Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto ETF Sector Experiences Withdrawal Challenges, Fidelity Ethereum ETF Sees Highest Outflow

The cryptocurrency ETF sector experienced another setback, with a total of over $290 million in outflows from U.S. spot Bitcoin (BTC) and Ethereum (ETH) ETFs on October 1, 2024.

This decline occurs amidst rising geopolitical tensions in the Middle East, which have resulted in significant drops in the prices of both Bitcoin and Ethereum.

Data from SoSoValue indicates that the majority of the outflows were from Bitcoin ETFs, which experienced withdrawals totaling $242.53 million, while Ethereum ETFs saw outflows of $48.52 million.

Crypto ETF Outflows: Bitcoin ETF Challenges

Bitcoin ETFs encountered considerable outflow pressure, with more than $240 million withdrawn from various prominent funds.

Source: Farside

Source: Farside

Fidelity’s Wise Origin Bitcoin Fund (FBTC) was at the forefront of these exits, experiencing net outflows of $144.67 million, marking its most significant loss day in recent times.

This contrasts sharply with the previous week, during which Bitcoin ETFs had garnered over $1 billion in net inflows.

The ARK 21Shares Bitcoin ETF (ARKB) closely followed, with a reduction of $84.35 million.

BingX and VanEck’s Bitcoin ETF (HODL) also reported notable outflows of $32.7 million and $15.75 million, respectively.

In contrast, Grayscale’s Bitcoin Trust (GBTC) noted a more modest outflow of $5.9 million.

Notably, the only Bitcoin ETF to record positive net inflows was BlackRock’s iShares Bitcoin Trust (IBIT), which attracted $40.84 million on that day, making it the top-performing BTC ETF in the market, with cumulative net inflows exceeding $21.54 billion.

The abrupt change in investor sentiment coincided with a sharp drop in Bitcoin prices, which fell approximately 4% to around $60,000 following reports of Iran’s missile strike on Israel.

U.S. stock indices also faced declines of about 1%.

Source: Coingecko

Source: Coingecko

While Bitcoin briefly recovered to $61,450 by the time of this report, the outflows from ETFs suggest that many investors are preparing for further volatility in the near future.

