Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum Price Forecast: Analyzing Onchain Indicators Following ETH’s Strong Gains Over 24 Hours and 7 Days

Ethereum maintained its upward momentum this week, trading around $3,881.50 after a 4.04% increase in the last 24 hours, extending its gains over the past week. The second-largest cryptocurrency in the world reached an intraday peak of $3,924, bolstered by enhanced on-chain fundamentals, renewed investor confidence, and increasing institutional accumulation.

As reported by DefiLlama, Ethereum’s Total Value Locked (TVL) is approximately $84 billion, solidifying its status as the leading entity in decentralized finance, accounting for about two-thirds of the global DeFi liquidity. Despite a slight daily decrease of 0.7%, Ethereum’s network activity remains strong, highlighting its durability.

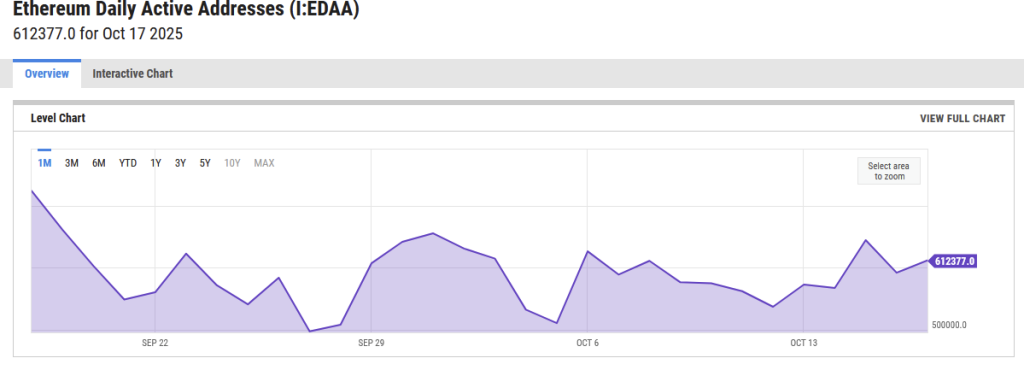

Ethereum Daily Active Addresses – Source: ycharts

Ethereum Daily Active Addresses – Source: ycharts

As of October 17, 2025, Ethereum’s daily active addresses rose to 612,377, representing one of the highest figures this month. Transaction volumes consistently exceed 1.6 million daily, while network fees surpassed $1.6 million within 24 hours, indicating ongoing demand for block space.

Simultaneously, ETH exchange reserves have continued to decline, suggesting long-term accumulation and diminished short-term selling pressure among holders.

Key insights from Ethereum’s current on-chain environment include:

- TVL around $84B despite a minor pullback

- 612K daily active addresses; over 1.6M transactions

- Declining exchange balances, indicating accumulation

Asian Investors Prepare $1 Billion Ethereum Treasury

A group of Asian investors is organizing a $1 billion Ethereum treasury to position ETH as a regional reserve asset. This initiative is spearheaded by Li Lin, the founder of Huobi and chairman of Avenir Capital, with contributions from HashKey Group’s Xiao Feng, Fenbushi Capital’s Shen Bo, and Meitu founder Cai Wensheng.

Ethereum is set to receive another $1 billion ETH treasury company.

Bullish. pic.twitter.com/ghoU4Jg8aL— RYAN SΞAN ADAMS – rsa.eth

(@RyanSAdams) October 17, 2025

According to Bloomberg, commitments have already surpassed $1 billion, including $500 million from HongShan Capital Group (formerly Sequoia China) and $200 million from Avenir Capital. This initiative, expected to be unveiled in the coming weeks, will reportedly integrate direct ETH holdings with yield-generating strategies based on Ethereum’s DeFi ecosystem.

Institutional portfolios have been progressively increasing their ETH holdings. Corporate treasuries currently possess approximately 3.6 million ETH, led by BitMine Immersion (1.7 million ETH) and SharpLink Gaming (797,000 ETH)—together valued at nearly $3 billion.

While some analysts caution about potential overvaluation in digital asset treasuries, others interpret this as a sign of market maturation, especially as Ethereum continues to excel compared to most Layer-1 competitors in terms of network adoption and liquidity retention.

Ethereum Technical Analysis: Triangle Pattern Suggests Potential Breakout

From a technical standpoint, Ethereum’s price outlook remains neutral as it consolidates within a symmetrical triangle, a formation that often precedes significant breakouts. The upper resistance is positioned near $3,937, coinciding with the 100-EMA, while support is found around $3,713–$3,510, where the 50-EMA converges.

A confirmed breakout above $3,937 could drive ETH towards $4,093, with a further target at $4,299, aligning with key Fibonacci retracement levels. Conversely, a decline below $3,510 might lead to a pullback towards $3,350.

Ethereum Price Chart – Source: Tradingview

Ethereum Price Chart – Source: Tradingview

With the RSI around 48 and a subtle bullish divergence emerging, Ethereum appears ready for renewed upward momentum. If the price confirms above resistance, ETH could surge towards $4,300–$4,550, aligning with the upper boundary of the descending channel.

Ethereum’s current consolidation likely signifies a phase of accumulation before its next major upward movement, a scenario increasingly supported by on-chain data, institutional inflows, and optimism regarding the forthcoming $1 billion Asian treasury launch.

With momentum building on both institutional and on-chain fronts, Ethereum’s structure indicates that this consolidation could precede a significant breakout towards $4,500 and beyond.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is introducing a new chapter to the Bitcoin ecosystem. While BTC remains the benchmark for security, Bitcoin Hyper enhances what it has traditionally lacked: Solana-level speed.

Designed as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), it combines Bitcoin’s stability with Solana’s high-performance architecture. The outcome: rapid, low-cost smart contracts, decentralized applications, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project prioritizes trust and scalability as adoption increases. The momentum is already significant, with the presale exceeding $23.9 million, and tokens priced at just $0.013125 before the next increase.

As Bitcoin activity rises and the demand for efficient BTC-based applications grows, Bitcoin Hyper distinguishes itself as the bridge connecting two of crypto’s largest ecosystems.

If Bitcoin laid the groundwork, Bitcoin Hyper could enhance its speed, flexibility, and enjoyment.

Click Here to Participate in the Presale

The post Ethereum Price Prediction: Examining Onchain Metrics After ETH Posts Solid 24h and 7d Gains appeared first on Cryptonews.

(@RyanSAdams) October 17, 2025

(@RyanSAdams) October 17, 2025