Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto Sector Lodges Complaint Against Australia’s ABC Regarding Bitcoin Piece

The Australian Bitcoin Industry Body has submitted an official complaint to the Australian Broadcasting Corporation, citing what it deems “factually incorrect and deceptive” reporting on Bitcoin, heightening friction between the nation’s expanding crypto industry and conventional media.

The complaint focuses on an ABC article that depicted Bitcoin mainly as a tool for money laundering, neglecting documented applications in energy stabilization, humanitarian remittances, and sovereign reserves.

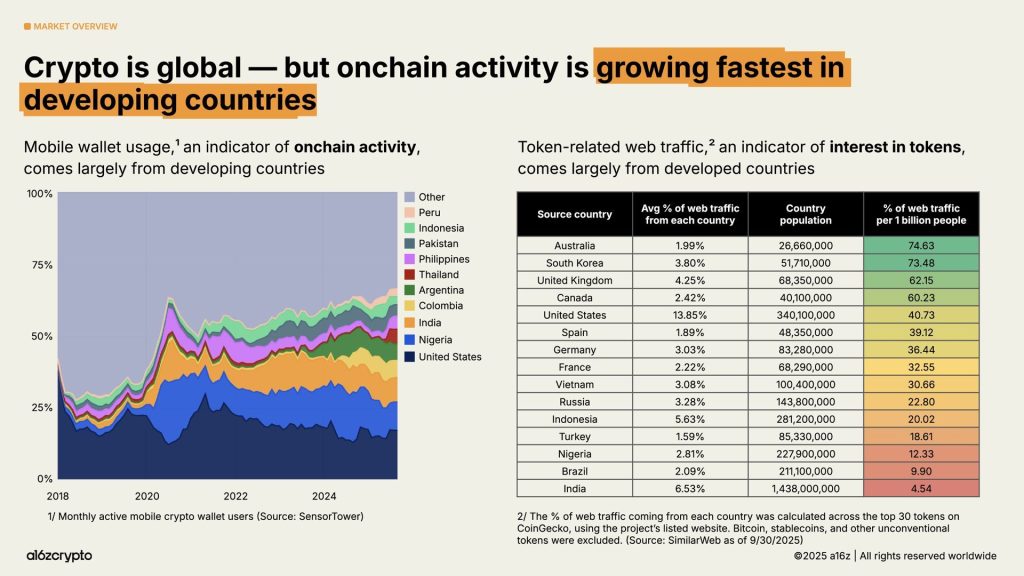

This action comes as Australia’s rate of crypto adoption surpassed that of the US, reaching 31% in 2025, up from 28% in 2024, positioning the country among the globe’s most crypto-engaged populations according to a16z’s State of Crypto 2025 report.

Source: a16z

Source: a16z

ABIB reported receiving regular communications from exasperated members about the persistent misrepresentation of Bitcoin in Australian media, particularly from public institutions mandated by law to deliver accurate journalism.

Industry Body Points Out Multiple Policy Violations

ABIB’s submission outlines specific statements that it claims violate the broadcaster’s editorial guidelines and code of conduct.

The complaint focuses on a biased portrayal that equates Bitcoin with illegal activities while disregarding publicly accessible information related to legitimate uses.

The ABC article, authored by chief business correspondent Ian Verrender, characterized Bitcoin as having “no beneficial purpose” and labeled money laundering as its “final useful business.”

The article concentrated on Bitcoin’s price fluctuations, which fell from $126,000 to below $90,000, while highlighting the cryptocurrency’s purported shortcomings.

ABIB contended that the reporting reduced Bitcoin to outdated clichés centered on price volatility and U.S. politics, urging ABC to make corrections and involve subject-matter experts in future coverage.

The Australian Bitcoin Industry Body (ABIB) has filed a formal complaint with the Australian Broadcasting Corporation (@abcnews) concerning its recent article on Bitcoin.

The article included numerous factual inaccuracies, misleading assertions, and biased framing that violate the ABC’s…— Australian Bitcoin Industry Body (@AusBTCIndBody) December 2, 2025

Complaint Emerges Amid Regulatory Change

The conflict arises during a period of significant regulatory transformation in Australia’s digital asset landscape.

In November, Treasurer Jim Chalmers and Financial Services Minister Daniel Mulino presented the Corporations Amendment (Digital Assets Framework) Bill 2025, which establishes the country’s first all-encompassing regulatory framework for companies managing crypto on behalf of clients.

The ministers stated they “take Australia’s crypto sector seriously,” noting that blockchain and digital assets offer “great opportunities for our economy, our financial sector, and our enterprises.”

The government’s reforms could unleash $24 billion in yearly productivity enhancements while bolstering protections for Australians entrusting their digital assets to private platforms.

Australia has launched its first complete regulatory framework for crypto custody and exchange platforms, promising stricter oversight.#Australia #Cryptohttps://t.co/jzYWZ9Vk6I

— Cryptonews.com (@cryptonews) November 27, 2025

According to the bill, crypto exchanges and custody providers are required to obtain an Australian Financial Services License, placing them under ASIC oversight.

The framework introduces two new license categories: a digital asset platform and a tokenized custody platform, with licensed entities obligated to adhere to ASIC standards for transactions, settlement processes, and asset custody.

Regulators Aim to Balance Innovation with Safety

ASIC has also clarified digital asset regulations while promoting industry advancement.

In October, the regulator classified stablecoins, wrapped tokens, tokenized securities, and digital asset wallets as financial products under existing legislation, mandating service providers to secure licenses while offering an eight-month transition phase through June 30, 2026.

ASIC Commissioner Alan Kirkland stated, “Distributed ledger technology and tokenization are transforming global finance,” and that the guidance offers regulatory clarity, allowing firms to innovate with confidence.

Moreover, ASIC Chair Joe Longo cautioned that Australia risks lagging behind as blockchain-driven tokenization reshapes international markets, warning that if Australia does not adapt, it could become a “land of missed opportunities.”

He mentioned that J.P. Morgan informed him their money market funds will be entirely tokenized within two years.

Australia must “seize the opportunity or be left behind” as tokenization alters capital markets, warns @ASIC_Connect Chair Joe Longo.#Australia #Tokenization #ASIChttps://t.co/gbJI1uAzb6

— Cryptonews.com (@cryptonews) November 7, 2025

Australia’s institutional engagement with crypto has surged noticeably, with self-managed superannuation funds representing a quarter of the pension system and crypto exposure skyrocketing sevenfold since 2021 to A$1.7 billion.

This increasing adoption has attracted major players, with Coinbase set to introduce a dedicated SMSF service that has over 500 investors on its waiting list, targeting the nation’s pension pool, while OKX launched a similar offering in June that surpassed expectations.

The regulatory framework allows for an 18-month grace period before licensing requirements become effective.

Small operators with less than A$10 million in annual transaction volume will be exempt.

For those who might violate the regulations, prior legislation has suggested penalties of up to 10% of annual turnover for platforms breaching rules, with firms facing fines of A$16.5 million, three times the benefit gained, or 10% of annual turnover for misleading conduct.

The post Crypto Industry Files Complaint Against Australia’s ABC Over Bitcoin Article appeared first on Cryptonews.

Australia has launched its first complete regulatory framework for crypto custody and exchange platforms, promising stricter oversight.#Australia #Cryptohttps://t.co/jzYWZ9Vk6I

Australia has launched its first complete regulatory framework for crypto custody and exchange platforms, promising stricter oversight.#Australia #Cryptohttps://t.co/jzYWZ9Vk6I