Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto Fraudsters Employ AI and Expert Networks to Generate Billions – Chainalysis Analysis

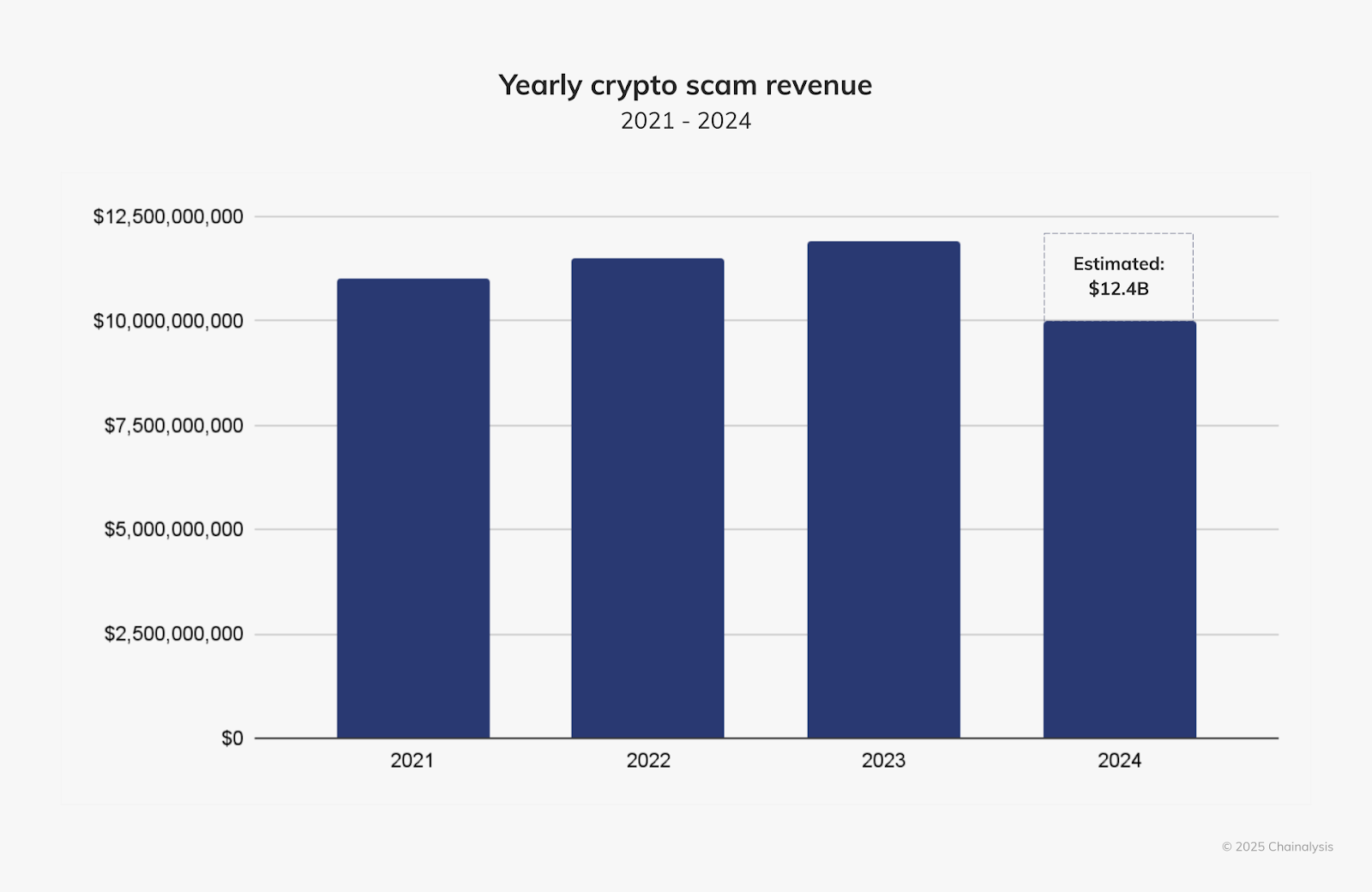

In 2024, cryptocurrency scammers deceived victims out of at least $9.9 billion, representing one of the most significant financial crimes of the year.

