Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum Price Expected to Rise to $5K by Year-End: Factors Indicating a Potential “Santa Rally”

As the price of Ethereum (ETH) stabilizes just above $3,900, traders are considering the potential for a rise as the year concludes, a trend commonly known as a “Santa Rally.”

From a technical standpoint, Ethereum appears to be in a favorable position, remaining above all significant moving averages and clearly in an upward trend.

Nonetheless, resistance from the early 2024 highs, just above $4,000, continues to limit Ethereum’s price movements.

However, it seems that Ethereum investors might be in for an early Christmas.

Currently, Polymarket betting odds assign only a 14% chance for Ethereum to reach new all-time highs at $5,000, which may indicate that the market is undervaluing the potential for a significant breakout. Here’s the reasoning behind this.

Could Ethereum Price Surge to $5,000 Soon? Here’s Why It’s Possible

Reason 1 – Market Sentiment

Describing the current sentiment in the crypto market as positive would be an understatement, especially with an almost unfathomably pro-crypto US administration set to take office in March.

This week, Trump pledged to make significant advancements for the crypto sector, his selections for Treasury Secretary and SEC Chair are strongly pro-crypto, and his family was recently seen increasing their holdings in ETH, AAVE, and LINK.

U.S. President Donald Trump’s World Liberty Financial bought

• 2,631 $ETH ($10M)

• 3,357 $AAVE ($1M)

• 41,335 $LINK ($1M)

UNREAL pic.twitter.com/KubybniuBb— Quinten | 048.eth (@QuintenFrancois) December 12, 2024

It is not an exaggeration to suggest that we are on the brink of a new golden era for crypto markets as US policy shifts decisively in a favorable direction.

This is a compelling reason why buying pressure is likely to stay high as the year concludes, which is promising for Ethereum’s price.

Reason 2 – Market Leadership and ETF Inflows

The potential establishment of a national Bitcoin reserve in the USA indicates that Bitcoin (BTC) will likely benefit significantly under the forthcoming administration.

However, altcoins like Ethereum, which have faced considerable regulatory uncertainty in recent years, may experience an even more substantial rebound.

Ethereum is well-positioned to be one of the top-performing altcoins. It continues to dominate the DeFi space, holding a 56% market share of total value locked (TVL) according to DeFi Llama, even though Solana has surpassed it in speculative trading activities due to lower fees.

For new investors in crypto looking to diversify beyond BTC, Ethereum is likely to be the most apparent next choice.

This is particularly true as Ethereum is the only other major cryptocurrency with spot ETFs available in the US.

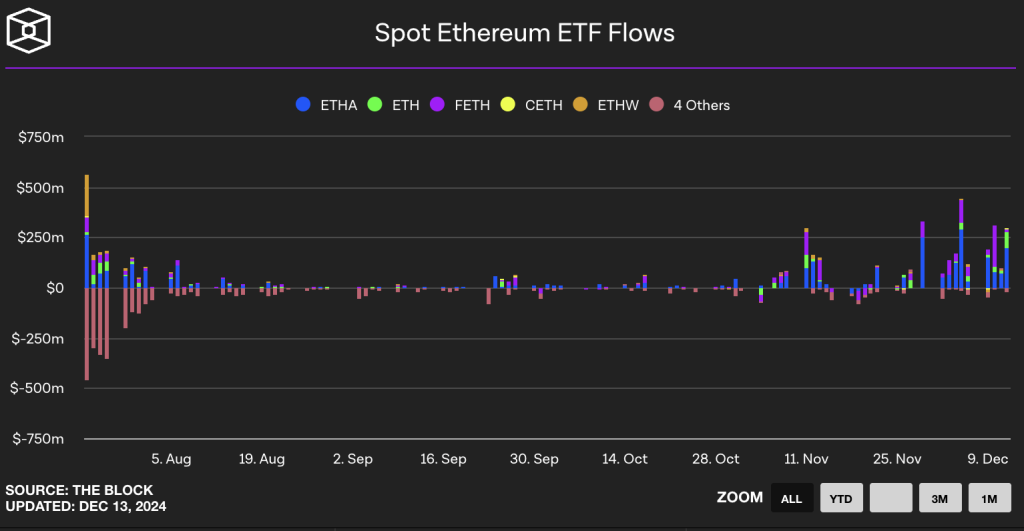

Data from The Block indicates that Ethereum ETF inflows have been increasing since Trump’s election victory.

