Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

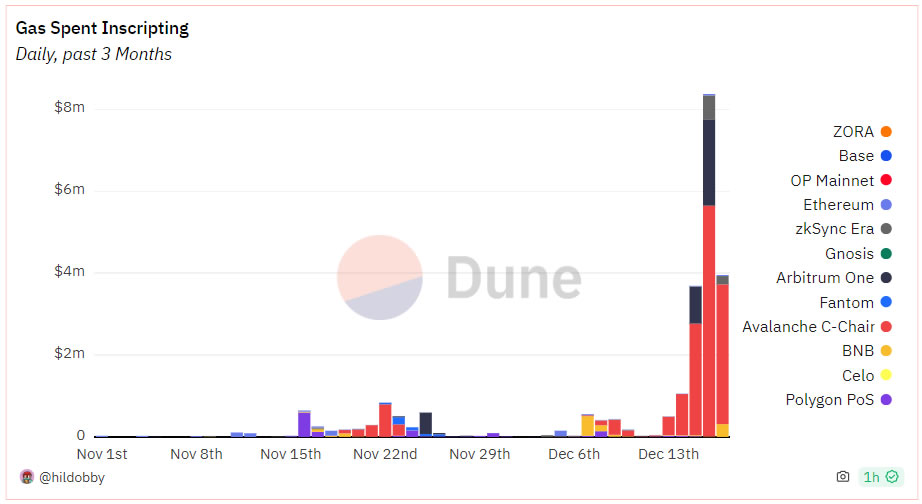

Daily expenditure on EVM inscriptions reaches unprecedented level of $8 million.

Transaction fees across various blockchains surged over the weekend as the Ordinals inscriptions phenomenon continues to elevate the demand for blockspace—not limited to the Bitcoin network.

Inscriptions on Ethereum Virtual Machine (EVM) chains experienced a dramatic increase over the weekend, leading to a rise in gas expenditures on these networks.

On December 16, gas costs for inscriptions reached an unprecedented $8.3 million, as reported by data from Dune Analytics.

The Avalanche network recorded the highest gas expenditure, with over $5.6 million spent on that day alone. Arbitrum One followed in second place, with $2.1 million allocated for gas related to inscriptions.

EVM inscriptions gas expenses. Source: Dune Analytics

EVM inscriptions gas expenses. Source: Dune Analytics

In the last 24 hours, Avalanche has seen 58% of its network gas utilized for EVM inscriptions, while zkSync Era reported that 48% of its fees were directed toward them.

Additionally, BNB Chain has recorded that 73% of its transactions in the past 24 hours were focused on inscriptions.

The situation on the Arbitrum One network was so critical that it resulted in a 78-minute outage on December 15.

Similar to Ordinals on the Bitcoin network, EVM inscriptions consist of data embedded in transaction call data to create unique non-fungible assets on-chain.

At the same time, the Bitcoin network also experienced a rise in Inscriptions over the weekend, further increasing block space demand and transaction fees. Currently, there are nearly 280,000 unconfirmed transactions, according to mempool.space.

This has led to Bitcoin transaction fees soaring as high as $37, according to observers, rendering the network’s intended use as peer-to-peer digital money impractical for many users.

Bitcoin pioneer and cryptographer Adam Back stated that Ordinals are unstoppable and that the elevated fees “drive adoption of layer-2 and force innovation.”

Related: Bitcoin Ordinals team launches nonprofit to grow protocol development

On December 18, NFT and Ordinals specialist “Leonidas” pointed out that a single collection achieved more volume in the past 24 hours than CryptoPunks, BAYC, MAYC, Pudgy Penguins, Azuki, DeGods, Moonbirds, Doodles, and Meebits combined.

The Bitcoin Frogs ordinals collection also led the market capitalization rankings with $182 million, he reported.

According to Cryptoslam, there was a notable increase to $4.8 million in secondary sales of the collection on December 17.

Magazine: BlackRock revises BTC ETF filing, El Salvador’s crypto citizenship trending, and more: Hodler’s Digest, Dec. 10-16