Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum Price at Risk of 40% Decline as Notable Whale Sells $543M in ETH – Future Implications?

Ethereum recently experienced a moment that prompts a closer examination of the chart. A prominent whale transferred approximately $543 million in ETH to Binance.

Experts are already cautioning that if critical support levels are breached, ETH might be facing a possible decline of 40%.

Key Takeaways

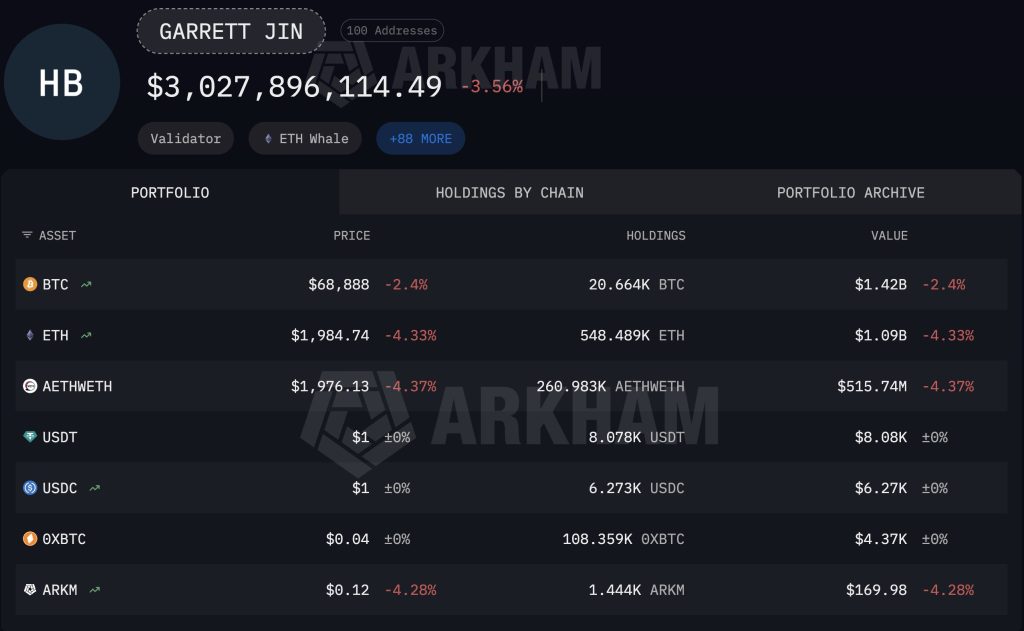

- The whale wallet “Garrett Jin” transferred 261,024 ETH to Binance in swift batches.

- Technical analysis indicates a bear pennant formation suggesting a drop to $1,200.

- Bears require a confirmed break below $1,950 to initiate the 40% downward movement.

Is a Significant Sell-Off Starting?

Data reveals that a wallet associated with early investor Garrett Jin moved precisely 261,024 ETH to Binance in three substantial transactions. When such a large volume appears on a centralized exchange, traders typically conclude one thing: either a significant hedge or a sell-off.

The whale still possesses over $1.6 billion in assets, indicating this is not a complete exit. However, even a small portion of that supply entering the market could create volatility.

Source: Arkham

Source: Arkham

Market sentiment is already precarious following disappointing earnings across the industry and overall price weakness. If this whale begins to sell into limited spot liquidity, the order books could become depleted.

Ethereum Price Path to $1,200

The chart appears tense, without a doubt. Ethereum’s price is consolidating into a classic bear pennant on the daily chart.

This pattern frequently breaks in the direction of the previous movement, which was the decline from $2,800 to the $1,900 range earlier this month.

Source: ETHUSD / TradingView

Source: ETHUSD / TradingView

A break below $1,950 would technically pave the way toward the $1,200 region.

However, it is important to note that pennants are compression patterns. When prices coil this tightly, the subsequent breakout can be significant in either direction.

If Ethereum can hold the $1,950 level and rise above the upper trendline of the pennant, it could trap late shorts and trigger a relief rally.

The post Ethereum Price Faces 40% Crash Risk as Legendary Whale Dumps $543M ETH – What Happens Next? appeared first on Cryptonews.