Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ethereum Fueled July Surge as Corporate Holdings Increased by 127% to 2.7 Million ETH: Binance

In July, Ethereum (ETH) captured attention in the cryptocurrency market, as corporate holdings experienced their most significant monthly rise on record.

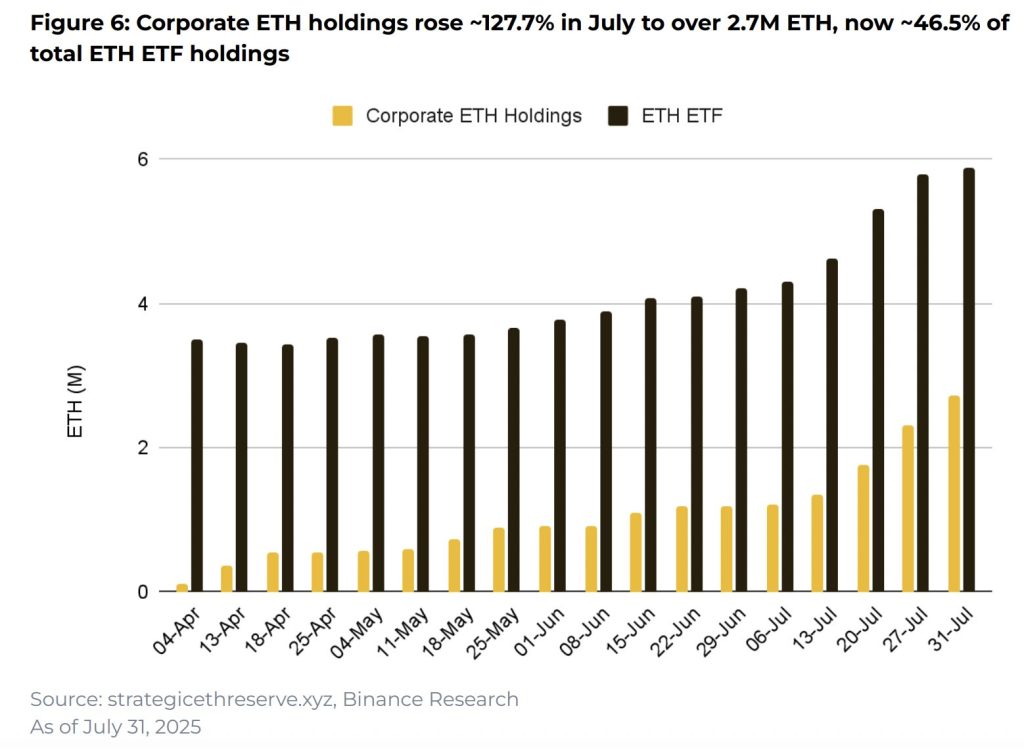

According to Binance Research’s monthly market insights report, the balances maintained by companies increased by approximately 127% to over 2.7 million ETH ($11.6 billion).

This surge was accompanied by a rise in the number of companies that have added Ethereum to their assets. Twenty-four new entities entered the market, raising the total to 64.

Collectively, these corporations now possess about 46.5% of the ETH held by exchange-traded funds, which also saw their assets grow by 39.5% to exceed 5.8 million ETH, as noted in the report.

Corporate ETH Reserves Surpass Ethereum Foundation as Adoption Grows

This increase signifies a transition towards direct exposure to Ethereum, moving away from passive ETF investments. Some companies now hold more ETH than the Ethereum Foundation itself, with Bitmine leading at 1.1 million ETH, followed by Sharplink with 521,000 ETH.

Further disclosures are anticipated in the upcoming months, as additional firms unveil similar approaches. The Ether Machine was a notable late-July addition, highlighting the momentum in corporate ETH adoption.

This accumulation of holdings coincided with robust market performance. Ethereum appreciated by over 50% during the month, establishing itself as one of the top-performing large-cap digital assets. The ETH-to-Bitcoin ratio reached a six-month peak of 0.032, indicating renewed strength in comparison to Bitcoin as investors shifted their capital.

Ethereum’s Staking Yield and Deflationary Features Attract Corporate Investors

While corporate Bitcoin treasuries have garnered attention for some time, many of these new Ethereum strategies seem to be influenced by Michael Saylor’s approach.

Nonetheless, they are also capitalizing on Ethereum’s distinctive features, including staking rewards, a deflationary supply model, and its position as the primary collateral in decentralized finance.

Favorable regulatory conditions have further enhanced its attractiveness. The US SEC’s implicit acknowledgment of ETH as a commodity, along with the enactment of significant stablecoin legislation, has bolstered confidence in the asset’s long-term potential.

July Sees Highest Institutional Demand for ETH to Date

This trend is emerging against a backdrop of broader market gains. Binance Research reported that the global cryptocurrency market capitalization increased by 13.3% in July 2025. This rise was fueled by Bitcoin achieving repeated all-time highs, heightened institutional interest in Ethereum and major altcoins, record levels of corporate treasury adoption, and improved regulatory clarity.

Although Bitcoin continued to be a dominant player, July witnessed a noticeable shift towards altcoins, with Ethereum leading the way. The asset attracted inflows from both spot ETFs and corporate treasuries eager to secure additional staking yield, reinforcing its role in the evolving digital asset landscape.

Ethereum’s market share climbed to 11.8%, while Bitcoin’s dominance decreased to around 60%. The month also marked a record 19 consecutive days of positive net inflows into Ethereum spot ETFs, highlighting sustained investor interest.

The prospects for corporate Ethereum adoption remain encouraging, although the market is still in a maturation phase.

Increased volatility compared to Bitcoin could challenge the sustainability of these treasury strategies, but for the time being, Ethereum’s appeal among institutional and corporate investors seems to be expanding at an unprecedented rate.

The post Ethereum Led July Rally as Corporate Holdings Surged 127% to 2.7M ETH: Binance appeared first on Cryptonews.