Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Coinbase Implements 0.1% Charge on USDC Exchanges Exceeding $5M Following Revenue Shortfalls

Starting August 13, Coinbase will implement a 0.1% fee on USDC-to-USD conversions that exceed $5 million within a 30-day timeframe, marking the first instance where the exchange has monetized its previously complimentary stablecoin off-ramping service.

This decision follows disappointing earnings for Q2, which resulted in a 15% decline in stock value and led the company to announce a $2 billion convertible bond offering.

User Backlash Emerges as Free Stablecoin Conversions End

Users expressed their dissatisfaction with the new fee structure on social media, with some likening it to conventional banking fees and questioning whether Coinbase was adopting practices similar to traditional financial institutions.

Hmmm…why

I don’t love the precedent here. What if this dropped to $10k. Feels like bank fees again @coinbase.

$1 USD = $1USDC right? pic.twitter.com/l9easdJM2t— RYAN SΞAN ADAMS – rsa.eth

(@RyanSAdams) August 6, 2025

CEO Brian Armstrong confirmed via social media that the fee aims to address competitive disadvantages posed by Tether’s existing redemption fees, which had made USDC off-ramping the most economical option for large fiat conversions.

The fee will be applied to net conversion volume, calculated by deducting USDC purchases from sales over rolling 30-day periods.

Coinbase representatives characterized this change as an “experiment to better understand how fees impact USDC off-ramping,” while highlighting that competitors impose higher fees for fiat conversions.

This revenue-generating initiative aligns with Coinbase’s broader financial difficulties, including a 39% decline in retail trading volumes to $764 million in Q2 and total revenue of $1.5 billion, which fell short of analyst projections.

Despite these challenges, the company continues to advance its “everything exchange” strategy, particularly with its recent rebranding efforts.

Stablecoin Wars Drive Fee Introduction as USDT Maintains Market Advantage

Industry analysts, including notable trader Cobie, noted that Tether’s existing exit fees created an arbitrage opportunity, leading users to convert USDT to USDC before off-ramping to USD.

This is probably because Tether has an exit fee, which means the cheapest practical route was to swap USDT to USDC and then off-ramp USDC to USD, which shrinks USDC supply and maintains USDT supply. If I were to guess.

— Cobie (@cobie) August 7, 2025

This process diminished USDC supply while preserving USDT circulation, placing Circle’s stablecoin at a disadvantage in market share competition.

USDT trades at a premium to USDC, partly due to its demand for collateralizing perpetual futures contracts, which primarily utilize Tether as the base currency.

The premium enhances the appeal of the USDC burn route for large conversions, exerting pressure on Circle’s market standing.

Coinbase’s fee structure is designed to deter one-way flows from USDC to fiat while compensating for the costs associated with facilitating large redemptions.

The exchange likened this mechanism to ETF creation and redemption fees, asserting that significant one-way flows incur operational costs that warrant the implementation of fees.

Critics pointed out the irony that USDC’s enhanced utility as a conversion mechanism necessitated artificial constraints to remain competitive.

Several users recommended that large-scale converters utilize Circle’s direct OTC minting services instead of retail exchange platforms.

The introduction of the fee signifies Coinbase’s attempt to optimize liquidity costs and minimize fiat off-ramping by institutional participants while promoting USDC retention within its ecosystem.

The company presents this change as essential for sustaining stablecoin operations amid competitive pressures.

Revenue Pressures Mount as Retail Trading Volumes Decline

Coinbase’s Q2 financial results highlighted substantial challenges, with transaction revenue declining by 39% quarter-over-quarter due to reduced retail trading activity.

XRP emerged as an unexpected highlight, contributing 13% of consumer transaction revenue, compared to Ethereum’s 12%, for the second consecutive quarter.

