Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto Treasury’s ‘Easy Money’ Phase Concludes as Firms Engage in ‘Player vs Player’ Rivalry – Implications for Investors?

The corporate cryptocurrency treasury movement has reached a pivotal moment, evolving from a phase of assured premiums to what Coinbase Research describes as a “player-versus-player” competitive landscape.

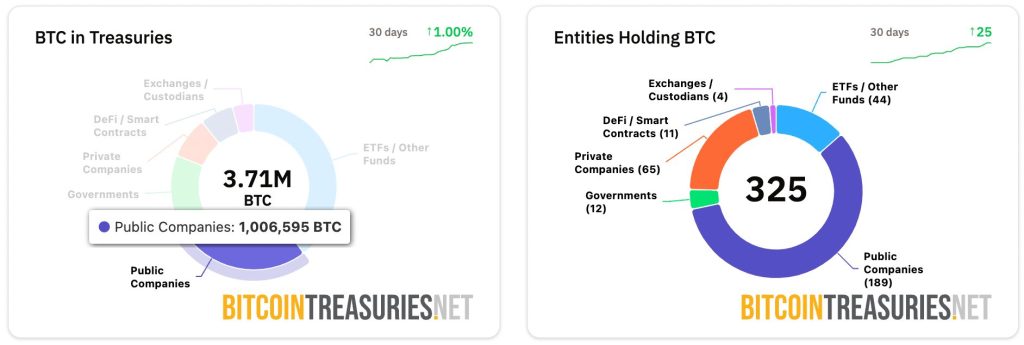

Publicly traded companies currently possess over 1 million Bitcoin valued at $110 billion, with digital asset treasuries managing $215 billion across 213 organizations.

Nevertheless, recent research cautions that the majority of participants may encounter significant challenges during unfavorable credit cycles.

Source: BitcoinTreasuries

Source: BitcoinTreasuries

Strategy Leads Corporate Crypto Movement Despite Mounting Pressures

MicroStrategy, now functioning as Strategy Inc, is at the forefront with 638,460 BTC after reporting $14.05 billion in unrealized gains during Q2 2025.

The firm’s bold accumulation approach has inspired numerous followers, but early adopters like Strategy have experienced significant premiums to net asset value that have since diminished due to competitive dynamics.

The shift commenced in 2020 when Michael Saylor’s Strategy pioneered the corporate Bitcoin treasury framework utilizing convertible bonds and equity raises.

Mining companies such as MARA Holdings followed suit with 52,477 BTC, while newcomers like Jack Mallers’ XXI gathered 43,514 BTC, and Japan’s Metaplanet aims for 210,000 BTC by 2027.

However, the landscape has fundamentally changed. Nasdaq has tightened oversight requirements for digital asset treasuries, necessitating shareholder approval for specific transactions.

Saylor’s Strategy Inc. reverses stock sale restrictions as Bitcoin premium erodes and purchasing slows down.#Bitcoin #Strategy #Saylorhttps://t.co/t2RZmD3n3I

— Cryptonews.com (@cryptonews) August 19, 2025

Strategy has lifted its self-imposed 2.5x market-to-net-asset-value limit for stock sales as funding pressures increased, while contending with multiple class-action lawsuits regarding its business practices.

Coinbase Research identifies this shift as moving beyond mere imitation of MicroStrategy strategies toward success that relies on execution.

The scarcity premium that favored early adopters has faded, compelling companies to distinguish themselves through strategic positioning rather than just accumulating Bitcoin.

Corporate Treasuries Face Structural Vulnerabilities in Rising Rate Environment

Earlier last month, Sentora research highlighted significant weaknesses in corporate Bitcoin strategies, cautioning that “idle Bitcoin on a corporate balance sheet is not a scalable strategy in a rising-rate world.”

Most Bitcoin treasury firms operate as either unprofitable entities or depend heavily on mark-to-market gains for their financial viability.

This strategy resembles historical wealth accumulation through leveraged acquisition of scarce assets but lacks Bitcoin’s transition from digital property to yield-generating capital.

In contrast to real estate, which produces rental income, Bitcoin treasury firms engage in negative-carry trades, borrowing fiat currency to acquire non-yielding assets without sufficient risk management strategies.

Strategy employs $3.7 billion in ultra-low coupon convertible bonds and $5.5 billion in perpetual preferred shares to fund acquisitions.

Similarly, Metaplanet continues its aggressive accumulation, doubling its Bitcoin holdings every 60 days while utilizing zero-interest convertible bonds valued at ¥270.36 billion.

Metaplanet finalizes $1.45B share sale to fund Bitcoin purchases, holdings hit $2.25B with 20,136 $BTC as sixth-largest corporate holder.#Bitcoin #Metaplanethttps://t.co/Q2Pgfgpsn7

— Cryptonews.com (@cryptonews) September 10, 2025

The company recently completed its $1.45 billion stock sale to support substantial Bitcoin acquisitions, issuing 385 million shares with settlement set for September 16.

Increasing interest rates exacerbate negative carry effects, while stagnation in Bitcoin prices over 2-3 years could diminish confidence and render equity issuance dilutive.

Market Saturation and Regulatory Scrutiny Challenge New Entrants

Glassnode analyst James Check has previously expressed concerns regarding the sustainability of the strategy, asserting that easy gains have disappeared for new entrants as markets mature.

BitcoinTreasuries data indicates that new entities are consistently adding BTC holdings at scale each month, but investors increasingly anticipate clear differentiation beyond basic Bitcoin accumulation.

Crypto analyst Ran Neuner suggested that many treasury firms function as exit vehicles for insiders rather than authentic market participants.

Companies frequently receive crypto contributions from existing holders in exchange for shares that later trade at significant premiums, enabling early contributors to cash out while retail investors pay 2-4x net asset value.

The Financial Times reported in August that 154 US-listed companies raised $98.4 billion for crypto acquisitions in 2025, a substantial increase from the $33.6 billion raised by 10 companies previously.

Just this month, forward Industries secured $1.65 billion for Solana-based treasuries backed by Galaxy Digital and Jump Crypto, while corporate Ethereum holdings reached $28 billion across various entities.

Source: Coinbase Research

Source: Coinbase Research

Despite being the leading firm, Strategy was recently denied inclusion in the S&P 500, despite meeting technical criteria, with the index committee voicing concerns regarding Bitcoin-heavy business models and high volatility risks.

The broader movement faces warnings that participants may not endure credit cycles due to structural vulnerabilities in environments with rising interest rates.

However, Coinbase Research maintains a positive outlook for large-cap crypto entities that benefit from ongoing DEX capital flows.

Coinbase Research contends that heightened competition compels companies to move beyond simple imitation of MicroStrategy, potentially fostering more strategic capital allocation and sustained buying pressure as firms vie for investor interest.

The post Crypto Treasury ‘Easy Money’ Era Ends as Companies Enter ‘Player vs Player’ Competition – Good for Investors? appeared first on Cryptonews.

Saylor’s Strategy Inc. reverses stock sale restrictions as Bitcoin premium erodes and purchasing slows down.#Bitcoin #Strategy #Saylorhttps://t.co/t2RZmD3n3I

Saylor’s Strategy Inc. reverses stock sale restrictions as Bitcoin premium erodes and purchasing slows down.#Bitcoin #Strategy #Saylorhttps://t.co/t2RZmD3n3I