Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Delphi Digital: Perpetual DEXs Set to Supplant Banks as Comprehensive Financial Powerhouses

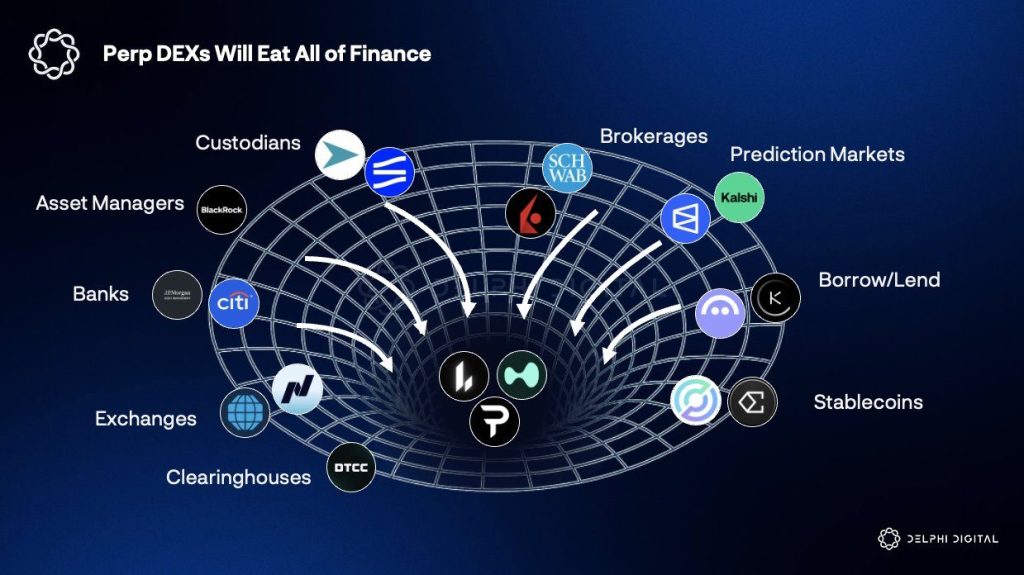

Perpetual decentralized exchanges are transitioning from the peripheries of cryptocurrency trading to the forefront of the market, as recent insights and analysis from Delphi Digital indicate that these platforms may develop into comprehensive financial hubs that rival the functions typically performed by banks.

This shift is attributed to the enduring appeal of blockchain-based systems to traders, which minimize the need for intermediaries, reduce expenses, and operate continuously, despite the volatile nature of token prices in the market.

Source: Delphi Digital

Source: Delphi Digital

Perp DEXs enable users to engage in trading perpetual futures contracts with leverage, offering a product that has historically been dominated by centralized exchanges and conventional derivatives desks.

Perp DEXs Gain Ground as DeFi Bundles Trading, Credit, and Custody

Delphi Digital’s 2026 forecast highlighted that this area of decentralized finance is now poised to capture additional market share from traditional financial products, propelled by structural efficiencies that are challenging for conventional systems to match.

The research firm contended that traditional finance remains disjointed and costly to manage, while decentralized frameworks can consolidate various financial functions into a unified on-chain architecture.

In a post shared on X, Delphi Digital pointed to Hyperliquid’s shift towards native lending as a significant indicator of the sector’s trajectory.

https://t.co/m1EcOi3uNS

— Delphi Digital (@Delphi_Digital) January 13, 2026

Delphi noted that this development paves the way for perp DEXs to function as all-encompassing financial platforms, managing trading, custody, clearing, and credit within a single on-chain framework.

Competing platforms like Aster, Lighter, and Paradex are now in a race to create similar functionalities.

This convergence signifies a broader trend in the cryptocurrency space, where trading venues are extending their services beyond execution into lending, custody, and capital management.

Data indicates that this transition is already progressing well, as Perp DEXs have consistently gained revenue and volume share from centralized exchanges over the last three years.

According to CoinGecko, perp DEXs represented merely 2.1% of the centralized exchange perpetuals volume in January 2023.

By November 2025, this figure had surged to an unprecedented 11.7%, indicating that nearly one in every nine dollars traded in perpetual futures was conducted on a decentralized platform.

Source: CoinGecko

Source: CoinGecko

For the entire year, cumulative perp DEX volume tripled to $12.09 trillion, increasing from $4.1 trillion at the beginning of 2025.

Approximately $7.9 trillion of that activity occurred throughout 2025 itself, underscoring the rapid acceleration of adoption over the past year.

The sector currently holds more than $20 billion in total value locked, with monthly volumes frequently surpassing $1 trillion and open interest remaining around $20 billion.

Crypto derivatives trading experienced a sharp increase in 2025 as traders increasingly turned to on-chain perpetual futures. #Crypto #Derivatives https://t.co/NRfJCBERpc

— Cryptonews.com (@cryptonews) December 30, 2025

DEX Spot Trading Grows Sharply as the Gap With CEXs Narrows

Spot trading has followed a similar path, albeit at a slower pace. Decentralized exchanges accounted for just 6.0% of spot trading volume compared to centralized exchanges in January 2021.

By November 2025, that ratio had climbed to 21.2%, with a peak of 37.4% reached in June 2025 during a surge in memecoin speculation and activity on PancakeSwap.

Source: CoinGecko

Source: CoinGecko

Simultaneously, the report and accompanying data underscore the distance the sector still needs to cover.

The annual transaction volume of 12 trillion handled by perp DEXs is still relatively low compared to the 846 trillion notional value of outstanding over-the-counter derivatives reported by the Bank for International Settlement in mid-2025.

Traditional banks continue to hold advantages in areas such as regulatory clarity, fiat integration, and services like uncollateralized lending and consumer protections.

Industry analysts point out that for perp DEXs to pose a serious challenge to banks, they would need to continue expanding beyond derivatives into lending, payments, and tokenized real-world assets, while also addressing security, user experience, and regulatory compliance.

Numerous platforms are already experimenting with on-chain order books, zero-fee models, incentive programs, and high-throughput blockchains to enhance performance and accessibility.

The post Delphi Digital: Perp DEXs Poised to Replace Banks as “All-In-One” Financial Giants appeared first on Cryptonews.