Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ether.fi Transfers Crypto Card Offering from Scroll to OP Mainnet

Ether.fi is transitioning its payment system, Ether.fi Cash, to OP Mainnet, relocating approximately 70,000 active cards and 300,000 accounts from the Scroll Layer 2 network, as detailed in a recent blog entry.

The announcement made on Wednesday outlines the plan to transfer millions in Total Value Locked (TVL) over the upcoming months to integrate with Optimism’s expansive Superchain ecosystem.

This strategic shift highlights the intense competition among Layer 2 solutions for high-traffic consumer applications, with Ether.fi emphasizing access to a broader DeFi ecosystem as a key motivator.

Key Takeaways

- Mass Migration: Around 70,000 active cards and 300,000 accounts are transitioning to Optimism.

- Volume Impact: Ether.fi Cash manages approximately $2 million in daily spending volume.

- Incentives: Ether.fi will fully cover gas fees for card transactions during and after the transition.

Why Is Network Choice Critical?

Ether.fi initially established its reputation through asset restaking but successfully shifted to consumer payments with Ether.fi Cash in 2024.

This product enables users to spend stablecoins or borrow against staked assets like eETH to finance real-world Visa purchases.

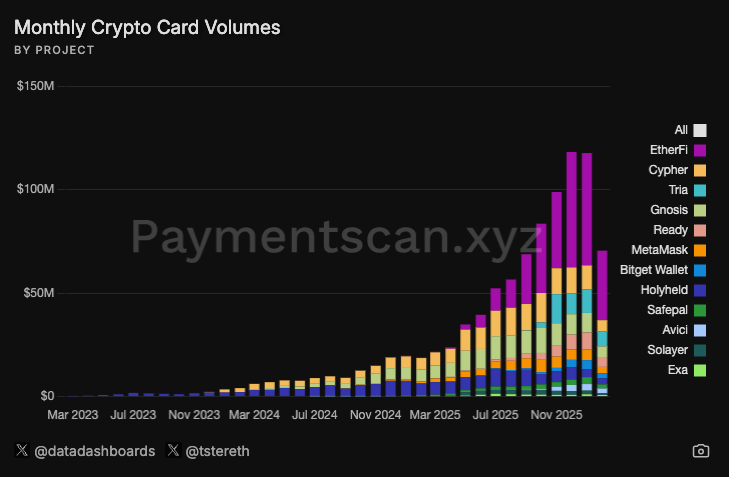

As reported by Paymentscan, these cards now account for nearly half of all crypto-native card transactions.

Source: Paymentscan

Source: Paymentscan

The selection of the underlying network influences transaction speed and liquidity depth.

Operational reliability is crucial for consumer products; recent events with Moonwell illustrate this point.

Payment providers must address infrastructure risks by choosing established execution layers. Ether.fi’s transition indicates that the liquidity depth on OP Mainnet currently surpasses the ZK-rollup benefits provided by Scroll for this particular application.

Discover: The best crypto presales right now

Breaking Down the Migration

The migration leverages an OP Enterprise partnership, granting Ether.fi dedicated support and shared codebase tools.

Transaction fees for card usage will be covered by the protocol, ensuring users face no obstacles during the transition. This is essential as Ether.fi Cash currently handles about 2,000 internal swaps and 28,000 spending transactions daily, metrics that have reportedly doubled every two months.

1/ Today, we announce our plan to move to @Optimism’s OP Mainnet

70,000+ active cards, 300,000+ accounts, and $160M+ in TVL will migrate to the Superchain in the coming months, marking a long-term partnership to accelerate global onchain payments.

Learn more below ↓ pic.twitter.com/ayd11I4SAd— ether.fi (@ether_fi) February 18, 2026

Capital efficiency is the primary technical driver in this scenario. Similar to how new frameworks are introducing unified liquidity and staking solutions, Ether.fi anticipates deeper liquidity for swaps on OP Mainnet compared to its previous setup.

Enhanced liquidity pools result in reduced slippage for users converting crypto to fiat at the point of sale.

The OP Stack itself processed an impressive 3.6 billion transactions in the latter half of 2025, accounting for 13% of all crypto transactions during that timeframe.

What Does This Mean for the L2 Landscape?

For Scroll, this signifies a significant loss of volume. The ZK-powered chain had depended on Ether.fi as a major contributor to daily activity.

On the other hand, Optimism strengthens its status as a leading hub, securing a high-retention consumer product just as internal ecosystem dynamics evolve, particularly with Base indicating moves toward a custom chain platform.

This consolidation mirrors a maturing Ethereum ecosystem where projects prioritize proven liquidity over innovative tech stacks.

It aligns with broader institutional strategies, akin to how funds like Founders Fund have adjusted their ETH-related exposure to reflect current market conditions.

For the end user, while the backend infrastructure changes, the card in their digital wallet simply becomes more efficient.

Discover: Diversify your crypto portfolio with these top picks

The post Ether.fi Moves Crypto Card Product to OP Mainnet From Scroll appeared first on Cryptonews.