Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

DDA and Heliad Introduce the First Dynamic Blockchain ETP on Börse Stuttgart

Deutsche Digital Assets (DDA), in collaboration with Heliad Crypto Partners, has unveiled the DDA Heliad Dynamic Blockchain ETP (HELI) on the Stuttgart Stock Exchange, which is Germany’s second-largest securities market.

This innovative exchange-traded product (ETP) grants investors access to a dynamically adjusted portfolio of up to 13 blockchain tokens.

New ETP Provides Dynamic Exposure to Leading 13 Blockchain Tokens

The DDA Heliad Dynamic Blockchain ETP introduces a novel method for cryptocurrency investment by following a dynamic index of prominent blockchain tokens.

As stated in DDA’s X post from December 17, the ETP tracks the Heliad Dynamic Blockchain Index, which selects 13 cryptocurrencies “with a distinct emphasis on user adoption, market traction, and performance metrics based on usage.”

𝗗𝗲𝘂𝘁𝘀𝗰𝗵𝗲 𝗗𝗶𝗴𝗶𝘁𝗮𝗹 𝗔𝘀𝘀𝗲𝘁𝘀 𝗮𝗻𝗱 #Heliad 𝗶𝗻𝘁𝗿𝗼𝗱𝘂𝗰𝗲 𝗗𝗗𝗔 𝗛𝗲𝗹𝗶𝗮𝗱 𝗗𝘆𝗻𝗮𝗺𝗶𝗰 𝗕𝗹𝗼𝗰𝗸𝗰𝗵𝗮𝗶𝗻 𝗘𝗧𝗣

DDA, in partnership with Heliad Crypto Partners, launches the world’s first Dynamic Blockchain ETP (ISIN: DE000A4AHWT9, WKN: A4AHWT,… pic.twitter.com/Zu3lVFkOnK

