Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum Price Forecast: $2.5B Liquidated as ETH Dips to $2,400 – Is $2,100 on the Horizon?

Ethereum is undergoing one of its most significant downturns this cycle, with its value declining towards $2,400 as the broader cryptocurrency market adopts a cautious stance. While Bitcoin and other prominent altcoins are also experiencing declines, Ethereum’s losses are more pronounced in percentage terms.

In the last 24 hours, ETH has decreased by approximately 9 to 10%, and trading volumes have surged beyond $50 billion. This indicates a trend of panic selling rather than typical profit-taking. The combination of low liquidity and high leverage has exacerbated the sell-off, accelerating losses as the weekend approaches.

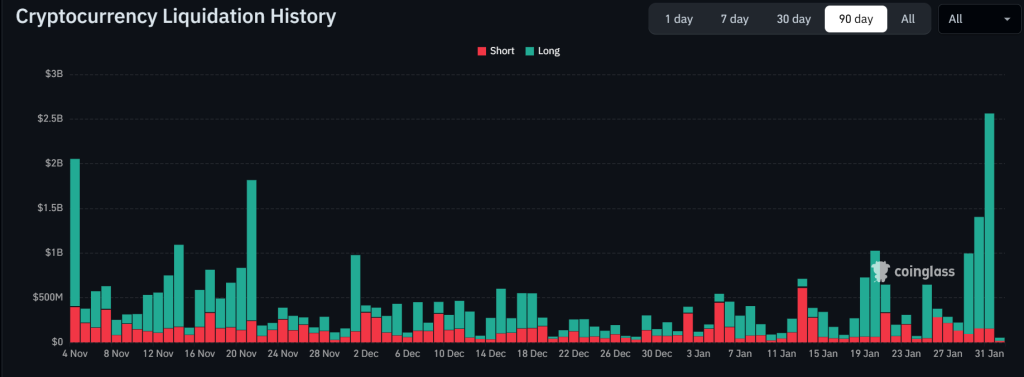

$2.5 Billion Liquidations and Large Holder Selling Are Pressuring Prices

Intense forced liquidations have fueled the sell-off. More than $2.5 billion in crypto positions were liquidated in just one day, with Ethereum accounting for the largest share. Many traders had positioned themselves for rising prices, making ETH susceptible to a downturn when critical support levels were breached, resulting in a flurry of margin calls.

Cryptocurrency Liquidation History Source: Coinglass

Cryptocurrency Liquidation History Source: Coinglass

Additionally, significant investors and institutions have contributed to the selling pressure. After a prolonged period of accumulation, large holders are now trimming their positions. Flows from ETFs and derivatives also indicate that investors are attempting to mitigate their risk. As the overall cryptocurrency market capitalization approaches $2.6 trillion and fear persists, market sentiment remains weak.

Ethereum Price Forecast: ETH Declines to $2,400 as Downtrend Accelerates

Examining the charts, it is evident that Ethereum’s price forecast is firmly in a bearish trend. The daily chart reveals that ETH is trapped in a descending channel that has influenced its price since late 2025. The price faced rejection in the $3,200 to $3,300 range, just beneath the declining 100-day and 200-day moving averages, concluding the last attempt at stabilization.

Ethereum Price Chart – Source: Tradingview

Ethereum Price Chart – Source: Tradingview

When ETH fell below the $2,800 level, which had served as a crucial support, it confirmed the continuation of the downtrend. Recent price bars indicate substantial selling pressure, with little indication that sellers are losing momentum.

Momentum indicators also reflect weakness. The RSI has dropped into the mid-20s, indicating that ETH is significantly oversold, yet there are no signs of a potential reversal at this moment. In strong downtrends, this typically suggests that selling may persist for the time being.

Key Price Levels and Anticipations Moving Forward

Considering potential price trajectories, there are two primary scenarios. ETH could experience a short-term rebound to the $2,600 to $2,700 range, where previous support and the lower channel now serve as resistance. If ETH fails to rise above this area, prices might decline to $2,250 next, and potentially $2,100 if selling intensifies.

A more optimistic outlook will require time. Ethereum must maintain its position above $2,400, establish a higher low, and close above $2,800 to initiate a recovery towards $3,100 to $3,300 later on. Currently, ETH appears to be undergoing a leverage reset, which is challenging but often necessary before a more robust recovery can occur.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is ushering in a new era for the BTC ecosystem. While BTC remains the benchmark for security, Bitcoin Hyper introduces what it has always needed: Solana-level speed. The outcome is rapid, cost-effective smart contracts, decentralized applications, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project prioritizes trust and scalability as adoption increases. Moreover, momentum is already substantial. The presale has exceeded $31.4 million, with tokens priced at just $0.013665 prior to the next increase.

As Bitcoin activity rises and the demand for efficient BTC-based applications grows, Bitcoin Hyper emerges as the bridge connecting two of crypto’s largest ecosystems. If Bitcoin constructed the foundation, Bitcoin Hyper could enhance it by making it fast, flexible, and enjoyable once more.

Click Here to Participate in the Presale

The post Ethereum Price Prediction: $2.5B Liquidated as ETH Slides to $2,400 – Is $2,100 Next? appeared first on Cryptonews.