Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto Sees Significant Progress in User Expansion, Stablecoin Utilization, and DeFi, According to a16z Crypto Report

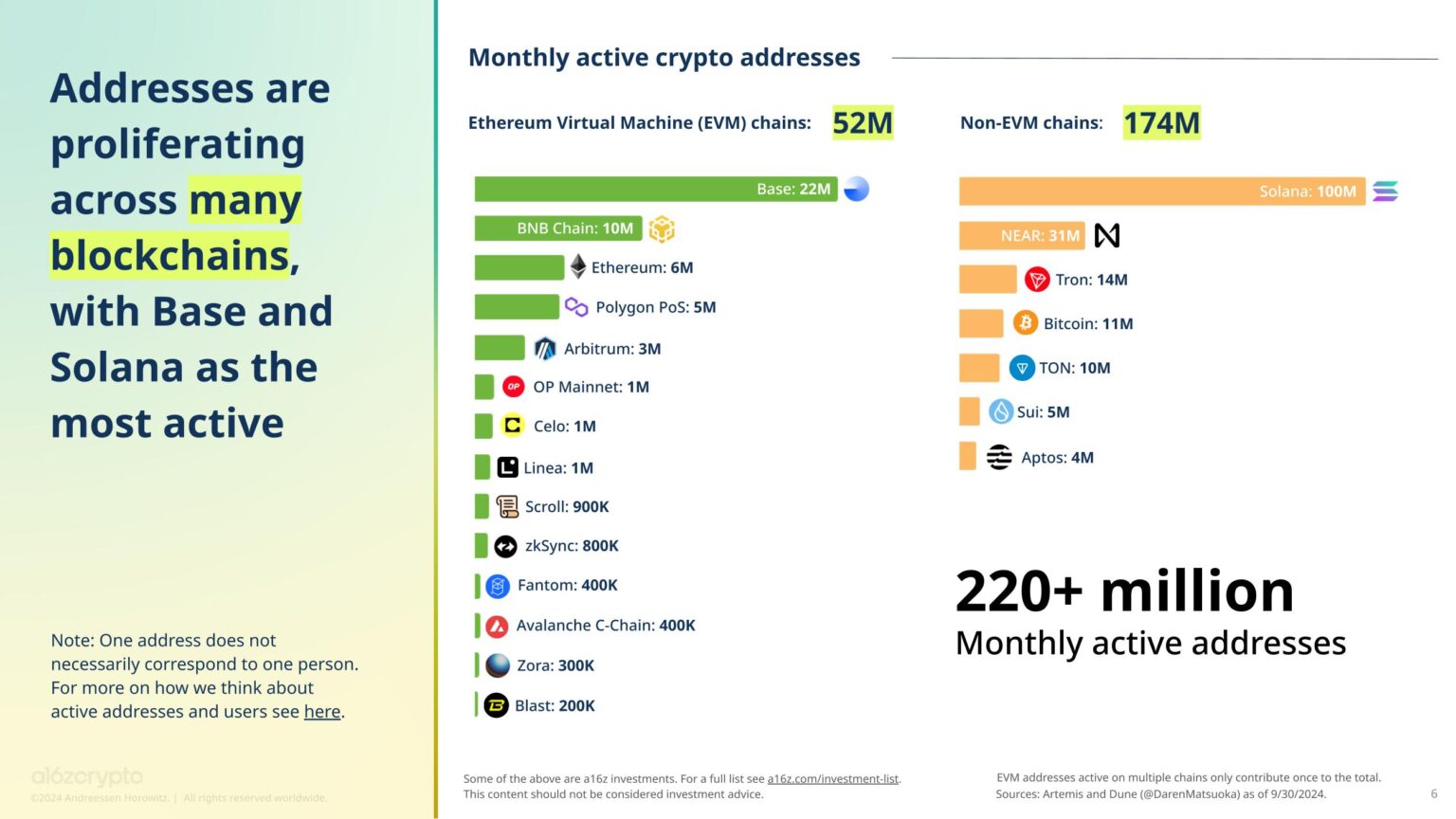

Cryptocurrency engagement is at an unprecedented level, with the count of monthly active addresses tripling since late 2023, as indicated in the latest State of Crypto Report 2024 released by a16z, a venture capital firm focused on Web3.

