Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum Price Forecast: Daily Active Addresses Reach 2-Year High – Implications for ETH’s Worth?

Ethereum is once again in the limelight—not for its price, but due to its activity. Daily active addresses on Ethereum have reached 841,100, the highest level observed since 2022. This statistic measures the number of distinct addresses participating in ETH transfers each day and serves as an indicator of user involvement on the network.

The increase marks a notable shift from the 600,000-range stabilization we’ve experienced in recent months. While this surge is positive for user engagement, it does not distinguish between purchases and sales. Historically, these increases in address activity are precursors to volatility, and this instance is no different—Ethereum’s price has notably declined following the surge in activity.

Ethereum $ETH daily active addresses surged to 841,100, the highest in a year, just before the recent drop below $3,500. pic.twitter.com/uHIVLcfBbH

— Ali (@ali_charts) August 2, 2025

What implications does this have? A rise in transactions often indicates that traders are adjusting their positions, particularly ahead of significant market events or critical technical setups.

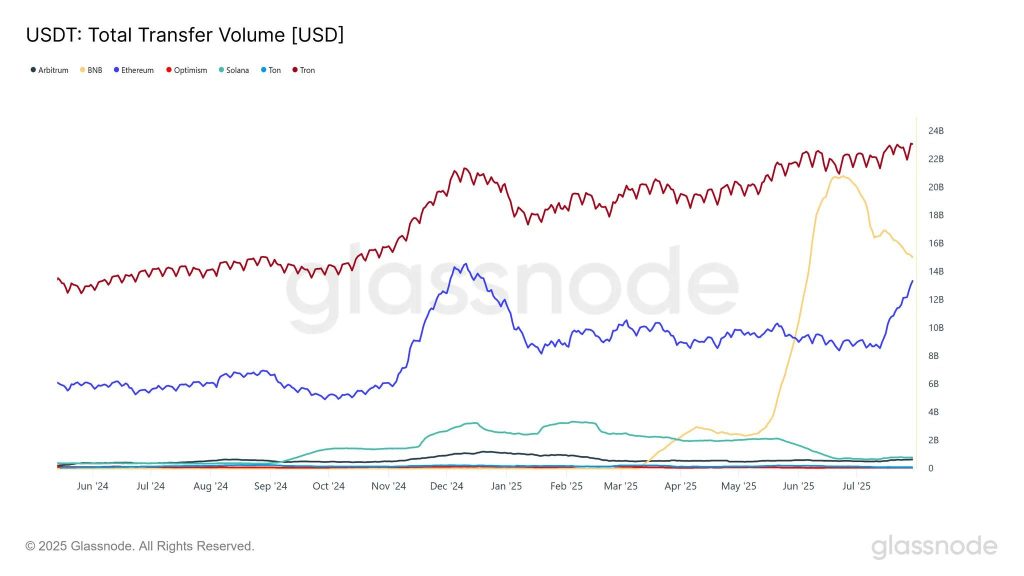

USDT Trends Indicate Broader Market Caution

According to Glassnode, the 30-day moving average transfer volume of USDT has increased to $52.9 billion, rebounding from the market decline of 2022. However, Ethereum’s share of USDT transaction volume has diminished.

https://twitter.com/CryptosR_Us/status/1951283799016317415

Currently:

- Tron leads with $23 billion in USDT volume

- BNB follows with $14.9 billion

- Ethereum lags behind both

This decline in stablecoin settlement dominance suggests that while Ethereum network activity is on the rise, the preference for transactions may be shifting toward chains with lower fees for stablecoin usage—particularly in light of the fluctuating ETH gas prices.

ETH/USD Technical Outlook: Short Bias Continues

From a price action perspective, the forecast for Ethereum appears to be weakening. ETH has dipped below $3,548 and has not managed to maintain its position above the upward trendline established since mid-July. A bearish engulfing pattern, along with three substantial red candles (similar to the Three Black Crows), indicates distribution.

Ethereum Price Chart – Source: Tradingview

Ethereum Price Chart – Source: Tradingview

Key indicators:

- RSI at 28.97: Oversold yet no bullish divergence

- 50-period SMA at $3,745 acts as resistance

- Lower highs and lower lows form a descending triangle

Support levels to monitor:

- $3,428 (next significant zone)

- $3,331 and $3,235 (targets upon breakdown)

Trade Strategy:

If ETH retests $3,548 and faces rejection (e.g., shooting star), consider shorting at $3,548 with a stop above $3,600 and targets at $3,428 or lower. A more aggressive approach would be to short at $3,428 with targets at $3,331 and $3,235. The bias would turn bullish if it regains a position above $3,651 and the trendline.

Bitcoin Hyper Presale Exceeds $6.2M as Price Increase Approaches

Bitcoin Hyper ($HYPER), the first BTC-native Layer 2 supported by the Solana Virtual Machine (SVM), has successfully raised over $6.2 million in its public presale, with $6,278,761 achieved out of a target of $21,644,097. The token is currently priced at $0.0115, with the next price tier likely to be announced soon.

Aimed at combining Bitcoin’s security with Solana’s speed, Bitcoin Hyper facilitates rapid, low-cost smart contracts, dApps, and meme coin creation, all while ensuring seamless BTC bridging. The project has undergone auditing by Consult and is designed for scalability, trust, and simplicity.

The fusion of meme appeal and practical utility has positioned Bitcoin Hyper as a Layer 2 project to keep an eye on in 2025. With staking options, a streamlined presale, and a complete rollout anticipated by Q1, $HYPER is gaining considerable momentum.

The post Ethereum Price Prediction: Daily Active Addresses at 2-Year Peak – What Does This Mean for ETH’s Value? appeared first on Cryptonews.