Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Cryptocurrency Linked to Increase in Loan Defaults Among South Korean Youth

The number of young South Koreans involved in cryptocurrency trading who are defaulting on loans from neobanks is “soaring,” according to reports from media outlets on October 20.

Media “analysis” suggests this is “attributed to the significant number of neobank accounts associated with” cryptocurrency exchange wallets.

Is the Enthusiasm for Crypto Costing South Korean Youth?

This assertion follows the publication of data indicating an uptick in loan defaults among customers in their teens and twenties at K Bank.

The statistics reveal that 4.05% of K Bank clients under 30 have failed to meet their loan obligations.

K Bank is well-known for its partnership with the cryptocurrency exchange Upbit. The bank has recently experienced a substantial increase in accounts from younger individuals engaged in crypto trading in South Korea.

This trend has positioned the bank for an initial public offering (IPO), anticipated to be finalized by the end of this month.

The South Korean government announced on Thursday that it will implement regular mental health evaluations for individuals aged 20 to 34, starting next year as part of the national health examination initiative. https://t.co/FbjD67l4Yd

— The Korea Herald 코리아헤럴드 (@TheKoreaHerald) October 20, 2024

Several South Korean media sources, including Digital Daily, reported a rise in loan defaults at other neobanks as well.

This includes Kakao Bank, which formed a partnership with the Coinone cryptocurrency exchange in August 2022.

The information was obtained from the Financial Supervisory Service following a freedom of information request by lawmaker Kim Hyun-jung, a member of the National Assembly’s Political Affairs Committee.

Young borrowers who have not repaid their debts have left banks with losses amounting to approximately $288 million.

@Microsoft report indicates that the stolen cryptocurrency funds are reportedly financing over half of North Korea’s nuclear and missile initiatives. #Microsoft #NorthKorea #ThreatGroups https://t.co/rADBf4yMp1

— Cryptonews.com (@cryptonews) October 17, 2024

This reflects a fiat value increase of around 484% compared to figures from December 2021, as reported by Segye Ilbo.

It also signifies a 0.3% increase in cases since the conclusion of 2023. The reports highlighted that K Bank’s default rate was approximately double that of its neobank rivals.

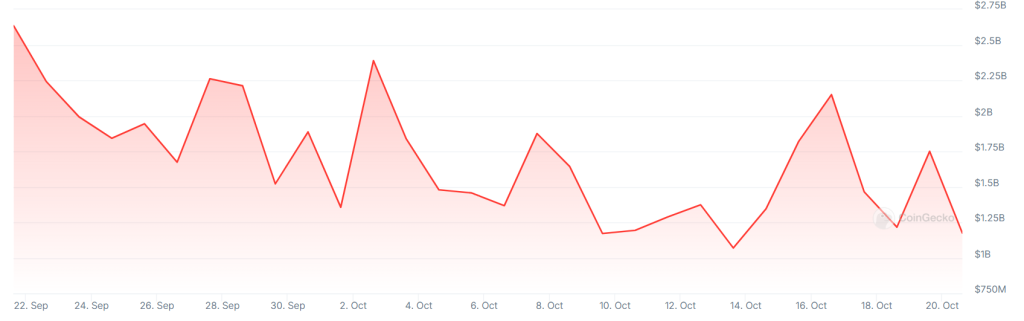

Trading volumes on the Upbit crypto exchange over the past month. (Source: CoinGecko)

Trading volumes on the Upbit crypto exchange over the past month. (Source: CoinGecko)

Lawmaker Advocates for Stricter Loan Assessment

<papproximately 2.1% of kakao bank clients aged 29 and under have defaulted on their loans, according to the data.

At Toss Bank, a neobank that currently does not collaborate with a domestic cryptocurrency exchange, the default rate was 1.75%.

South Korea is contemplating eliminating regulations that necessitate human involvement for algorithm-based trading of its currency. https://t.co/UbLkP2QvF8

— Bloomberg (@business) October 18, 2024

Financial sector “experts” informed media outlets that “individuals in their twenties with Upbit-linked accounts at K Bank” may have “borrowed funds for cryptocurrency investments” and subsequently “lost the capacity to repay their loans.”

Kim asserted that this situation demonstrated the need for neobanks to enhance their loan screening processes.

“The accessibility of loans from neobanks has some beneficial aspects. However, it can also facilitate young individuals in taking out loans beyond their financial capabilities. This can expose them to significant financial risks. We require measures to prevent young people from borrowing more than they can afford to repay.”

South Korean lawmaker Kim Hyun-jung

The post Crypto Blamed for Rise in South Korean Youth Loan Defaults appeared first on Cryptonews.