The report highlights a surge in the crypto sector, with active crypto addresses reaching 220 million by September 2024.

A closer examination shows that Solana (SOL) is the main contributor to this increase, representing approximately half of the active addresses reported (100 million). This indicates a shift in user preferences, as newer, faster blockchains are gaining popularity alongside established networks like Bitcoin (BTC), which has 11 million active addresses. Ethereum (ETH), the leading blockchain for decentralized applications (DApps), currently has 6 million active addresses.

Monthly active addresses across various chains. Source: State of Crypto Report 2024

Monthly active addresses across various chains. Source: State of Crypto Report 2024

Usage of mobile crypto wallets is also on the rise, reaching an all-time high of 29 million users in June 2024. While the United States (U.S.) continues to have the largest proportion of mobile wallet users (12%), its lead is diminishing. This trend illustrates the worldwide expansion of crypto adoption, with countries such as Nigeria, India, and Argentina witnessing notable growth.

Nevertheless, the report estimates that there are between 30-60 million active crypto users globally. This accounts for only 5-10% of the estimated 617 million crypto owners worldwide.

Policymakers Embrace Crypto

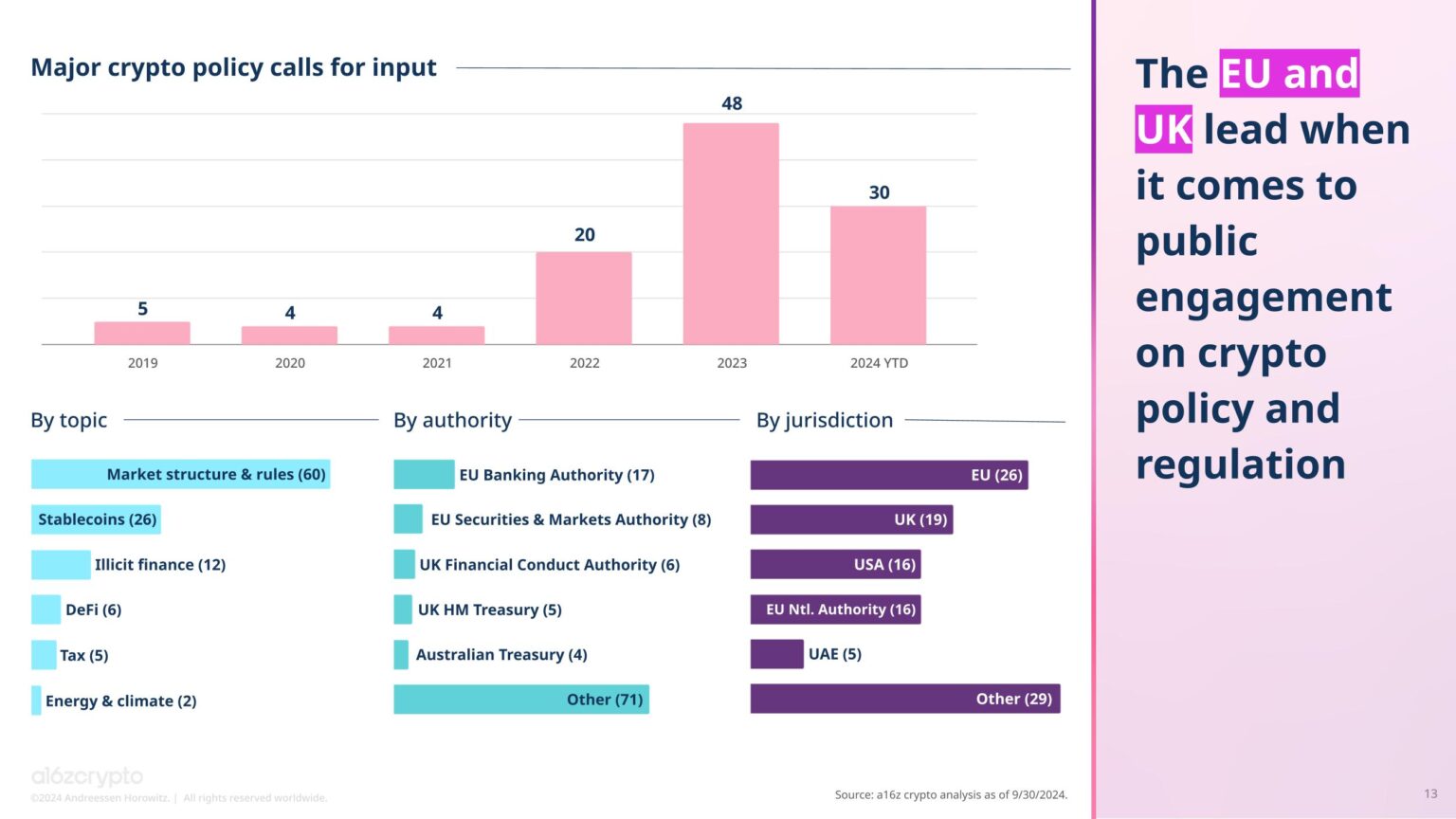

Cryptocurrency has also gained considerable political traction, with policymakers and politicians increasingly engaging in discussions and endorsing its potential advantages.

The introduction of Bitcoin and Ether exchange-traded funds (ETFs) was a significant milestone, according to the report, indicating a rise in institutional acceptance.

The European Union (E.U.) and the United Kingdom (U.K.) have adopted a more proactive stance in involving the public and shaping crypto policy compared to the U.S. Various European agencies have made numerous requests for feedback on crypto-related regulations (such as the Markets in Crypto Assets (MiCA)), far surpassing the initiatives of the U.S. Securities and Exchange Commission (SEC).

The EU and UK have been more proactive in shaping crypto policy. Source: State of Crypto Report 2024

The EU and UK have been more proactive in shaping crypto policy. Source: State of Crypto Report 2024

