Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Cryptocurrency Exchange Stocks Drop 60% as Trading Activity Disappears – Is the Decline Concluded or Merely Starting?

In the past three months, the stocks of cryptocurrency exchanges have experienced a significant decline due to a drop in trading activity on centralized platforms, raising concerns about whether the sector is nearing the nadir of another downturn or merely entering its most difficult phase yet.

Shares of major exchange operators have decreased by 40-60% since October, as the market reflects a substantial decrease in spot trading volumes that has erased much of the remarkable gains achieved earlier last year.

Source: Newhedge

Source: Newhedge

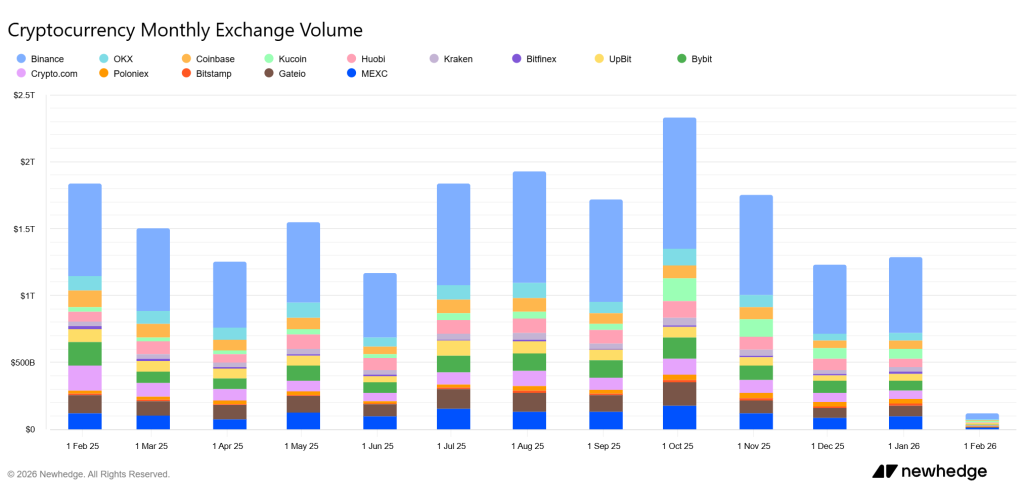

Data from Newhedge shows that centralized exchange spot trading volumes peaked in January 2025 and again in October, when total monthly activity surged to around $2.3 trillion.

Crypto Spot Volume Declines Nearly 90% From October High

In October, Binance executed nearly $1 trillion in transactions, accounting for over 40% of the total volume, before overall spot trading across exchanges dropped to approximately $1.7 trillion in November.

Trading continued to fall, hitting $1.2 trillion in December and plummeting to between $120-150 billion in January 2026, nearly 90% lower than in October.

Binance remained the largest exchange, reporting only $70 billion to $80 billion in trades, while most other exchanges recorded volumes in the single to low two-digit billions.

According to CoinGecko data, Binance maintained its lead in December with a 38.3% market share, but its spot trading volume decreased by over 40% month-on-month to $361.8 billion.

Other major platforms, including Bybit, MEXC, and others, also experienced double-digit declines.

Source: CoinGecko

Source: CoinGecko

While the total spot trading volume among the top 10 exchanges showed a slight increase on a yearly basis in 2025, the latter half of 2025 was marked by a clear slowdown, with several key platforms reporting annual declines.

This decline in trading activity has directly exerted pressure on exchange stocks.

Shares of Coinbase, Gemini, and Bullish have all lagged behind broader equity markets since October, experiencing sharper declines than Bitcoin itself, which has fallen about 35% from its peak.

Coinbase’s stock dropped 40.4% over the past six months to $189.62, closely following the reduction in exchange volume. Bullish also saw a significant drop, declining 56.7% over the same timeframe to $29.43.

Source: Google Finance

Source: Google Finance

Robinhood Markets has shown more resilience, with its shares down only 16.0% over six months to $89.37, significantly outperforming its crypto-native counterparts during this period.

After $19B Liquidation, Traders Retire and Volumes Dwindle

Market analysts suggest this trend is typical during crypto downturns.

As prices rise, trading volumes increase as investors pursue momentum, but when sentiment shifts, participation drops rapidly, exacerbating revenue declines for exchanges.

The latest downturn follows a historic liquidation event on October 10, when around $19 billion in positions were eliminated, reducing risk appetite among both retail and institutional traders.

Over 1.66 million crypto traders were liquidated as the market faced a sharp downturn, erasing $19.33 billion in positions.#Trump #Bitcoinhttps://t.co/7PNRagvFrx

— Cryptonews.com (@cryptonews) October 11, 2025

Conversely, this cycle has differed from previous crashes in several important ways.

There has been no exchange failure or wave of regulatory crackdowns as seen in past downturns.

Instead, the retreat is viewed as driven by exhaustion following a rapid rally, a tightening financial landscape, and broader risk-off behavior in global markets.

In January, Bitcoin declined by nearly 11%, marking the most significant drop in months since 2018, with investors shifting to perceived safer assets or exiting entirely.

Bitcoin spot ETFs see $817M outflow as $BTC crashes to $81,315, its nine-month low, influenced by Fed uncertainty, tech-sector weakness, and macro risks. #Bitcoin #ETFshttps://t.co/e157j5VJoV

— Cryptonews.com (@cryptonews) January 30, 2026

Historically, such drops in volumes have occurred after crypto winters following significant booms, such as the collapse of Mt. Gox in 2014, the burst of the ICO bubble in 2018, and the liquidity crisis of 2022.

Recoveries have generally taken years and have been driven by new structural catalysts rather than a quick resurgence of speculative enthusiasm.

The post Crypto Exchanges’ Stock Plunges 60% as Trading Volumes Vanish – Is the Crash Over or Just Beginning? appeared first on Cryptonews.

Over 1.66 million crypto traders were liquidated as the market faced a sharp downturn, erasing $19.33 billion in positions.#Trump #Bitcoinhttps://t.co/7PNRagvFrx

Over 1.66 million crypto traders were liquidated as the market faced a sharp downturn, erasing $19.33 billion in positions.#Trump #Bitcoinhttps://t.co/7PNRagvFrx