— Deutsche Digital Assets (@DDA_GmbH) December 17, 2024

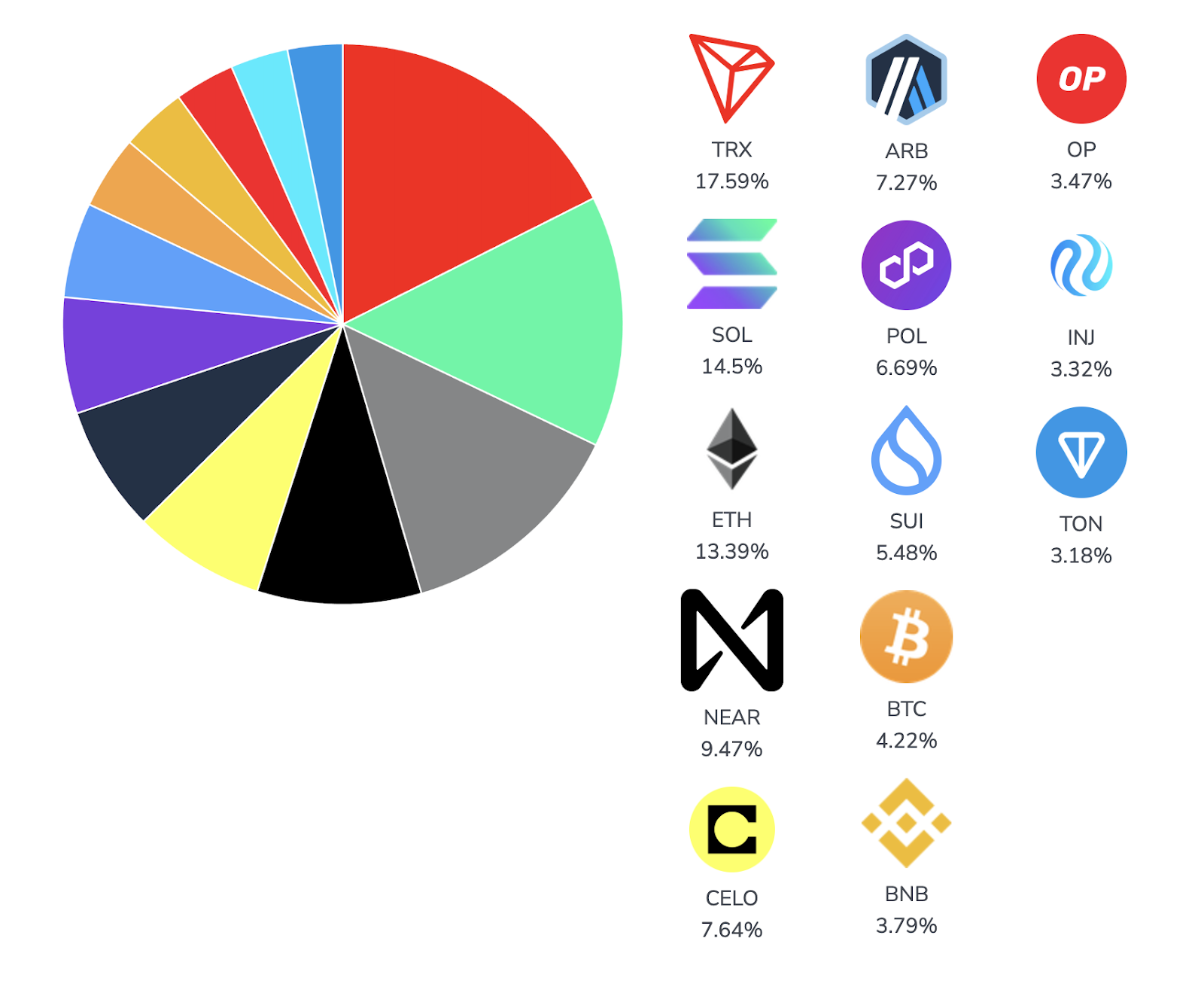

The chosen tokens encompass Bitcoin (BTC), Ether (ETH), Solana (SOL), Binance Coin (BNB), Toncoin (TON), Optimism (OP), Polygon (POL, formerly MATIC), Tron (TRX), NEAR Protocol (NEAR), Sui (SUI), Celo (CELO), Arbitrum (ARB), and Injective (INJ), each with different weightings.

Current composition of the DDA Heliad Dynamic Blockchain ETP. Source: DDA

Current composition of the DDA Heliad Dynamic Blockchain ETP. Source: DDA

“As the first of its kind, our index concentrates solely on fundamentals-based factors such as actual user engagement and valuation discrepancies. This <…> methodology has yielded impressive backtest results along with robust current performance,” remarked Christopher Garlich, Managing Director at Heliad Crypto Partners.

The ETP not only provides dynamic exposure to a diversified selection of tokens but also ensures the security and accessibility of a regulated investment product. “By utilizing DDA’s white-label ETP platform, we empower our partner Heliad to introduce their <…> crypto investment strategy to the market, while maintaining compliance with regulatory requirements, seamless exchange listings, and effective index tracking,” stated Dominik Poiger, Head of Product Management at DDA.

100% Physically Backed and Regulated

The DDA Heliad Dynamic Blockchain ETP is entirely physically backed. DDA ETPs mirror the performance of the underlying index with a 3.2% management fee and “provide the holder of the note a claim on the specified amount of the assets (basket of cryptocurrencies).”

DDA asserts that digital assets are securely held with regulated custodians such as Coinbase Germany GmbH and Aplo, removing the necessity for investors to manage their own wallets and private keys.

The ETP trades similarly to a stock or exchange-traded fund (ETF) on major European exchanges, including Deutsche Börse Xetra, Euronext Paris & Amsterdam, SIX Swiss Exchange, and Börse Stuttgart, offering liquidity and ease of access.

Furthermore, German investors enjoy tax-free gains after a one-year holding period.

Crypto ETPs Continue to Attract Investors

The global crypto ETP market is on a continuous upward trend.

ETFGI, a research and advisory firm, reported that assets invested in globally listed crypto ETPs reached a record high of $91.69 billion at the end of July. This surpasses the previous record of $84.69 billion set in March 2024 and signifies an increase of 506.4% since the conclusion of 2023.

According to ETFGI, this asset growth is fueled by strong investor interest, with net inflows of $11.02 billion in July. Year-to-date, net inflows have already totaled $56.62 billion, indicating a rising demand for regulated and accessible crypto investment products.

This trend is further illustrated by the growing number of crypto ETP listings, with 208 products and 551 listings available across 20 exchanges in 16 countries (data as of August 2024).

The post DDA and Heliad List World’s First Dynamic Blockchain ETP on Börse Stuttgart appeared first on Cryptonews.