Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto Exchange Trading Activity Decreases in April as Bitcoin Pulls Back from All-Time High

In April, trading volume across prominent cryptocurrency exchanges saw a notable decrease, coinciding with Bitcoin’s pullback from its peak value.

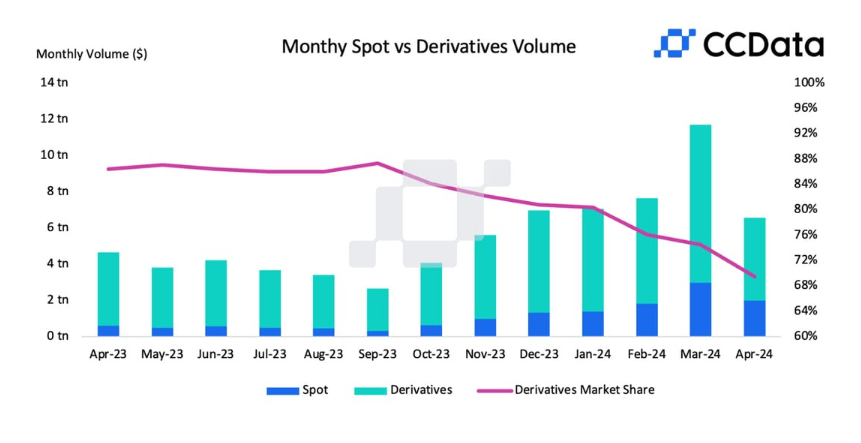

According to research firm CCData, spot trading volume on centralized exchanges such as Coinbase Global, Binance, and Kraken fell by 32.6% to $2 trillion last month.

Moreover, derivatives trading volume experienced its first decline in seven months, dropping by 26.1% to $4.57 trillion.

Trading Volume Reductions Linked to Tightening Financial Conditions

The increase in trading volume observed earlier this year, following the launch of U.S. exchange-traded funds that invest in Bitcoin, diminished due to the tightening financial conditions in the United States.

The Federal Reserve’s actions to tackle ongoing inflation issues played a role in this transition.

Leading up to the April 19 Bitcoin halving event, which halved the issuance of new coins, there was market anticipation and enthusiasm.

Jacob Joseph, a research analyst at CCData, informed Bloomberg that the drop in trading activity on centralized exchanges post-Bitcoin halving corresponds with trends seen in earlier cycles.

He further noted that the release of higher-than-expected Consumer Price Index (CPI) inflation figures and rising geopolitical tensions in the Middle East introduced uncertainty and apprehension into the market.

These elements, along with negative net flows from spot Bitcoin ETFs, resulted in significant crypto assets hitting their range lows.

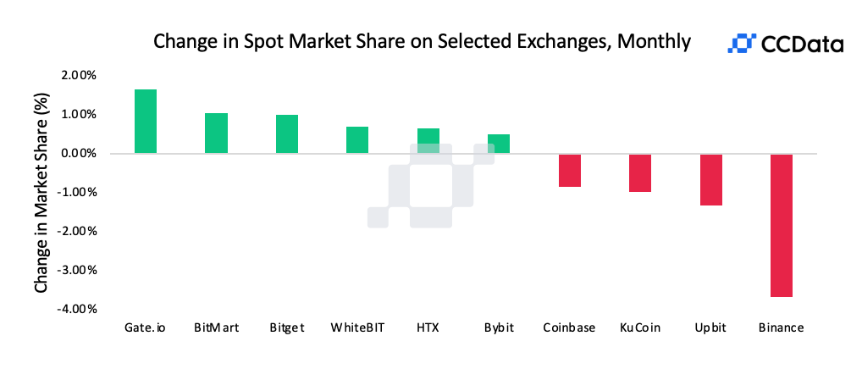

The reduction in trading volumes also impacted Binance’s spot market share, the largest crypto exchange globally.

For the first time since September 2023, Binance’s spot market share declined by nearly 4% to 33.8%, marking its lowest point since January, as per CCData.

The CME Group, a leading derivatives marketplace, also recorded a drop in crypto trading volume for the first time in seven months.

In April, its derivatives trading volume fell by almost 20% to $124 billion, according to CCData.

Despite the downturn, Jacob Joseph indicated that trading activity on centralized exchanges, while slower than its peak in March, remains elevated compared to prior months.

CEX Trading Volume Triples in 2024

Centralized cryptocurrency exchanges (CEXs) such as Binance experienced a substantial increase in trading volumes from October 2023 to March 2024, as detailed in Bybit’s 2024 Institutional Industry Report released on April 18.

Notably, OKX recorded a 278% rise in 30-day volumes since October, closely followed by Binance, which saw a 239% increase.

Bybit exchange also showed remarkable growth, adding 264% to its trading volumes during the same timeframe.

A spokesperson for Bybit confirmed that these exchanges have surpassed the industry’s average growth rate of 255%.

The U.S.-based exchange Coinbase also experienced growth, though slightly lagging with a 193% rise in trading volume.

However, the growth of CEXs has not outpaced the even faster expansion of decentralized exchanges (DEXs).

For example, leading DEX Uniswap v3 saw a 320% increase in volumes during the same period, as indicated in Bybit’s data.

Uniswap has exceeded $2 trillion in total trading volume.

The post Crypto Exchange Trading Volume Declines in April as Bitcoin Retreats from Record High appeared first on Cryptonews.