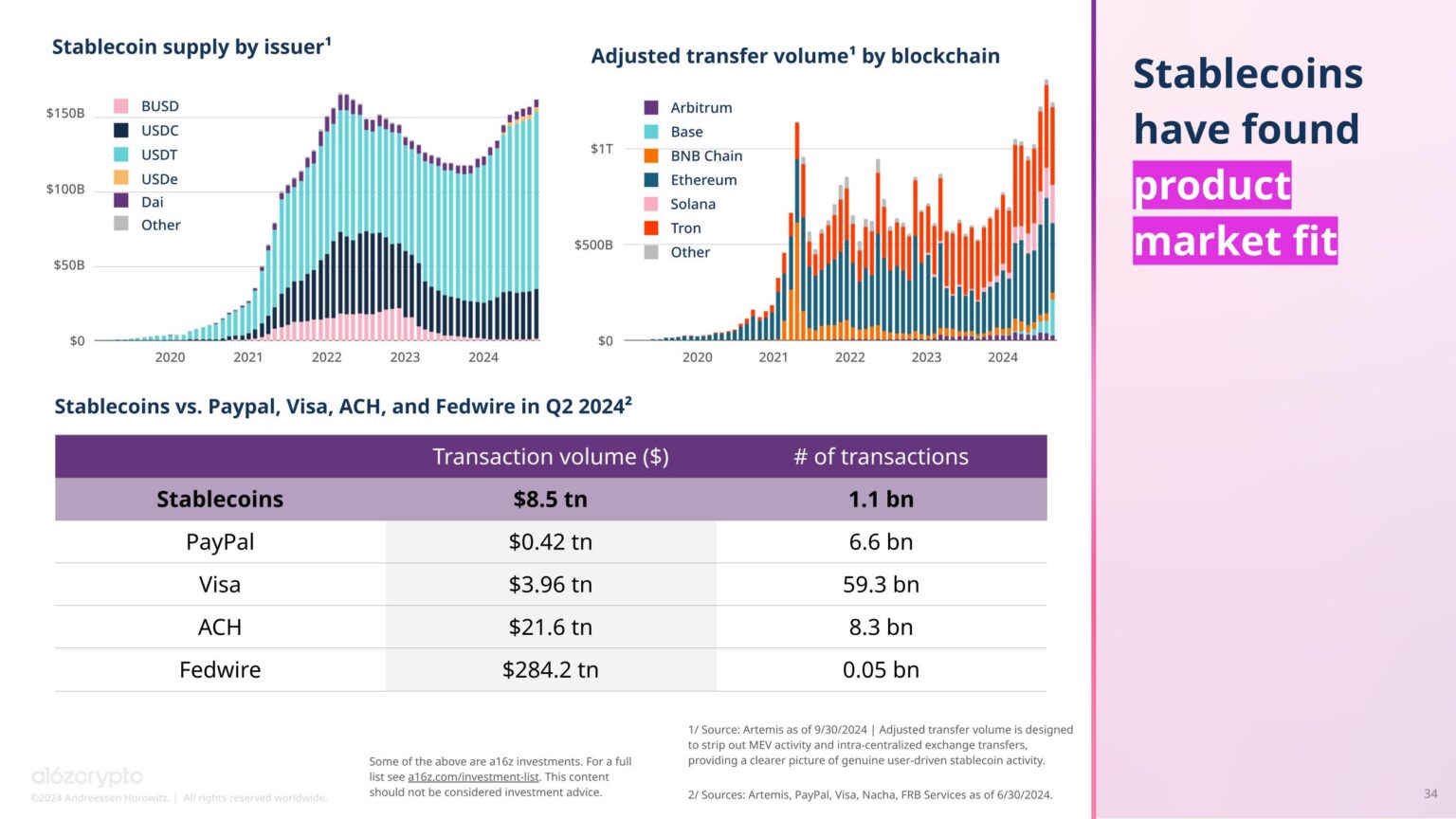

Stablecoins have emerged as a significant instrument for global transactions. In Q2 2024, the transaction volume of stablecoins exceeded that of Visa ($8.5 trillion compared to Visa’s $3.9 trillion), highlighting their increasing utility and acceptance.

Moreover, stablecoins are becoming a central topic in policy discussions, especially in the U.S. One motivating factor is the acknowledgment that stablecoins can enhance the global standing of the U.S. dollar, particularly as its dominance as a reserve currency diminishes.

Stablecoins surpassed Visa in transaction volume in Q2 2024. Source: State of Crypto Report 2024

Stablecoins surpassed Visa in transaction volume in Q2 2024. Source: State of Crypto Report 2024