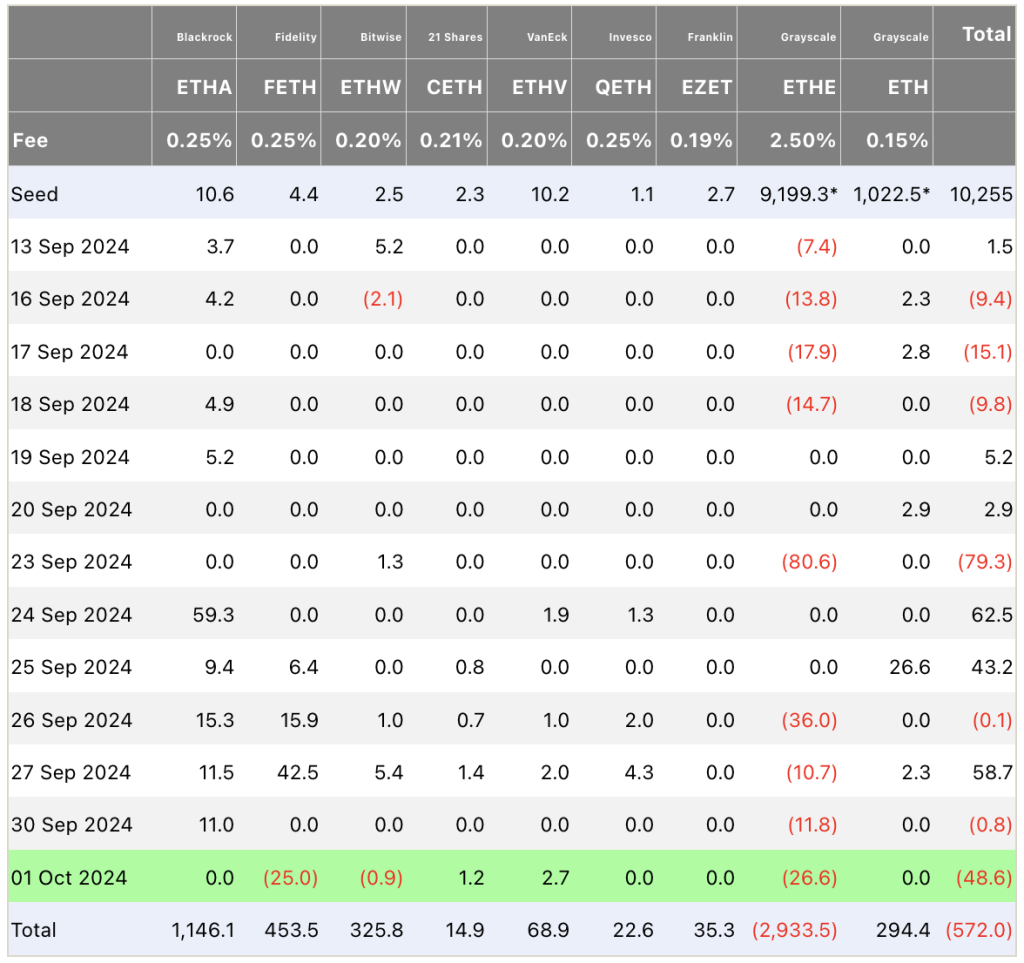

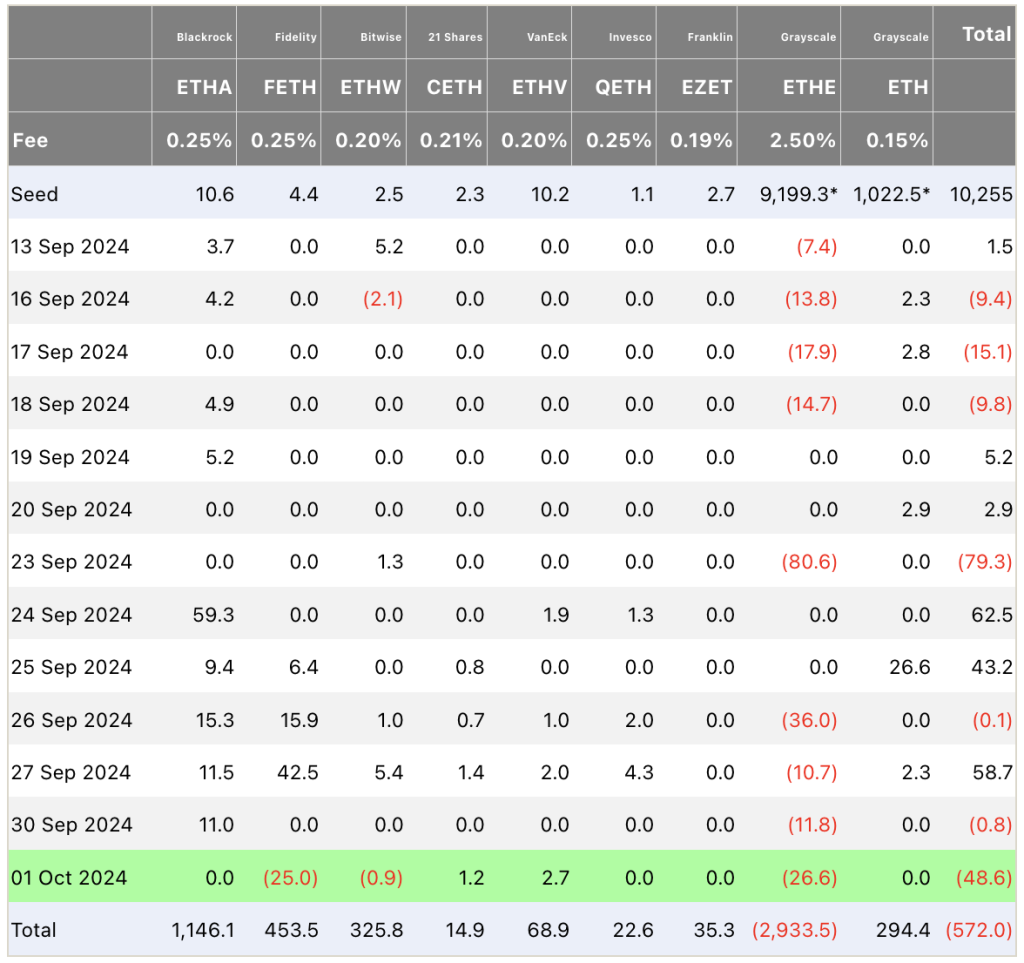

Ethereum ETFs Reflect Bitcoin Trends

Ethereum ETFs followed the pattern observed in Bitcoin ETFs, with total outflows amounting to $48.52 million.

Source: Farside

Source: Farside

Fidelity’s Ethereum Fund (FETH) led the outflows, recording $24.97 million, marking its largest single-day loss to date.

Grayscale’s Ethereum Trust (ETHE) also experienced significant outflows of $26.64 million, continuing a trend of investor withdrawals that have resulted in a cumulative net outflow of nearly $3 billion.

The Bitwise Ethereum ETF (ETHW) saw smaller, yet notable outflows of $895,650.

Despite the prevailing market sentiment, VanEck’s Ethereum Trust (ETHV) defied the trend, achieving modest net inflows of $2.74 million.

Additionally, the 21Shares Core Ethereum ETF (CETH) recorded $1.25 million in inflows, its largest since early August.

The outflows from Ethereum ETFs occurred as the token experienced a sharp 6.5% price decline, dropping to a low of $2,450 due to the same geopolitical tensions affecting Bitcoin.

Source: Coingecko

Source: Coingecko

Similar to Bitcoin, Ethereum showed some recovery but remained under pressure, with market participants becoming increasingly cautious amid growing uncertainty.

The global geopolitical unrest, particularly the intensifying conflict between Iran and Israel, has increased market volatility.

Both cryptocurrencies and traditional financial markets have reacted to these developments, as investors brace for potential economic disruptions.

Moreover, the cryptocurrency market is facing heightened regulatory scrutiny, especially in the U.S.

The Securities and Exchange Commission (SEC) has ramped up its oversight of crypto companies, with legal disputes involving major entities like Coinbase and Ripple over allegations of trading unregistered securities.

The post Crypto ETF Market Faces Outflow Pressure, Fidelity Ethereum ETF Records Largest appeared first on Cryptonews.