Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

DOJ Dismisses OpenSea NFT Fraud Case Following Appeals Court Reversal

US prosecutors have officially withdrawn their case against former OpenSea manager Nathaniel Chastain following a reversal by an appeals court that dismantled what had been touted as the first NFT insider trading prosecution in the history of the United States.

As per sources, the Justice Department declared on Wednesday that it would engage in a one-month deferred prosecution agreement before ultimately dismissing the indictment with prejudice.

This decision concludes a saga that began in June 2022 when Chastain was arrested and charged with wire fraud and money laundering for utilizing confidential information to acquire NFTs prior to their display on OpenSea’s homepage.

The case garnered significant attention as prosecutors endeavored to apply established financial crime laws to the burgeoning digital asset markets.

Appeals Court Ruling Undermines Prosecution’s Foundation

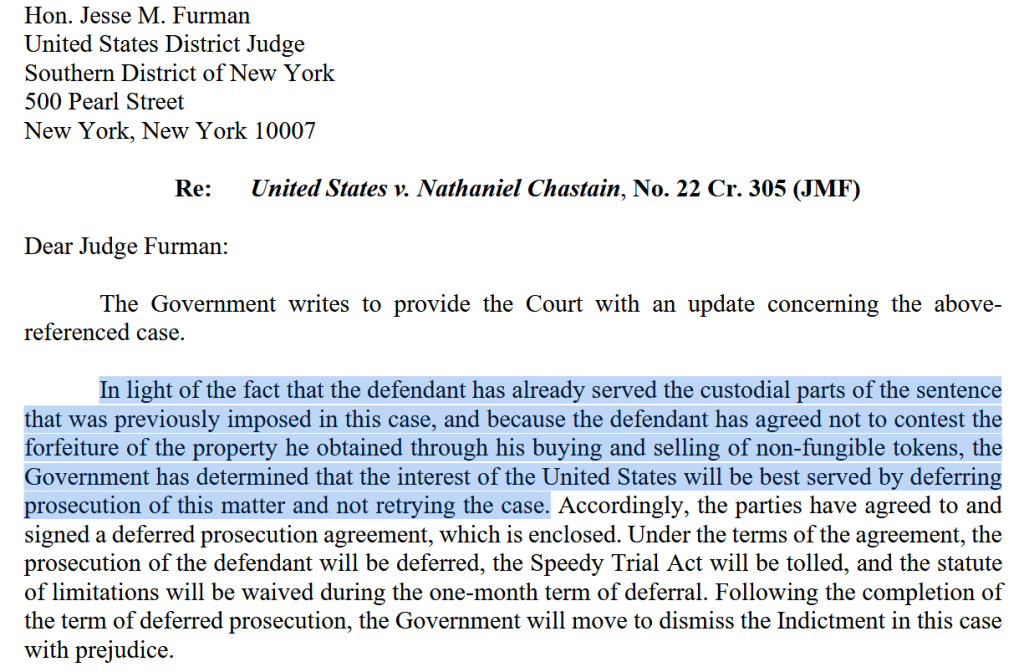

Manhattan US Attorney Jay Clayton, a former SEC chair, informed the federal court that prosecutors would not pursue a retrial given that Chastain had already completed three months of incarceration and consented to forfeit 15.98 ETH valued at $47,330.

“The interest of the United States will be best served by deferring prosecution of this matter and not retrying the case,” Clayton noted in the court document.

Jay Clayton’s letter. | Source: Cointelegraph

Jay Clayton’s letter. | Source: Cointelegraph

The collapse originates from a July 2024 appeals court ruling that determined the trial jury received erroneous instructions.

The 2nd US Circuit Court of Appeals ruled 2-1 that jurors had been improperly informed they could convict Chastain based solely on unethical conduct instead of actual theft of property possessing commercial value.

Judge Steven Menashi stated last August that the lower court made a mistake by permitting a conviction even when the information Chastain utilized lacked tangible value to OpenSea.

The appeals panel strongly criticized jury instructions that allowed a conviction based on breaches of “broad notions of honesty and fair play,” cautioning that such criteria could criminalize nearly any misleading action.

The court concluded that the featured NFT data had not been monetized by OpenSea and was not regarded internally as a valuable asset, rendering it too “ethereal” to be considered property under federal wire fraud laws.

Original Conviction Built on Novel Legal Theory

Chastain was convicted in May 2023 after prosecutors accused him of taking advantage of his position to purchase numerous NFTs shortly before they were showcased on OpenSea’s homepage between June and September 2021.

After the tokens were highlighted and their prices surged, he sold them for profits ranging from two to five times using anonymous wallets. The government claimed he profited over $57,000 from the scheme.

US Attorney Damian Williams had described the case as a cautionary tale for digital asset markets when announcing the charges. “NFTs may be new, but this kind of criminal scheme is not,” Williams stated.

“As alleged, Nathaniel Chastain betrayed OpenSea by exploiting its confidential business information for his personal gain.”

The conviction followed a week-long trial, with prosecutors opting to charge wire fraud instead of securities fraud since NFTs have not been legally classified as securities.

Over 300 defense attorneys submitted letters advocating for dismissal, contending that treating confidential business information as property would “criminalize a broad array of conduct.”

Broader Regulatory Retreat Under Trump Administration

The retraction of prosecution aligns with a wider transformation in federal crypto enforcement during the Trump administration.

As reported by Cryptonews earlier today, a Cornerstone Research report indicated that the SEC initiated only 13 crypto-related actions in 2025, a 60% decrease from 33 in 2024, marking the lowest level since 2017.

The agency has closed several high-profile cases, including those against Coinbase, Kraken, Consensys, and Cumberland DRW.

The SEC also concluded its investigation into OpenSea in February 2025 after issuing a Wells notice in August 2024, which alleged that the platform operated as an unregistered securities marketplace.

The SEC has officially terminated its investigation into NFT marketplace @OpenSea, according to the company’s founder, @dfinzer.#SEC #OpenSeahttps://t.co/OtOT6c3WMd

— Cryptonews.com (@cryptonews) February 22, 2025

At that point, OpenSea founder Devin Finzer referred to the closure as “a victory for everyone who is creating and building in our space.”

For the time being, Chastain will not be under supervision by US Pretrial Services and can seek the return of the $50,000 fine and special assessment paid following his conviction.

Notably, the global NFT market cap currently stands at $2.56 billion, reflecting a 6.72% decline in the last 24 hours, with total sales volume reaching $3.68 million, according to CoinGecko data.

Source: CoinGecko

Source: CoinGecko

This figure signifies an 84.78% drop from the market’s peak of $16.82 billion in April 2022, when digital collectibles were among the most sought-after assets in crypto and the Chastain case was initially unfolding.

The post DOJ Drops OpenSea NFT Fraud Case After Appeals Court Overturns Conviction appeared first on Cryptonews.

The SEC has officially terminated its investigation into NFT marketplace @OpenSea, according to the company’s founder, @dfinzer.#SEC #OpenSeahttps://t.co/OtOT6c3WMd

The SEC has officially terminated its investigation into NFT marketplace @OpenSea, according to the company’s founder, @dfinzer.#SEC #OpenSeahttps://t.co/OtOT6c3WMd