Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto ETFs Experience Initial Monthly Withdrawals of 2025 as Holdings Decline from September Highs: ETFGI

Global crypto exchange-traded funds (ETFs) and exchange-traded products (ETPs) experienced net outflows of $2.95 billion in November, marking the first month of net withdrawals in 2025, as reported by ETFGI.

Despite this monthly decline, the sector is still significantly larger compared to a year prior. At the end of November, total assets in global crypto ETFs reached $179.16 billion, indicating a 17.8% increase year-to-date from $152.10 billion at the close of 2024.

Crypto ETFs listed globally experienced net outflows of US$2.95 Bn in November, @etfgi https://t.co/TyXvIqjrN9 #Register your interest for our 2026 events at https://t.co/ZYBgBU4o5I pic.twitter.com/zAJ3wgcxUw

— ETFGI (@etfgi) December 31, 2025

Assets Retreat From Record Levels

The outflows in November followed a significant decline from September’s peak asset level of $229.53 billion as crypto markets cooled and investors took profits after a robust performance earlier in the year.

ETFGI highlights that increased volatility across digital asset markets impacted investor sentiment throughout the month. Year-to-date net inflows amount to $47.87 billion, making 2025 the second-strongest year on record for crypto ETF flows.

Only 2024, which recorded $72.08 billion in net inflows, had a higher annual total, while 2021 ranked third with $9.02 billion.

Bitcoin and Ethereum Lead Monthly Withdrawals

Products linked to Bitcoin and Ethereum accounted for the majority of November’s outflows. Bitcoin-focused ETFs and ETPs, which dominate the market, saw $2.36 billion in net outflows during the month, while Ethereum products experienced $1.36 billion in withdrawals.

By the end of November, Bitcoin-related products represented $142.46 billion in assets across 127 offerings, while Ethereum ETFs and ETPs held $25.05 billion across 62 offerings.

Despite the decline in November, ETFGI reports that Bitcoin and Ethereum continue to lead year-to-date inflows, attracting $26.26 billion and $12.89 billion, respectively.

ETFGI data indicates that the global crypto ETF market remains highly concentrated. iShares is the largest provider with $83.15 billion in assets, accounting for 46.4% market share, followed by Grayscale Advisors with $25.49 billion (14.2%) and Fidelity International with $21.86 billion (12.2%). Collectively, the top three providers represent 72.8% of global crypto ETF assets, out of a total of 75 issuers.

Smaller Tokens Gain Limited Attention

While Bitcoin and Ethereum remain dominant, smaller crypto themes are gradually gaining traction. Solana-linked products held $1.38 billion in assets across nine offerings with $0.90 billion in year-to-date inflows.

Products associated with Cardano and Polkadot remain niche, each holding significantly less than $100 million in assets, although both recorded modest positive flows in November.

Selected Products Defy the Trend

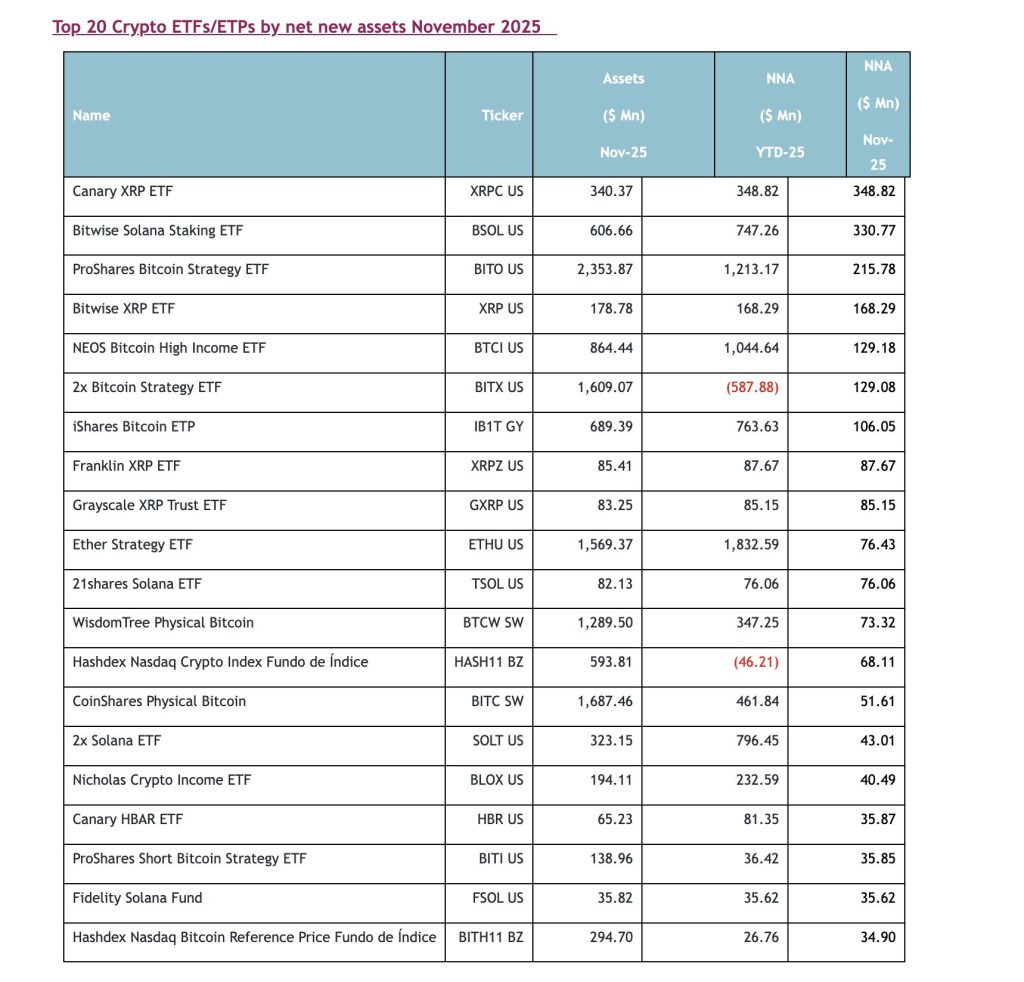

Notably, the top 20 crypto ETFs and ETPs by net new assets collectively attracted $2.17 billion in November, countering the broader market outflows.

The Canary XRP ETF led individual inflows, securing $348.82 million, demonstrating ongoing investor interest in selective crypto exposures even amid wider withdrawals.

Overall, ETFGI stated that the data from November highlights a maturing crypto ETF market where periods of consolidation follow rapid growth rather than indicate a structural retreat from digital assets.

Sudden Turnaround: Spot Bitcoin ETFs Attract $355M

U.S. spot Bitcoin ETFs experienced a notable turnaround on December 30, drawing in $355 million in net inflows and ending a seven-day period of consistent capital withdrawals.

This shift marked the strongest daily inflow since mid-December and occurred after nearly two weeks during which ETF investors consistently reduced their exposure as prices softened and year-end liquidity diminished.

Sosovalue data indicates that the rebound was primarily driven by BlackRock’s iShares Bitcoin Trust, which attracted $143.75 million in new capital on that day.

The post Crypto ETFs Post First Monthly Outflows of 2025 as Assets Retreat From September Peak: ETFGI appeared first on Cryptonews.