Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Coinbase Aims for Comprehensive Exchange for Cryptocurrency, Stocks, and Commodities by 2026

Coinbase CEO Brian Armstrong revealed that the exchange aims to implement an “everything exchange” approach in 2026, integrating cryptocurrencies, equities, prediction markets, and commodities through spot, futures, and options offerings.

This strategy positions Coinbase to directly rival traditional brokerages while diversifying beyond its foundational digital asset operations into tokenized securities and event-centered markets that have drawn billions in recent trading activity.

In a post on X, Armstrong identified three main priorities:

- Establishing the Everything Exchange on a global scale

- Enhancing stablecoins and payment systems

- Encouraging users to engage on-chain via Coinbase’s developer resources, Base blockchain, and consumer application.

“The objective is to make Coinbase the leading financial app globally,” he stated, noting that the company is investing significantly in product excellence and automation to facilitate this growth.

Our key priorities for 2026 at Coinbase include:

1) Expand the everything exchange internationally (cryptocurrencies, equities, prediction markets, commodities – across spot, futures, and options)

2) Enhance stablecoins and payment solutions

3) Onboard the world onto the blockchain via @CoinbaseDev, @base chain,…— Brian Armstrong (@brian_armstrong) January 1, 2026

Focus on Prediction Markets and Tokenized Equities

In late 2025, Coinbase took decisive steps into the prediction markets by partnering with Kalshi, a federally regulated platform sanctioned by the US Commodity Futures Trading Commission.

Leaked images from November showcased a Coinbase-branded prediction interface that supports trading in USDC or USD across categories such as economics, politics, sports, and technology.

This offering operates through Coinbase Financial Markets, the exchange’s derivatives division, utilizing Kalshi’s regulatory framework to provide event contracts framed as straightforward yes-or-no inquiries.

In addition to prediction markets, Coinbase intends to issue tokenized equities internally instead of relying on outside partners, marking a shift from competitors like Robinhood and Kraken that depend on third-party providers for stock tokens in certain regions.

Leaked images indicate @Coinbase is developing a prediction markets platform utilizing @Kalshi’s regulated framework. #Kalshi #Coinbase https://t.co/2aWPAEBQcV

— Cryptonews.com (@cryptonews) November 19, 2025

According to rwa.xyz, monthly transfer volumes for tokenized equities have surged approximately 76% over the last 30 days, reaching around $2.46 billion, as platforms experiment with bringing conventional assets onto the blockchain.

This initiative aligns with Coinbase’s vision of becoming an “everything app” for digital assets, allowing users to trade cryptocurrencies, tokenized securities, and event-driven markets all in one place.

The prediction markets have seen remarkable growth in the past year, drawing interest from both traditional exchanges and crypto-native companies that view them as a novel way to capitalize on information and order flow.

Recently, Gemini received CFTC approval to launch its prediction platform, Gemini Titan, for American users.

Simultaneously, Crypto.com established partnerships, including with Trump Media & Technology Group, to assist in developing prediction markets.

Furthermore, Robinhood and trading firm Susquehanna committed to acquiring 90% of the regulated venue LedgerX, increasing their involvement in the crypto prediction market space.

Regulatory Support and Institutional Growth Accelerate

Coinbase executives anticipate favorable conditions as regulatory clarity advances and institutional engagement intensifies.

David Duong, the exchange’s head of investment research, remarked in a year-end forecast that 2025 was a pivotal year for digital assets, with regulated spot ETFs broadening investor access and stablecoins becoming increasingly integrated into conventional financial operations.

“We expect these dynamics to build in 2026 as ETF approval timelines shorten, stablecoins play a larger role in delivery-vs-payment frameworks, and tokenized collateral gains wider acceptance in traditional transactions,” Duong stated.

@Coinbase predicts ETFs, stablecoins, and tokenization will reinforce one another and accelerate crypto adoption in 2026. #Coinbase #Crypto https://t.co/TN8aoyEUEE

— Cryptonews.com (@cryptonews) January 1, 2026

During a February earnings call, Armstrong highlighted the regulatory shift, asserting, “the significance of the changes that have occurred in recent months cannot be overstated.”

He contended that the evolving US perspectives on cryptocurrency are influencing global markets, while Coinbase utilizes a strategic plan for international growth.

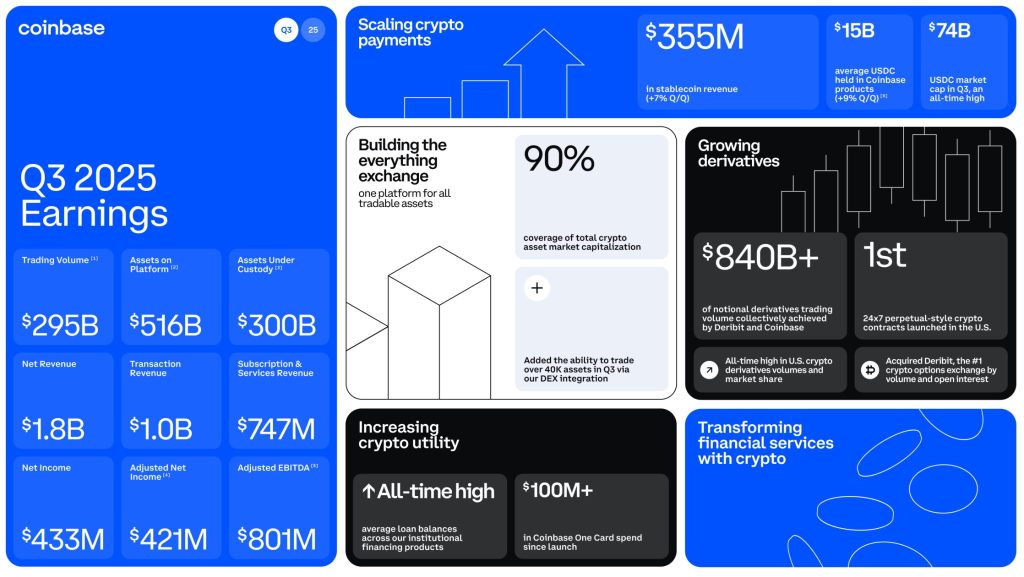

According to its Q3 shareholder report, the exchange managed $516 billion in assets, accounting for 16% of the total cryptocurrency market capitalization.

Source: Coinbase

Source: Coinbase

Armstrong predicted that as much as 10% of global GDP could operate on crypto infrastructure by the end of the decade, likening the transition to how companies adapted to the internet in the early 2000s.

“It’s somewhat akin to the early 2000s when every business had to figure out how to adapt to the Internet,” he remarked during the call.

Regarding stablecoins, Faryar Shirzad, Coinbase’s chief policy officer, recently cautioned that limitations on stablecoin incentives could undermine the United States’ position in digital payments, as China permits commercial banks to offer interest on digital yuan wallets starting January 1, 2026.

The People’s Bank of China introduced a framework to expand its central bank digital currency beyond merely a cash substitute, prompting Chinese investors to funnel over $188 million into digital yuan-related stocks following the announcement.

The post Coinbase Plans All-in-One Exchange for Crypto, Stocks, and Commodities in 2026 appeared first on Cryptonews.

@Coinbase predicts ETFs, stablecoins, and tokenization will reinforce one another and accelerate crypto adoption in 2026. #Coinbase #Crypto https://t.co/TN8aoyEUEE

@Coinbase predicts ETFs, stablecoins, and tokenization will reinforce one another and accelerate crypto adoption in 2026. #Coinbase #Crypto https://t.co/TN8aoyEUEE