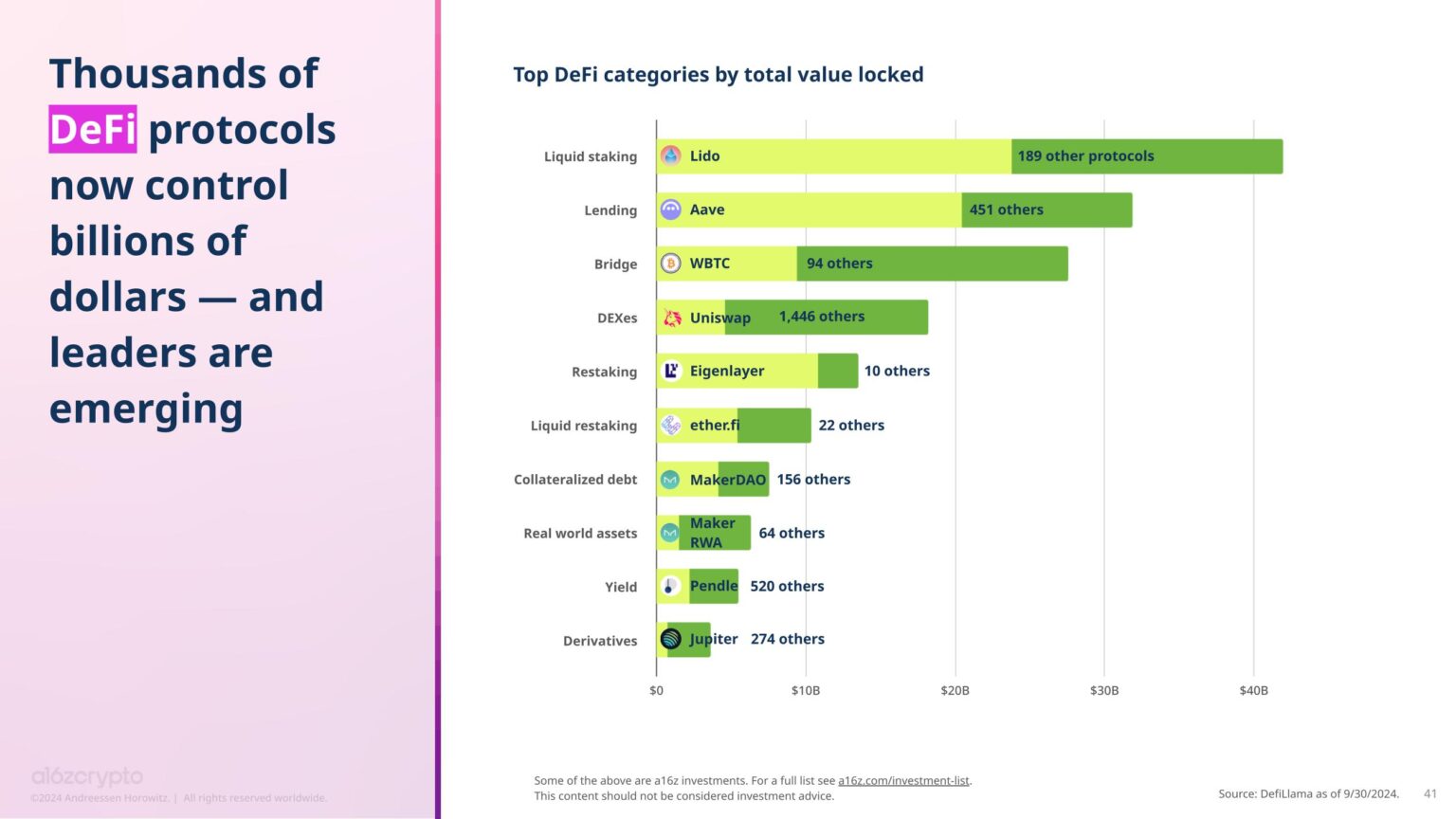

DeFi’s Continued Growth

Decentralized finance (DeFi) continues to be a prominent category within the crypto space, attracting more developers than blockchain infrastructure and accounting for the highest daily usage of cryptocurrencies. Since its inception in 2020, decentralized exchanges (DEXs) have expanded significantly, capturing 10% of spot crypto trading activity, a market that was previously dominated by centralized exchanges (CEXs).

The report also indicates that over $169 billion is currently locked in various DeFi protocols, with staking and lending being among the most favored subcategories.

Top DeFi categories by TVL. Source: State of Crypto Report 2024

Top DeFi categories by TVL. Source: State of Crypto Report 2024

Ethereum’s shift to proof-of-stake (PoS) in 2022 represented a crucial advancement in reducing the network’s energy consumption. Since that time, the proportion of staked Ether has risen to 29%, thereby enhancing network security.

The authors of the report conclude that DeFi presents a potential remedy to the increasing centralization and consolidation of power within the traditional financial system:

“While still in its early stages, DeFi presents a hopeful alternative to the trend of centralization and power consolidation afflicting the U.S. financial system, where the number of banks has dropped by two-thirds since 1990 and where an increasingly small share of big banks dominate assets.”

The post Crypto Makes Big Strides in User Growth, Stablecoin Adoption, and DeFi: a16z Crypto Report appeared first on Cryptonews.