Although this figure indicates a 29% decrease from the record $14 billion stolen in 2021, experts caution that the final total could surpass $12 billion as additional fraudulent activities are uncovered.

These insights are derived from a report published on February 13 by blockchain data and analytics firm Chainalysis, which details how criminals have adopted advanced technologies such as artificial intelligence (AI) and utilized organized scam networks to enhance their operations.

Cryptocurrency fraud revenue from 2021 to 2024. Source: Chainalysis

Cryptocurrency fraud revenue from 2021 to 2024. Source: Chainalysis

Surge in Pig Butchering Scams Amid Decline in Investment Scams

A particularly concerning trend this year was the significant increase in “pig butchering” scams, which rose by nearly 40% year-on-year (YoY) and constituted over 33% of total scam revenue.

These scams involve fraudsters creating false relationships with victims to defraud them gradually and have become more prevalent. Initially focused in large scam hubs in Southeast Asia, these operations have now spread to other regions, including Nigeria and Namibia.

Conversely, high-yield investment scams (HYIS) made up over 50% of total cryptocurrency scam revenue.

However, inflows from HYIS decreased by nearly 37% YoY. A notable case is Good Business Corp, a Ponzi scheme targeting Spanish-speaking investors, which generated approximately $1.5 billion in cryptocurrency transactions despite repeated regulatory warnings.

HYIS accounted for over 50% of total crypto scam revenue in 2024. Source: Chainalysis

HYIS accounted for over 50% of total crypto scam revenue in 2024. Source: Chainalysis

Crypto ATMs have also emerged as a favored tool for scammers, particularly in targeting elderly individuals.

According to the report, losses from crypto ATM-related scams in the US exceeded $65 million in the first half of 2024, with an average individual loss of $10,000.

Huione Assure: A Center for Money Laundering and Fraud

A significant facilitator of contemporary scam operations is Huione Assure, a peer-to-peer (P2P) marketplace linked to a Cambodian conglomerate.

Huione has become a center for fraudulent activities, enabling money laundering, AI-driven fraud tools, and other illicit services.

As per Chainalysis, Huione processed approximately $70 billion in cryptocurrency transactions, with around $375.9 million directly associated with vendors providing scam-enabling technology.

Crypto Scammers Leverage AI: From Fake Identities to Exploiting Job Seekers

The rapid advancement of AI has equipped scammers with powerful new tools to carry out increasingly sophisticated schemes.

AI-generated fake identities, deepfake videos, and cloned websites make scams harder to detect. Fraudsters openly market AI “face-changing” software on platforms like Huione Assure, facilitating evasion of law enforcement.

Scammers have also diversified their tactics beyond traditional long-term frauds.

Emerging schemes, such as employment scams, have seen a notable rise, according to the report. These scams deceive job seekers into completing fake tasks and demand upfront payments for “fees.”

While these scams yield smaller individual payouts, the large number of victims makes them highly profitable. In 2024, deposits to pig butchering scams surged by 210%, indicating an expansion in the victim pool, even as the average deposit per victim fell by 55% YoY.

Regulatory Responses

The alarming increase in crypto-related fraud has prompted regulatory actions globally.

In the US, the Senate Judiciary Committee in September 2024 urged major crypto ATM operators to adopt stronger fraud prevention measures.

States like California and Arizona have enacted legislation imposing daily transaction limits and requiring crypto ATM providers to register as money transmitters.

In Europe, regulators under the Markets in Crypto-Assets (MiCA) regulation have cracked down on unregistered crypto ATMs, citing their role in money laundering.

Some European countries took proactive measures before MiCA came into effect. In August 2024, Germany’s Federal Financial Supervisory Authority (BaFin) confiscated 13 crypto ATMs from 35 locations.

APAC nations, including Singapore and Australia, have also implemented stringent regulatory measures to prevent misuse.

The post Crypto Scammers Use AI and Organized Networks to Generate Billions – Chainalysis Report appeared first on Cryptonews.