Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

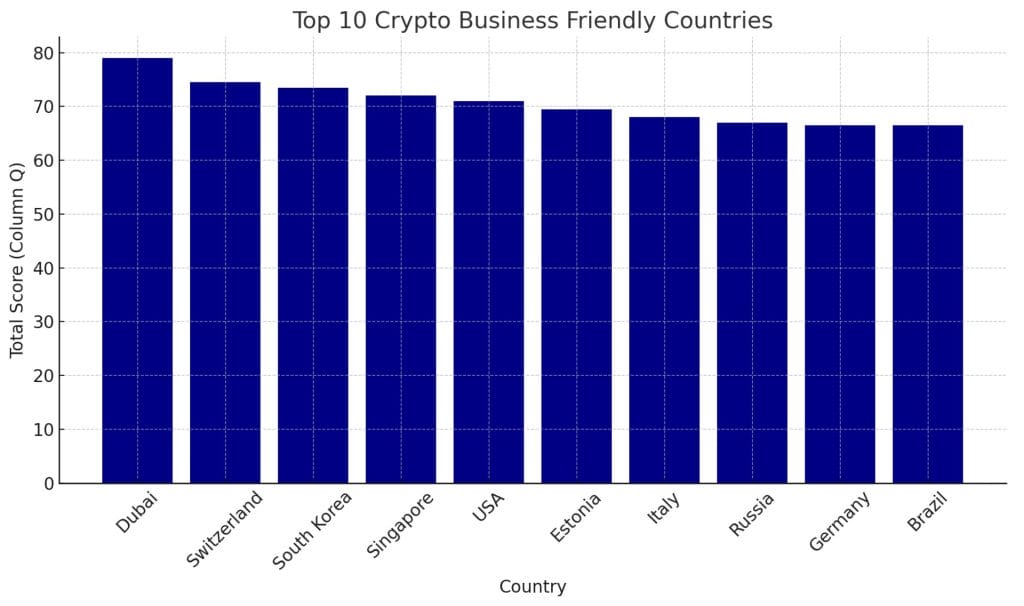

Dubai, Switzerland, and South Korea Recognized as Leading Crypto Business Hubs for 2024

Dubai, Switzerland, and South Korea have been recognized as leading locations for cryptocurrency enterprises in 2024.

A report from Social Capital Markets indicates that these nations excel in offering legal transparency. They also enforce advantageous capital gains and corporate tax rates. Additionally, these countries are home to a considerable number of registered crypto companies and exhibit broad acceptance of cryptocurrency transactions.

Each criterion was assigned a score out of 20, culminating in a total of 100 points, which determined the ranking of the top 10 crypto-friendly nations.

Dubai’s Innovative Crypto Regulations Secure Its Top Ranking Globally

Dubai achieved the highest ranking with a score of 79, demonstrating strengths in regulatory transparency, the absence of capital gains tax, a favorable corporate tax rate of 9%, and reasonable licensing costs.

By implementing a progressive regulatory framework and advantageous tax policies, Dubai has positioned itself as a prominent center for cryptocurrency and blockchain initiatives. The establishment of the Virtual Asset Regulatory Authority (VARA) and the Dubai Financial Services Authority (DFSA) fosters a clear legal framework, promoting innovation within the crypto sector.

Moreover, the DMCC Crypto Centre significantly contributes to the advancement of crypto and blockchain enterprises by providing specialized infrastructure. Dubai does not impose capital gains tax on cryptocurrency transactions, and the corporate tax threshold is set at AED 375,000. This tax approach enhances Dubai’s attractiveness to crypto businesses on a global scale.

Image Source: Social Capital Markets

Switzerland’s ‘Crypto Valley’ Flourishes with 900 Firms and Investor-Friendly Tax Structure

Switzerland occupies the second position with a score of 74.5, featuring 900 registered crypto firms and a capital gains tax of 7.8% for long-term investors.

FINMA, the financial regulator in Switzerland, has developed a clear and supportive regulatory environment for cryptocurrency businesses. This framework is particularly robust in areas like Zug, referred to as “Crypto Valley.” The requirement for registration with FINMA ensures legal certainty, facilitating the success of over 900 crypto companies in Switzerland.

Switzerland’s tax regime further enhances its attractiveness for crypto, with a capital gains tax of 7% and corporate tax rates ranging from 12% to 21%, presenting a more favorable tax environment compared to global averages. Additionally, more than 400 businesses accepting cryptocurrencies for transactions underscores the deep integration of crypto within the national economy.

South Korea’s Developing Crypto Regulations and Tax Incentives Elevate It to #3

South Korea ranks third with a score of 73.5 and actively contributes to shaping the global cryptocurrency environment.

The Korea Financial Intelligence Unit (KFIU), operating under the Financial Services Commission (FSC), has established an evolving regulatory framework designed to incorporate cryptocurrencies into the financial system. By mandating that crypto businesses register with the FSC, the country ensures regulatory oversight and legitimacy for their operations.

South Korea’s tax policies further enhance its appeal for cryptocurrency enterprises. The postponement of capital gains tax on cryptocurrencies, along with plans to implement corporate tax in 2025, provides temporary tax relief, potentially drawing in more businesses.

With over 376 active crypto firms, South Korea is broadening its market and setting a regional benchmark. Backed by state-supported initiatives such as CBDC exploration, the country combines regulatory clarity, business opportunities, and technological advancement, reinforcing its position in the global cryptocurrency arena.

The post Dubai, Switzerland, South Korea Crowned Top Crypto Business Locations in 2024 appeared first on Cryptonews.