Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum Price Forecast Following SEC Approval of Ethereum ETFs – What’s Next for ETH?

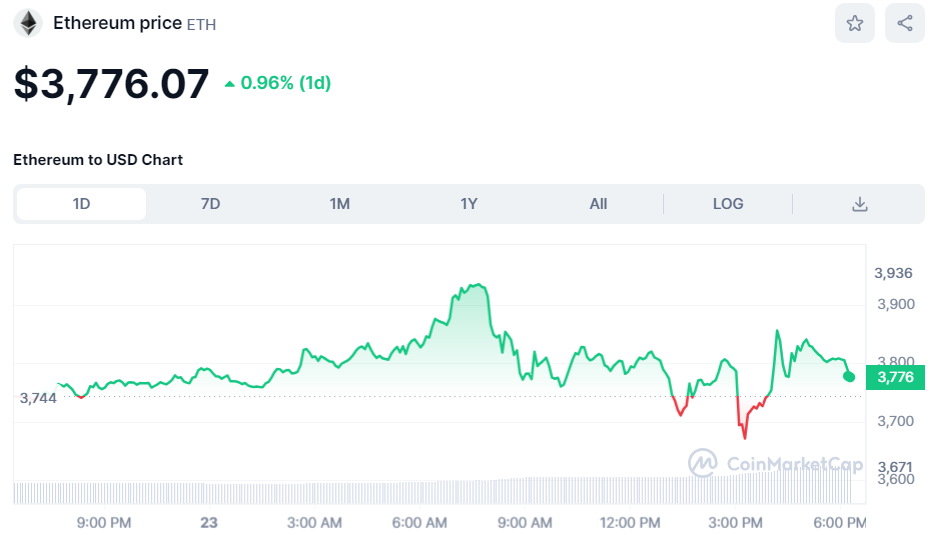

The price of Ethereum (ETH) is experiencing volatility in late Thursday trading following the announcement that the US SEC has granted approval for spot Ethereum ETFs, a surprising reversal that has taken the market by surprise, especially since just a week ago, expectations were leaning towards a rejection of Ethereum ETFs this week.

BOOM!! APPROVED! There it is. The SEC just approved spot #Ethereum ETFs. What a turn of events. It’s really happening.

h/t @PhoenixTrades_ pic.twitter.com/KQ39mDyCbT

— James Seyffart (@JSeyff) May 23, 2024

The last recorded trading price for Ethereum was approximately $3,800. This marks a significant decline from earlier session peaks close to $4,000, yet it also represents a notable increase from earlier session lows of $3,520.

The Ethereum price has been choppy on Thursday in wake of spot Ethereum ETF approvals. Source: CoinMarketCap

The Ethereum price has been choppy on Thursday in wake of spot Ethereum ETF approvals. Source: CoinMarketCap

Over the week, the price of Ethereum has risen by 24%. Speculation regarding an SEC reversal began on Monday.

This was subsequently followed by a surge of interactions between ETF issuers and the SEC.

Throughout this period, traders actively increased their bids for Ethereum, anticipating that ETFs would promote growth within the ecosystem.

All of this reached a peak on Thursday when the SEC approved eight spot Ethereum ETFs.

Why Spot Ethereum ETF Approval Matters

The approval of spot Ethereum ETFs in the US is expected to elevate the Ethereum price as institutional investors enter the market.

Traders may recall Bitcoin’s rise to new all-time highs following the approval of spot Bitcoin ETFs earlier this year.

Similarly, the Ethereum price could soon experience a similar trajectory. Its previous record highs are around $4,900, which is 28% above current levels.

This will enhance liquidity within the Ethereum ecosystem, likely leading to increased adoption, activity, and development.

Ethereum ETFs are anticipated to reinforce Ethereum’s position as the leading platform for smart-contract-enabled blockchains.

Ethereum Price Prediction – Where is ETH Headed Next?

The confirmation of the approval of spot Ethereum ETFs may lead to some short-term selling pressure.

This scenario is reminiscent of the events that unfolded when spot Bitcoin ETFs received approval earlier this year.

Some traders prefer to wait for confirmation of a favorable market catalyst before realizing profits.

If there is substantial demand for Ethereum ETFs upon their launch, ETH could potentially surpass $4,000.

Concerns regarding Ethereum’s regulatory status in the US had led many traders to short ETH compared to other cryptocurrencies.

Earlier this year, the SEC was believed to be advocating for the classification of ETH as a security.

However, with the approval of spot Ethereum ETFs, this situation appears to be clarified. ETH is now recognized as a digital commodity, similar to Bitcoin.

A significant number of shorts may need to be covered, which could provide ongoing support for the market.

Technical analysis of cryptocurrencies indicates that after breaking its downtrend from March to mid-May and moving above its 21 and 50-day moving averages, a retest of March highs near $4,100 is probable.

The Ethereum price is likely to soon vault to the north of $4,000. Source: TradingView

The Ethereum price is likely to soon vault to the north of $4,000. Source: TradingView

Once this level is surpassed, a swift move towards the 2021 highs near $4,900 is anticipated.

The post Ethereum Price Prediction as SEC Approves Ethereum ETFs – Where is ETH Headed Next? appeared first on Cryptonews.