Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Cryptocurrency Values Decline Amid Escalating Middle Eastern Conflicts – Latest Updates

Cryptocurrency values plummeted on Friday as escalating tensions in the Middle East prompted risk-averse panic selling across financial markets, with Bitcoin (BTC) declining by 5% over the past 24 hours to drop below $67,000, and Ether (ETH) falling 9% to around $3,200.

Israel is preparing for a potential counterstrike from Iran following the recent elimination of IRGC military leaders in Syria. Reports surfaced on Friday indicating that the US is deploying warships to position itself for Israel’s defense.

JUST IN: The United States has committed to DEFENDING ISRAEL in the event of an Iranian attack. Iran has warned that this will make the US a target. pic.twitter.com/Esn0bPXWFX

— Jackson Hinkle

(@jacksonhinklle) April 12, 2024

Since the Hamas attack on Israel on October 7th and Israel’s severe counteroffensive in Gaza, tensions in the Middle East have been heightened.

Growing concerns that the US and Iran could enter into direct conflict unsettled market sentiment on Friday.

The S&P 500 reached its lowest point in nearly a month, just above 5,100, declining by 1.4% for the day.

Cryptocurrency values fell on Friday as the S&P 500 retreated from recent peaks due to geopolitical worries / Source: TradingView

Cryptocurrency values fell on Friday as the S&P 500 retreated from recent peaks due to geopolitical worries / Source: TradingView

Safe-haven assets such as the US dollar and gold experienced significant gains. The DXY surged above 106 for the first time since last November, while gold briefly reached record highs exceeding $2,400.

Gold achieved new record highs as cryptocurrency values declined on Friday due to geopolitical issues / Source: TradingView

Gold achieved new record highs as cryptocurrency values declined on Friday due to geopolitical issues / Source: TradingView

Consequently, it is not surprising that cryptocurrency prices faced downward pressure, as many investors consider cryptocurrencies to be high beta risk assets.

Altcoins Bear the Brunt as Cryptocurrency Prices Dump

The sell-off in Bitcoin on Friday was relatively mild compared to the declines experienced by many major altcoins.

According to CoinMarketCap, cryptocurrencies such as Solana, XRP, Dogecoin, Toncoin, Cardano, and Avalanche all fell between 10-16% within 24 hours.

Dogwifhat, Bonk, and Arbitrum were among the poorest performers in the top 100 by market capitalization.

The carnage on Friday resulted in a 30% reduction in open interest for altcoin cryptocurrencies.

Altcoins lost approximately $6 billion in open interest.

30% decrease in total open interest.

Massacre.

— Zaheer (@SplitCapital) April 12, 2024

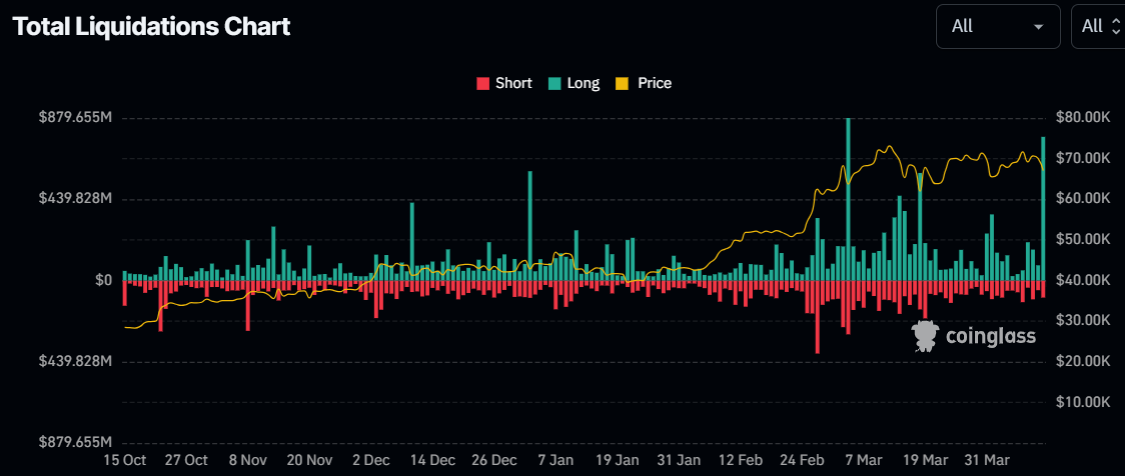

This followed the liquidation of $770 million in leveraged long crypto futures positions on Friday, according to data from coinglass.com.

Cryptocurrency values fell on Friday as leveraged long futures position liquidations surged / Source: coinglass.com

Cryptocurrency values fell on Friday as leveraged long futures position liquidations surged / Source: coinglass.com

Most of the aforementioned altcoins are down at least 25% from their recent peaks.

Some, including Arbitrum and Bonk, have seen declines exceeding 50% from their yearly highs.

In fact, the past few weeks had already been challenging for most alternative cryptocurrency prices, even before Friday’s sharp downturn.

After a strong conclusion to 2023 and a robust start to 2024, where many major altcoins recorded gains of 2-3x or more, alongside Bitcoin reaching new all-time highs, momentum has stalled, leading to profit-taking.

Concerns regarding potential turbulence related to a Bitcoin halving, diminishing Fed rate cut expectations, and geopolitical issues have introduced additional reasons for risk reduction.

Where Next For Cryptocurrency Prices?

It is still too early to definitively conclude that the recent decline in cryptocurrency prices has ended.

There remains significant potential for escalation between Iran and Israel.

The altcoin retreat offers a favorable opportunity for investors to enter at lower prices compared to a few weeks ago.

However, those considering entering the market now should be prepared for considerable volatility.

Alternatively, for those seeking to invest in a cryptocurrency with a lower risk of near-term 15% intra-day fluctuations, Bitcoin may be an option.

While Bitcoin has experienced a 5% drop in 24 hours due to risk-off flows, trading in the $67,000 range means BTC is only down 8% from the record highs of nearly $74,000 reached last month.

Furthermore, it remains well within recent trading ranges.

This may indicate that many perceive Bitcoin as a safe haven asset, similar to gold.

Its overall resilience in recent weeks could reflect a hesitance to sell ahead of the halving and amid ETF optimism.

Although a post-halving “sell-the-fact” reaction could drive Bitcoin back towards the $60,000s, its outlook remains positive.

Historically, halvings have often been followed by substantial price increases to new record levels within a few months.

Significant US deficit spending and global central bank easing suggest that macroeconomic factors will continue to provide support, even if the Fed is relatively slow to initiate rate cuts amid strong US economic data.

Lastly, institutional interest in spot Bitcoin ETFs has introduced a new, long-term source of buying pressure in the market.

A $100,000 Bitcoin later this year remains a possibility.

Bitcoin could retreat to $60,000 amid a widespread decline in cryptocurrency values / Source: TradingView

Bitcoin could retreat to $60,000 amid a widespread decline in cryptocurrency values / Source: TradingView

This indicates that, while the short-term outlook for altcoins may be volatile, traders should prepare for significant recoveries later this year.

The post Cryptocurrency Prices Dump As Middle Eastern Tensions Trigger Risk-off Panic – Here’s The Latest appeared first on Cryptonews.

(@jacksonhinklle) April 12, 2024

(@jacksonhinklle) April 12, 2024