trend.

A fully realized pattern breakout could lead to the neckline being tested around $5,500, reclaiming previous all-time highs and initiating new price exploration in a 75% increase.

However, as the bull market progresses, broader institutional involvement combined with traction in DeFi as mainstream applications are realized could amplify the move 225% to $10,000.

Traders should monitor historical psychological levels around $3,500 and $4,000 all-time highs as potential resistance to this movement.

Bitcoin Hyper: Solana Technology Applied to Bitcoin

Institutions that have opted for Ethereum as their TradFi investment may soon need to reevaluate, as the Bitcoin ecosystem is finally addressing its greatest challenge: scalability.

Bitcoin Hyper ($HYPER) is linking Bitcoin’s security with Solana technology, creating a new Layer-2 network that enables scalable, efficient use cases that Bitcoin could not support independently.

Similar to how Layer-2 solutions like Ondo enhanced Ethereum, Bitcoin Hyper could integrate Bitcoin more deeply into the DeFi dialogue.

The project has already secured over $30 million in presale, and after launch, even a small percentage of Bitcoin’s immense trading volume could propel $HYPER significantly higher.

Bitcoin Hyper is addressing the slow transaction speeds, high fees, and limited programmability that have historically constrained Bitcoin’s potential – just as the market turns bullish.

Visit the Official Bitcoin Hyper Website Here

The post Ethereum Price Prediction: Big Money Is Leaving Bitcoin – Are Institutions Quietly Flipping Bullish on ETH? appeared first on Cryptonews.