There is no indication that this trend will slow down as the year ends, suggesting potential upside for Ethereum’s price in the upcoming weeks.

Reason 3 – Increasing On-chain Activity

Another factor contributing to optimism regarding Ethereum’s price as the year concludes is the rising activity on its blockchain.

According to Glassnode’s Ethereum core on-chain dashboard, metrics such as active addresses, transaction counts, and total transfer volume are all on the rise, approaching yearly highs.

This bolsters the narrative of adoption and can help support prices. Additionally, it contributes to the view of Ethereum as a deflationary asset—since a portion of ETH gas fees is burned, increased fees lead to more ETH being burned.

What Are the Prospects for Ethereum’s Price?

With Ethereum nearing its all-time highs, investors might be concerned that the most significant part of the rally has already occurred.

However, that would be a misjudgment—similar to Bitcoin, Ethereum’s price has historically moved in cycles, entering phases of aggressive price discovery followed by extended drawdowns.

Fortunately for bullish investors, a new phase of price discovery may be imminent. Bitcoin entered its latest phase of price discovery last month, as it has historically done within eight months of the BTC halving.

Ethereum, on the other hand, has typically lagged behind Bitcoin by up to two months. This could indicate an imminent aggressive breakout to new record levels in January.

Various on-chain metrics also support the idea that the peak has not yet been reached—Ethereum’s “realized cap” (the market cap at the average price when each last coin moved) recently achieved new record highs at just under $248 billion.

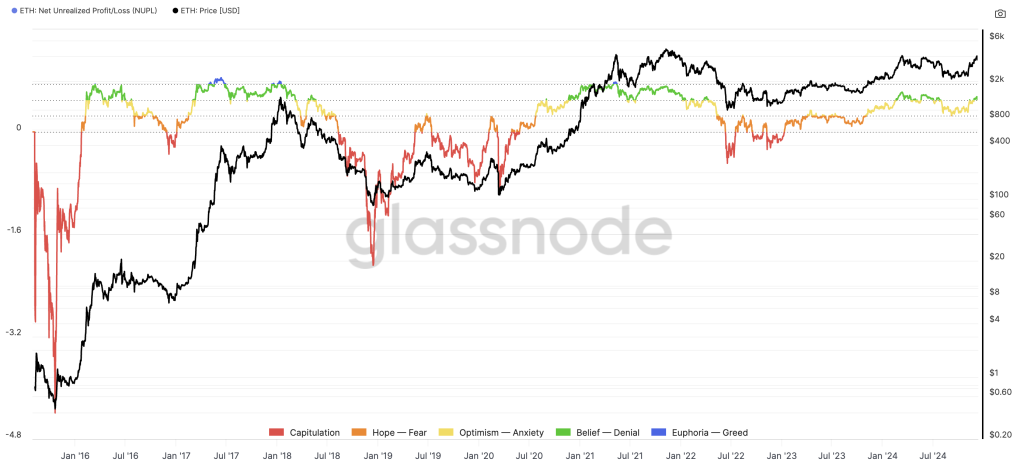

Moreover, the ratio of Ethereum’s market cap to its realized cap, which was around 1.5 according to Glassnode, remains significantly below levels that have historically indicated market peaks (above 3).

While the profitability of the Ethereum market is currently high, it is still below levels seen during previous price peaks. According to Glassnode, the Net Unrealized Profit/Loss (NUPL) was last just above 0.5, whereas prior market peaks have seen NUPL exceed 0.75.

When considering the question of “how much higher can Ethereum go?”, the answer remains uncertain. However, it is certainly a significant amount.

The previous cycle witnessed Ethereum’s price increase over fourfold beyond its prior record highs. A similar gain is quite possible, setting the stage for a near $20,000 Ethereum price.

The post Ethereum Price Set to Pump to $5K Before Year’s End? Here’s Why a “Santa Rally” Is Likely appeared first on Cryptonews.