Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

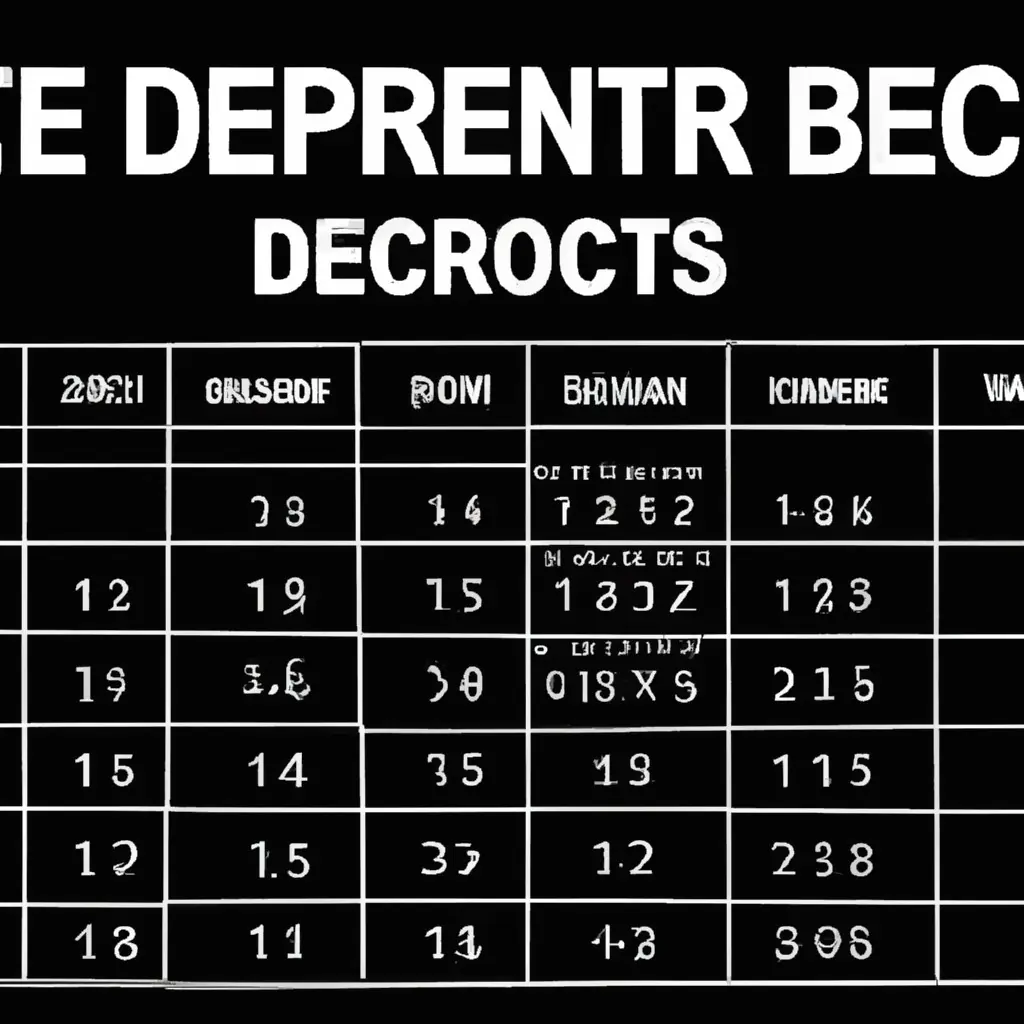

December Report on Spot and Derivatives Trading Activity on Centralized Cryptocurrency Exchanges

December represented a significant milestone for centralized cryptocurrency exchanges, achieving the highest combined spot and derivatives trading volumes ever documented, according to CCData’s latest market analysis.

The analysis indicated a 7.58% increase in overall trading activity, reaching a record high of $11.3 trillion.

Binance maintained its leading position in spot trading, recording $946 billion in volume, a modest rise of 0.13%. Following Binance were Bybit and Coinbase, with $247 billion (an increase of 18.8%) and $191 billion (up 9.62%), respectively.

Surge in Crypto Derivatives Trading

Crypto derivatives trading also experienced a notable increase, rising 7.33% to $7.58 trillion, marking the highest monthly volume in the history of derivatives.

CCData observed a rise in liquidations as traders aimed to take advantage of market fluctuations.

The trading activity in December coincided with Bitcoin’s remarkable ascent, exceeding $100,000 for the first time on December 5 and reaching a peak of $108,249 on December 17.

However, the month also saw a sharp $1 billion liquidation on December 20, as Bitcoin dropped 3.5% from its $100,000 level following comments from Federal Reserve Chair Jerome Powell indicating no immediate plans to lower interest rates.

Market enthusiasm was quickly dampened, with traders caught off guard by the impact of Powell’s statements, as noted by Swyftx analyst Pav Hundal.

The market outlook improved in January, as the U.S. Consumer Price Index (CPI) report indicated lower-than-anticipated core inflation for December, enhancing the prospects for interest rate reductions.

In response, Bitcoin rebounded from $96,000 to $100,522.

With the Federal Reserve’s first interest rate decision for 2025 set for January 29, traders are closely monitoring upcoming developments that could influence the market’s direction.

Bitcoin Network Settles $19 Trillion in 2024, Doubling Last Year’s Volume

The Bitcoin network processed over $19 trillion in transactions in 2024, more than doubling the $8.7 trillion settled in 2023.

This increase signifies a substantial turnaround following two years of declining transaction volumes since 2021, according to Pierre Rochard, vice president of research at Riot Platforms.

During the 2021 bull market, Bitcoin’s transaction volume peaked at $47 trillion but saw a significant decline in the subsequent years.

“The Bitcoin network settled more than $19 trillion worth of BTC transactions in 2024, clearly demonstrating that Bitcoin serves as both a store of value and a medium of exchange,” Rochard stated.

As reported, spot Bitcoin ETFs in the United States saw impressive net inflows of $35.66 billion in 2024, significantly surpassing initial industry forecasts.

BlackRock’s iShares Bitcoin Trust ETF (IBIT) led the market with $37.31 billion in inflows, followed by Fidelity’s Wise Origin Bitcoin Fund (FBTC) with $11.84 billion, and ARK’s 21Shares Bitcoin ETF (ARKB) with $2.49 billion.

Other notable contributors included the Bitwise Bitcoin ETF (BITB), which reported $2.19 billion in inflows.

At the end of 2024, the United States solidified its status as a leader in Bitcoin mining, accounting for over 40% of the global hashrate — the total computing power securing the Bitcoin network.

U.S.-based mining pools Foundry USA and MARA Pool played a significant role, collectively mining over 38.5% of all Bitcoin blocks.

The post December Sets Report for Spot and Derivatives Trading on Centralized Crypto Exchanges appeared first on Cryptonews.