Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto Card Market Surges 15 Times as Stablecoin Expenditures Rise 106% Yearly: Report

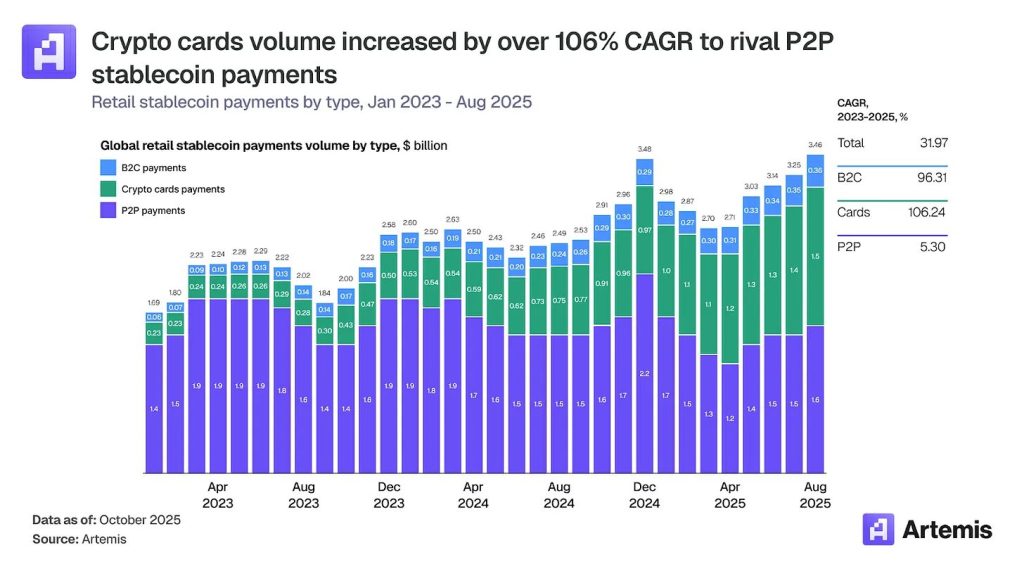

The landscape of crypto payments has experienced a significant shift, with the volume of crypto card transactions escalating from approximately $100 million per month in early 2023 to more than $1.5 billion by the end of 2025. This represents a 106% compound annual growth rate that now competes with peer-to-peer stablecoin transfers, according to an extensive report from Artemis Analytics.

Source: Artemis

Source: Artemis

This remarkable increase positions crypto cards as the main conduit between digital assets and daily commerce, with annual volumes surpassing $18 billion, while traditional P2P transfers saw only a 5% rise to $19 billion during the same timeframe.

Visa has emerged as the leading player in the crypto card infrastructure, commanding over 90% of on-chain card volume through early collaborations with emerging program managers and full-stack issuers.

Source: Artemis

Source: Artemis

Artemis observed that the payment giant’s strategy of partnering with infrastructure providers like Rain and Reap has proven to be more scalable than Mastercard’s method of forming direct exchange partnerships.

Full-Stack Issuers Transform Card Economics

The crypto card infrastructure consists of three essential layers (payment networks, card-issuing platforms, and consumer-facing products), with the most notable advancement being the rise of full-stack issuers that possess direct Visa principal membership.

Firms such as Rain and Reap have streamlined traditional card issuance dependencies by integrating BIN sponsorship, lender-of-record status, and direct Visa network settlement into unified platforms, seizing economics that were previously spread across various intermediaries.

Visa’s stablecoin-associated card spending reached an annualized run rate of $3.5 billion in Q4 fiscal 2025, reflecting a 460% year-over-year increase, although it still accounts for only about 19% of total crypto card settlement volume.

Source: Artemis

Source: Artemis

Centralized exchanges utilize cards as tools for user acquisition, with platforms like Gemini absorbing ongoing losses from credit card initiatives to enhance platform engagement.

DeFi protocols like Ether.fi provide structurally higher cashback through token rewards, offering around 4.08% returns while boosting protocol TVL via collateralized borrowing features.

Geographic Opportunities Focus Where Stablecoins Address Real Issues

Notably, India and Argentina emerge as global exceptions where USDC nearly matches USDT in market share, presenting distinctly different prospects for crypto card adoption.

Source: Artemis

Source: Artemis

India saw $338 billion in crypto inflows over the 12 months ending June 2025; however, stringent tax regulations pushed most operations offshore, leading to substantial latent demand for compliant crypto products hindered by regulatory obstacles instead of user interest.

Argentina’s opportunity revolves around stablecoin debit cards for inflation protection, where no competing digital infrastructure exists, while India’s potential lies in crypto-backed credit cards, given that UPI has already commoditized debit capabilities.

However, Artemis pointed out that in developed markets, the focus should be on capturing a distinct, high-value user segment that exhibits greater financial sophistication and increasing digital asset balances, rather than simply addressing unmet payment requirements.

For example, in the well-established U.S. credit card market, despite significant revenue growth across issuers, a new segment is emerging.

Source: Artemis

Source: Artemis

Consumers are now maintaining substantial stablecoin balances and are increasingly anticipating seamless spending capabilities, creating opportunities for traditional issuers who merge scale advantages with stablecoin-native functionalities before crypto-native competitors establish user connections.

Cards Remain Vital Despite Native Acceptance Push

Although major networks, including Visa, Mastercard, PayPal, and Stripe, are developing stablecoin-native merchant acceptance frameworks, three structural realities indicate that crypto cards will continue to hold strategic importance.

Artemis noted that network effects spanning 150 million merchant locations worldwide are exceptionally challenging to replicate, requiring years of coordinated infrastructure investment that stablecoin-native systems must rebuild from minimal merchant coverage.

Card networks offer bundled services that consumers expect, such as fraud protection, dispute resolution, unsecured credit, rewards programs, and purchase safeguards, which stablecoin payments cannot easily duplicate.

Source: Artemis

Source: Artemis

Significantly, earlier this month, Anthony Yim, co-founder of Artemis, remarked that DeFi traders favor USDC because it “frequently moves in and out of positions,” while broader adoption reflects an “unstable geopolitical landscape” driving demand for the digital dollar.

Global stablecoin transaction value reached $33 trillion in 2025, a 72% year-over-year increase, with Bloomberg Intelligence forecasting $56 trillion by 2030.

Revolut’s stablecoin payment volumes alone soared 156% to about $10.5 billion, with everyday transactions between $100 and $500 making up 30% to 40% of platform activity.

Despite rising adoption, major banks have intensified their opposition to yield-bearing stablecoins, cautioning that they could siphon trillions from traditional deposits.

Bank of America CEO Brian Moynihan has warned that stablecoins could pull trillions of dollars out of the US banking system.#Stablecoins #Cryptohttps://t.co/TTQ8cqCSm6

— Cryptonews.com (@cryptonews) January 15, 2026

Bank of America CEO Brian Moynihan warned that as much as $6 trillion could shift to stablecoins, while JPMorgan’s Jeremy Barnum cautioned against “the creation of a parallel banking system” without proper safeguards.

This resistance contributed to the Senate Banking Committee delaying its planned markup of an extensive crypto market structure bill after Coinbase withdrew its support, with Chairman Tim Scott referencing ongoing bipartisan discussions over provisions aimed at limiting stablecoin yield payments.

The post Crypto Card Market Explodes 15x as Stablecoin Spending Soars 106% Annually: Report appeared first on Cryptonews.