Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Coinbase Targets Australia’s Expanding $600B Pension Market

Coinbase exchange has significant ambitions to enhance services aimed at Australia’s $600 billion self-managed pension market, as reported by Bloomberg.

The largest cryptocurrency exchange in the US is said to be creating a customized service to address the unmet demand for crypto products, as confirmed by Coinbase’s Asia-Pacific Managing Director, John O’Loghlen.

“Self-managed super funds may opt for a single investment and then forget about it. We are developing an offering to serve those clients effectively on a one-time basis — allowing them to trade with us and remain with us.”

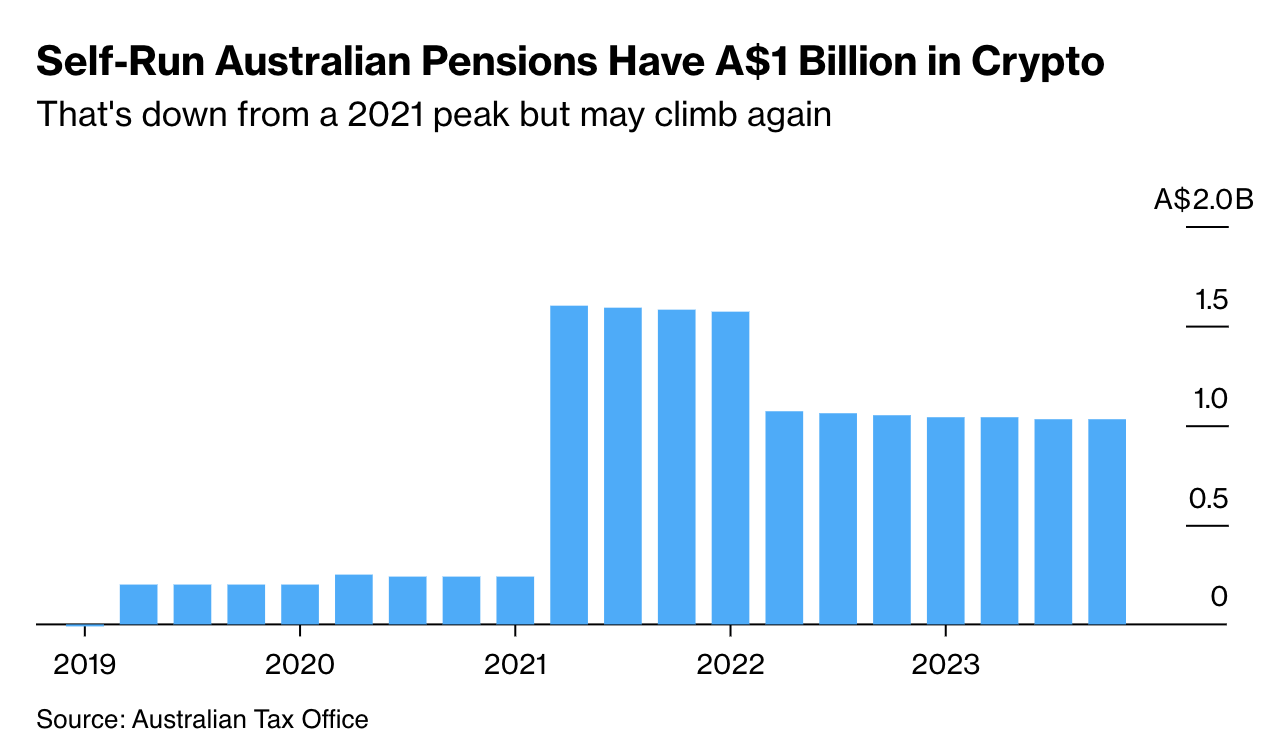

Recent data from the Australian Taxation Office indicates that self-managed pension portfolios account for a quarter of Australia’s $2.5 trillion pension system. This includes AU$1 billion ($664 million) allocated to crypto assets, down from a peak of AU$1.5 billion in 2021.

The decline may be linked to certain institutional investors in Australia who avoid the crypto market due to previous scandals and significant volatility. Nonetheless, recent developments, such as discussions about launching crypto exchange-traded funds (ETFs) in Australia and a rise in Bitcoin prices, have notably boosted the amount of cryptocurrencies held within these self-managed retirement funds.

Aussie’s DIY Pension Sector Lost Millions in Crypto Bets

Additionally, Michael Houlihan, head of a private wealth management firm, has publicly advised investors to steer clear of substantial investments in high-risk assets.

“You wouldn’t want a considerable portion of a portfolio in something that carries such high risk,” he remarked. He noted that investors interested in cryptocurrencies are generally in their 40s and have modest account balances.

This was evident in previous instances; for example, in 2023, thousands of Australians utilizing do-it-yourself (DIY) pension funds to speculate on cryptocurrencies encountered losses totaling hundreds of millions of dollars.

Such high-risk ventures endangered their savings in a system initially designed to provide sufficient retirement income. According to a Reuters analysis from last year, these investments fall outside the jurisdiction of the prudential regulator that supervises professionally managed funds.

In other parts of the world, the unregulated DIY pension sector is subject to some oversight. In the UK, self-managed pension funds are prohibited from directly investing in Bitcoin or other cryptocurrencies.

The post Coinbase Eyes Australia’s Growing $600B Pension Fund appeared first on Cryptonews.