Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

CME to Surpass Binance as Crypto Derivatives Move into Institutional Phase in 2025: CoinGlass

The worldwide cryptocurrency derivatives market experienced a significant transformation in 2025, moving from retail-driven speculation to a focus on institutional capital and more intricate risk dynamics.

As outlined in the CoinGlass 2025 Crypto Derivatives Market Annual Report, this year signifies a pivotal moment in the evolution of cryptocurrency as a recognized financial asset class.

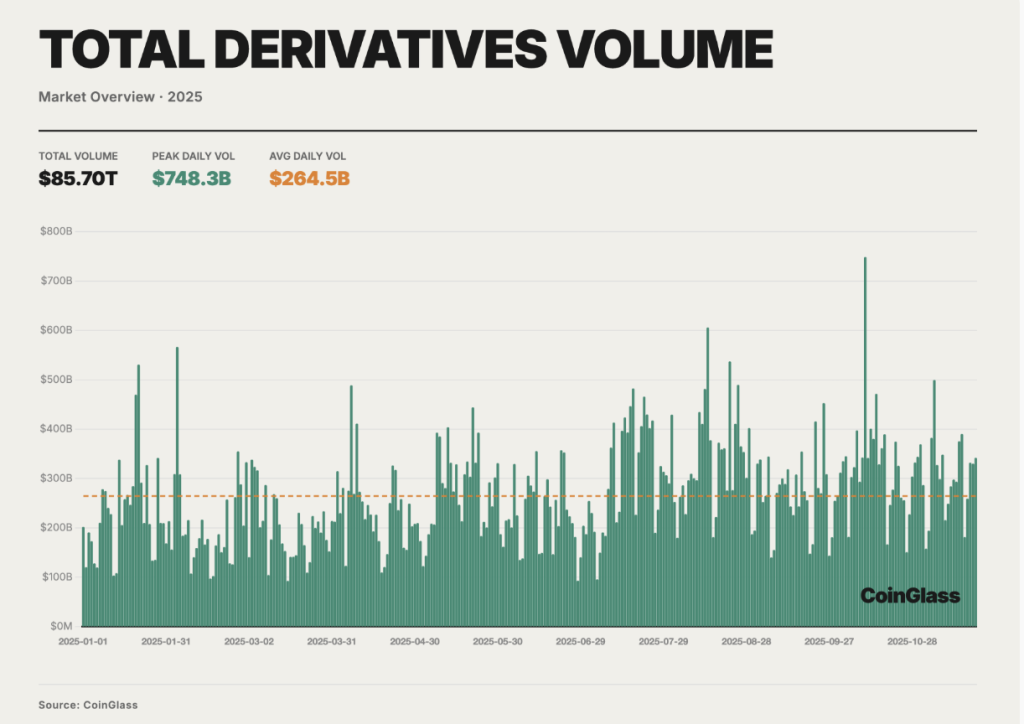

In 2025, the overall trading volume of the cryptocurrency derivatives market reached around $85.70 trillion, with a daily average turnover of approximately $264.5 billion.

Institutional Capital Reshapes Market Leadership

A key development in 2025 was the strengthening of institutional influence across derivatives platforms. The year-end report indicates that the demand for hedging, basis trading, and risk-managed exposure has shifted toward regulated exchange-traded products, according to CoinGlass.

This trend has bolstered the position of the Chicago-based futures market, with CME Group establishing its leadership in Bitcoin futures after surpassing Binance in open interest in 2024.

By 2025, the CME also reduced the gap with Binance in Ethereum derivatives, reflecting increasing institutional engagement beyond Bitcoin. Meanwhile, leading crypto-native exchanges such as OKX, Bybit, and Bitget maintained a significant market share.

Merry Christmas!

CoinGlass 2025 Crypto Derivatives Market Annual Reporthttps://t.co/WJ6wUNU8Hc— CoinGlass (@coinglass_com) December 25, 2025

Rising Complexity and Systemic Risk

CoinGlass highlights that extreme market occurrences in 2025 also tested margin frameworks, liquidation processes, and cross-platform risk transmission channels at an unprecedented level.

Crucially, these shocks were no longer limited to individual assets or exchanges, indicating the increasing interconnectedness of the derivatives ecosystem.

This fragility has led to heightened scrutiny of risk management practices, especially considering the concentration of open interest and user assets among a limited number of dominant platforms.

Macro Liquidity and High-Beta Behavior

From a macroeconomic standpoint, CoinGlass observes that Bitcoin continued to act less like an inflation hedge and more like a high-beta risk asset. Throughout the 2024–2025 easing cycle, BTC rose from approximately $40,000 to $126,000, primarily reflecting leveraged exposure to global liquidity expansion rather than independent value discovery.

As liquidity expectations shifted in late 2025, the subsequent pullback underscored Bitcoin’s sensitivity to central bank policies and geopolitical uncertainties.

These dynamics fostered an environment conducive to derivatives trading, as volatility associated with U.S.–China trade tensions, shifting Federal Reserve policies, and Japan’s monetary normalization created ongoing opportunities for hedging and speculative strategies.

On-Chain Derivatives and the Regulatory Backdrop

Another significant trend of 2025 was the evolution of decentralized derivatives from experimentation to real market competition.

High-performance application chains and intent-focused architectures allowed on-chain platforms to compete with centralized exchanges in specific areas, particularly in censorship-resistant trading and composable strategies.

Regulatory frameworks evolved concurrently. The United States moved towards clearer legislation, while the European Union enhanced consumer protection under MiCA and MiFID, and jurisdictions like Hong Kong, Singapore, and the UAE positioned themselves as compliant hubs.

Collectively, these developments indicate a gradual convergence under the principle of “same activity, same risk, same regulation.”

A New Phase for Crypto Derivatives

Overall, 2025 marked the transition of crypto derivatives into a fundamental component of global digital finance rather than a marginal speculative market.

Institutional dominance, regulatory integration, and on-chain innovation are now transforming how risk is priced, transferred, and managed—laying the groundwork for an even more intricate derivatives landscape in the future, according to CoinGlass.

The post Crypto Derivatives Enter Institutional Era in 2025 With CME Overtaking Binance: CoinGlass appeared first on Cryptonews.