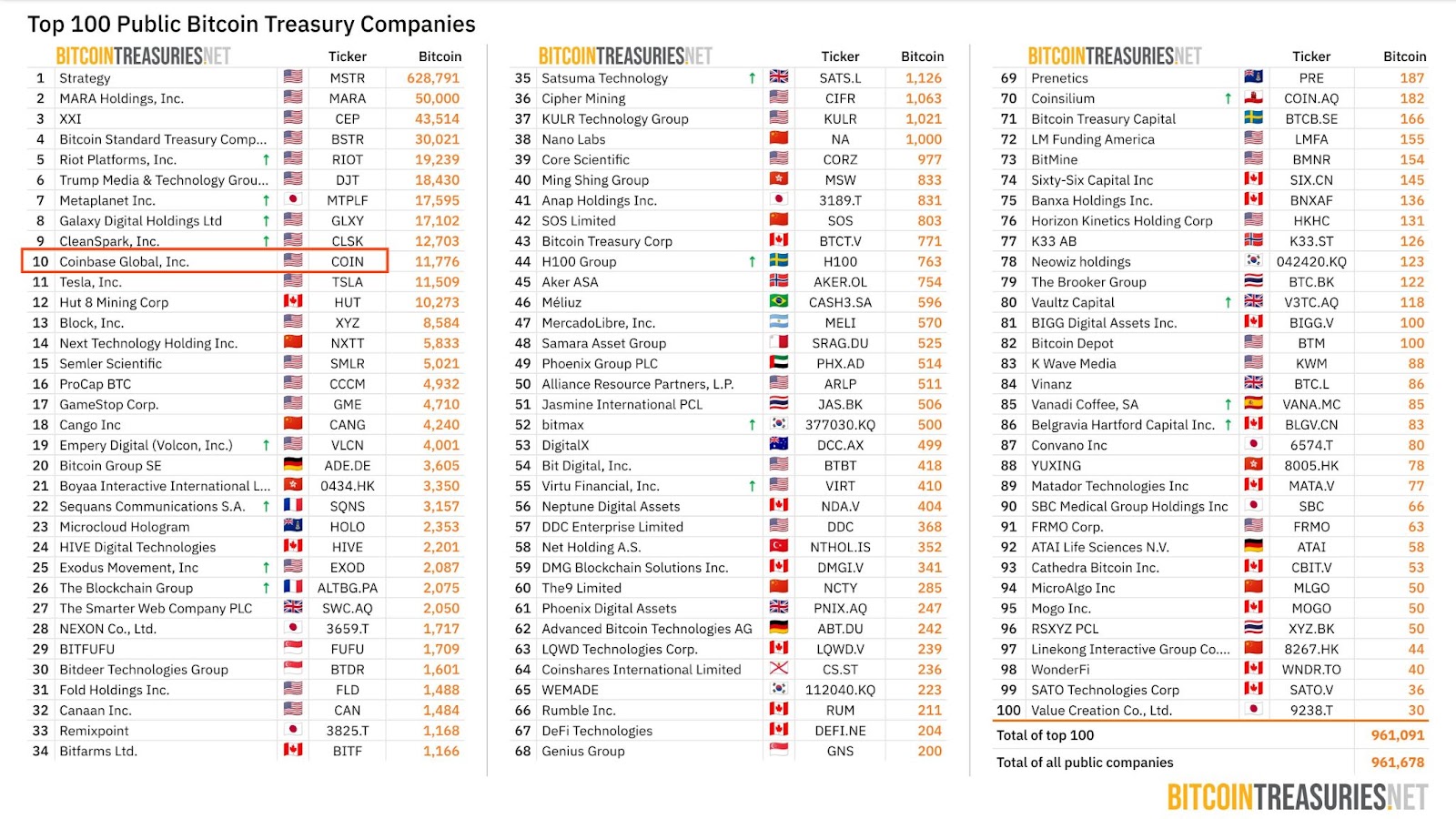

During Q2, the exchange acquired 2,509 Bitcoin valued at $222 million, increasing its total holdings to 11,776 BTC and positioning it among the top 10 public holders, ahead of Tesla.

Source: Bitcoin Treasuries

Source: Bitcoin Treasuries

However, the strategy of accumulating Bitcoin could not counterbalance the broader revenue declines impacting overall performance.

Cathie Wood’s Ark Invest sold $6.5 million worth of Coinbase shares on July 10, despite the stock rising alongside Bitcoin’s ascent to new all-time highs.

This sale continued Ark’s trend of reducing exposure to crypto-related investments following disappointing earnings results.

In light of this challenging Q2, Coinbase announced plans for a $2 billion convertible senior notes offering, divided between 2029 and 2032 maturities.

@Coinbase is turning to the bond market for support after a disappointing second-quarter earnings report triggered a sell-off in its stock. #Coinbase #Coinhttps://t.co/QAMu3x06KO

— Cryptonews.com (@cryptonews) August 5, 2025

Funds raised will be used for capped call transactions to limit share dilution and support corporate requirements, including working capital, acquisitions, and debt repurchases.

The company continues to pursue its “everything exchange” strategy with plans to introduce tokenized stocks, prediction markets, and derivatives for US users.

These initiatives aim to diversify revenue sources beyond traditional crypto trading as retail engagement fluctuates with market conditions.

Notably, despite a challenging quarter, TIME recognized Coinbase as one of 2025’s 100 Most Influential Companies, designating it a “disruptor” for influencing US digital asset policies.

The post Coinbase Introduces 0.1% Fee on USDC Swaps Over $5M After Missing Revenue Targets appeared first on Cryptonews.