Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Coinbase Offers Significant Forecasts on the Future of Cryptocurrency

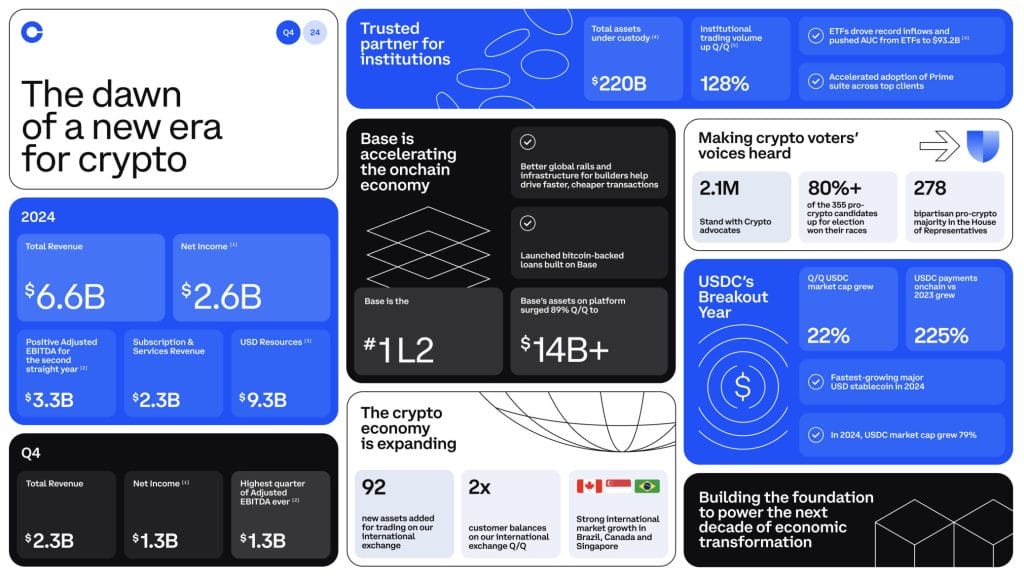

A range of attention has been directed towards Coinbase’s earnings from its operational activities in the last quarter of 2024.

This is warranted. The results from the cryptocurrency exchange significantly exceeded analyst forecasts, marking the highest quarterly revenues in three years.

Net income reached $1.3 billion from October to December — a 280% increase compared to the same timeframe a year prior, when the bull market was beginning.

The reasons are clear. Donald Trump’s return to the White House as a pro-Bitcoin president has ignited a trading surge, heralding a ‘golden age’ for cryptocurrency.

Picture: Coinbase

Picture: Coinbase

Recently, Coinbase’s CEO Brian Armstrong met Trump at Mar-a-Lago — and is expected to participate in the administration’s crypto advisory council.

This implies that his perspective on the industry’s status, along with his company’s future strategies, is now of significant importance.

His firm played a crucial role in the Stand With Crypto initiative, which meticulously examined the policy positions of U.S. election candidates — a task this group will undoubtedly undertake again during the midterms.

Armstrong is also advocating for regulatory reform, particularly concerning the Securities and Exchange Commission, following years of dissatisfaction.

During an earnings call with investors, he stated that “it’s difficult to overstate the significance of the changes that have occurred in recent months.”

The CEO noted that the shift in attitudes towards cryptocurrency in the U.S. is causing the rest of the world to take notice, and Coinbase now possesses a proven strategy for expanding into international markets.

Aggressive Forecasts

Crypto leaders often make lofty predictions regarding everything from Bitcoin’s price to widespread adoption during bullish markets. This has been observed repeatedly… particularly in 2017 and 2021.

However, the current environment feels notably different as Wall Street institutions are entering the space — with governments openly considering whether to begin holding Bitcoin on their balance sheets.

Perhaps the most newsworthy part of Armstrong’s call with analysts was his remark:

“It’s somewhat akin to the early 2000s when every company had to figure out how to adapt to the Internet. Up to 10% of global GDP could be operating on crypto rails by the end of this decade. And Coinbase is going to be the preferred partner to come in and build this for many of the companies out there because we have the most trusted and scalable infrastructure with the longest track record.”

This is a substantial prediction for the near future — but then again, stablecoins are currently gaining traction, and Coinbase has strong connections with USDC.

“We also have a stretch goal to make USDC the leading dollar stablecoin. We are very optimistic about stablecoins. We believe USDC has a network effect behind it. And the compliant approach they have taken is, I think, going to be very defensible in the long run. So we’ll be accelerating the market cap growth of USDC with more partnerships and leaning into new use cases like adding payment support across our product suite.”

Armstrong asserted that crypto “is much, much more than an asset class that people want to trade” — and soon, there will be “daily use cases for everyone in the world as crypto updates the global financial system.”

“We’re already at scale, I’d say, on stablecoin payments. There was $30 trillion of crypto stablecoin volume last year. That was up 3x year over year. And so we’re moving quickly to integrate crypto payments across our entire suite of products. We believe that will be a significant business over time.”

Coinbase is well-positioned to take advantage of this major shift, with Chief Financial Officer Alesia Haas disclosing that the exchange was managing $404 billion in assets as of December 31 — equivalent to 12% of the total market capitalization of all cryptocurrencies.

When specifically questioned about the evolving regulatory landscape in Washington, Armstrong stated:

“It’s truly been a sea change and it’s been positive. I think we have access to all the relevant decision-makers and individuals in government now. It doesn’t mean they’re all going to do what we want, but at least we can get meetings and share our perspective. They can take input from all the relevant parties to come up with clear guidelines.”

As he has previously suggested on X, one area of focus is modifying Coinbase’s listing process, as the company’s review team is currently unable to keep pace with vetting the vast number of tokens entering the ecosystem each week. Some estimates place that figure at a million.

He contended that the platform “needs to deeply integrate decentralized exchanges into our product” — adding:

“We also need to balance giving customers access to what they want with appropriate disclosures and consumer protection so that they know they are trading the right asset … there might be 100,000 results in Google, but you kind of want to only look at the first page or if you search for some product on Amazon, there might be hundreds of them, but you want to buy the one with the best reviews. So I think there are many ways we can balance that consumer protection with giving customers access to the broad range of assets available.”

A recurring theme during the Q&A was trust, with Brian Armstrong leveraging the brand recognition it has built in recent years.

“We truly want everyone to come into crypto. And I keep saying this and maybe people don’t fully believe me, but it’s really true. We’re trying to get the global financial system updated and have more and more global GDP run on crypto rails. We believe that a more efficient, fair, and free world will accelerate progress, and it creates economic freedom. And we’re going to need every bank, every payment company, every brokerage to integrate crypto into their platforms.”

If the bull market continues to gain momentum — and shake off its current stagnation — Coinbase could be a stock worth monitoring.

The post Coinbase Just Made Big Predictions on Crypto’s Future appeared first on Cryptonews.